T-Mobile US has revealed that its capital expenditures (Capex) will be between $9.4 billion and $9.7 billion during 2023.

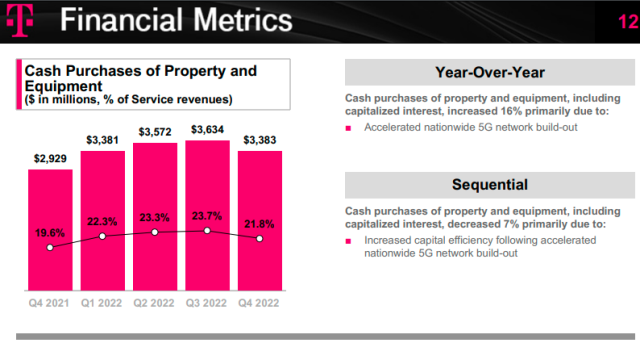

T-Mobile’s Capex increased 16 percent to $3.4 billion in Q4 2022 and rose 13 percent to $14 billion in 2022 driven by the accelerated build-out of the 5G network.

T-Mobile said service revenues increased 4 percent to $15.5 billion in Q4 2022 and 5 percent to $61.3 billion in 2022.

Total revenue of T-Mobile decreased 2.5 percent in Q4 2022 to $20.273 billion and rose 0.7 percent to $79.57 billion in 2022.

Net income of T-Mobile increased 250 percent to $1.5 billion in Q4 2022 and decreased 14 percent to $2.6 billion in 2022, which included merger-related costs of $3.7 billion and loss associated with the anticipated sale of the wireline business of $815 million.

The company’s 5G network covers 325 million people (98 percent of Americans), and its super-fast Ultra Capacity 5G covers 265 million people. Approximately 60 percent of T-Mobile’s postpaid customers have a 5G smartphone and approximately two-thirds of all traffic is on 5G network.

Bellevue, Washington-based T-Mobile US has 28.526 million postpaid customers in 2022. T-Mobile’s postpaid phone ARPU has touched $48.86 in Q4 2022 as compared with $48.89 in Q3, $48.96 in Q2 and $48.41 in Q1 and $48.03 in Q4 2021. This shows that T-Mobile’s 5G offerings did not attract customers to spend more.

The U.S. wireless carrier has been adding thousands of wireless subscribers lately, thanks to discounts on smartphones, bundled offerings, industry-low plan prices and an edge in 5G, owing to its $23 billion buyout of Sprint in 2020.

However, Verizon and AT&T enhanced their smartphone offers during the holiday season to tap into growing demand after the latest iPhone launch, hitting T-Mobile’s torrid growth, Reuters news report said.

The wireless carrier added 927,000 postpaid phone subscribers in the fourth quarter, the highest among its peers.

But its churn rate, which refers to the percentage of customers who stopped using the company’s services, was also the highest compared to rivals, at 0.92 percent. By contrast, Verizon reported churn of 0.89 percent for monthly phone subscribers while AT&T’s came in at 0.84 percent.

T-Mobile expects to add between 5 million and 5.5 million net monthly-bill paying subscribers in 2023, compared with the 6.4 million additions it reported in 2022.