AT&T reported robust financial and operational results for the fourth quarter and full year 2025, driven by growth in Mobility, Consumer Wireline, and Mexico markets, while maintaining disciplined capital spending and strategic network investments.

Revenue and Operating Performance

For Q4 2025, AT&T posted revenues of $33.5 billion, up 3.6 percent from $32.3 billion in the year-ago quarter. The growth was fueled by higher sales in Mobility, Consumer Wireline, and Mexico, partially offset by a decline in Business Wireline. Operating income for the quarter reached $5.8 billion, improving from $5.3 billion in Q4 2024.

Full-year 2025 revenues totaled $125.6 billion, a 2.7 percent increase from $122.3 billion in 2024. Operating income for the year jumped to $24.2 billion, compared to $19.0 billion in 2024, while adjusted operating income rose to $25.5 billion. Operating expenses for the year declined to $101.5 billion, reflecting efficiency gains from transformation initiatives and lower content licensing fees, partially offset by higher Mobility sales and network-related costs.

“With new investments in spectrum and fiber, we’re set to win more customers in more categories and geographies across the U.S. Backed by the best assets in the industry, we are accelerating our strategy to deliver improved growth, the best customer experience,” John Stankey, AT&T Chairman and CEO, said in the earnings report.

Capital Expenditures and Investment

AT&T maintained steady investment in its network, with Q4 2025 capital expenditures of $6.8 billion, consistent with the prior year. Full-year capex totaled $20.8 billion, supporting fiber expansion, network upgrades, and strategic transformation initiatives. Capital investment, including network modernization, remained largely flat at $22.0 billion, demonstrating disciplined investment strategy.

AT&T said capital investment will be in the $23 billion to $24 billion range annually during 2026-2028. AT&T’s capital expenditures for 2025 were $20.8 billion, versus $20.3 billion in 2024. Capital investment totaled $22 billion in 2025 vs $22.1 billion in 2024.

ARPU and Subscriber Growth

AT&T posted stable ARPU across key segments. Postpaid Phone ARPU reached $56.57 in 2025, slightly down from $56.72 in 2024. Broadband ARPU increased to $70.89 in Q4 2025 from $69.69 in Q4 2024, while Fiber ARPU rose to $72.87 from $71.71 in the year-ago quarter.

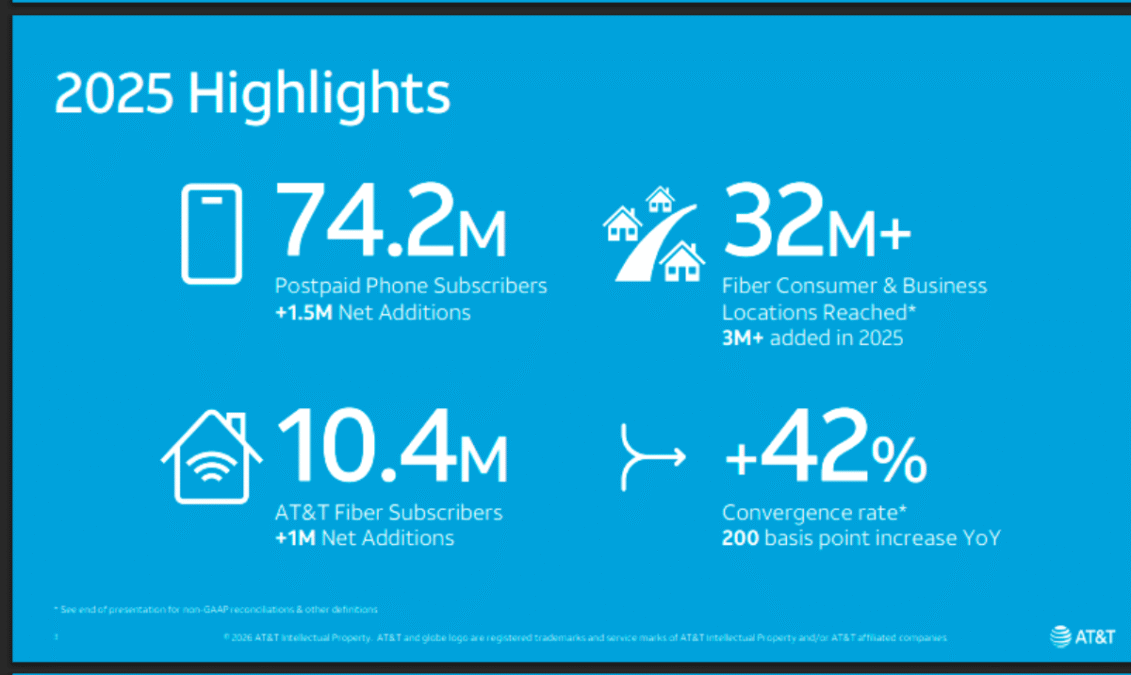

Subscriber momentum remained strong, with broadband adds of 210,000 in Q4 2025, compared to 123,000 in Q4 2024. Fiber subscribers grew by 283,000, while non-fiber broadband losses narrowed to 73,000. AT&T Internet Air added 221,000 subscribers in the quarter versus 157,000 last year. Postpaid phone additions reached 641,000 for the year, reflecting consistent customer demand.

Strategic Outlook

AT&T’s 2025 results underscore its strategy of expanding high-value services, modernizing its network, and maintaining disciplined capital allocation. The company continues to focus on Mobility growth, fiber deployment, and broadband expansion, supporting long-term revenue stability and enhanced customer experiences.

With consistent ARPU, solid subscriber gains, and controlled capex, AT&T enters 2026 well-positioned to leverage its network investments, drive service adoption, and deliver shareholder value.

BABURAJAN KIZHAKEDATH