South Africa’s fixed and mobile communications markets are on track for steady expansion over the next five years, supported by aggressive fiber rollouts, growing demand for high-speed broadband, and accelerating 5G adoption.

Data from GlobalData indicates that fixed communication services revenue will grow at a compound annual rate of 4.1 percent between 2025 and 2030, with fiber broadband and fixed wireless access emerging as the country’s strongest long-term growth drivers.

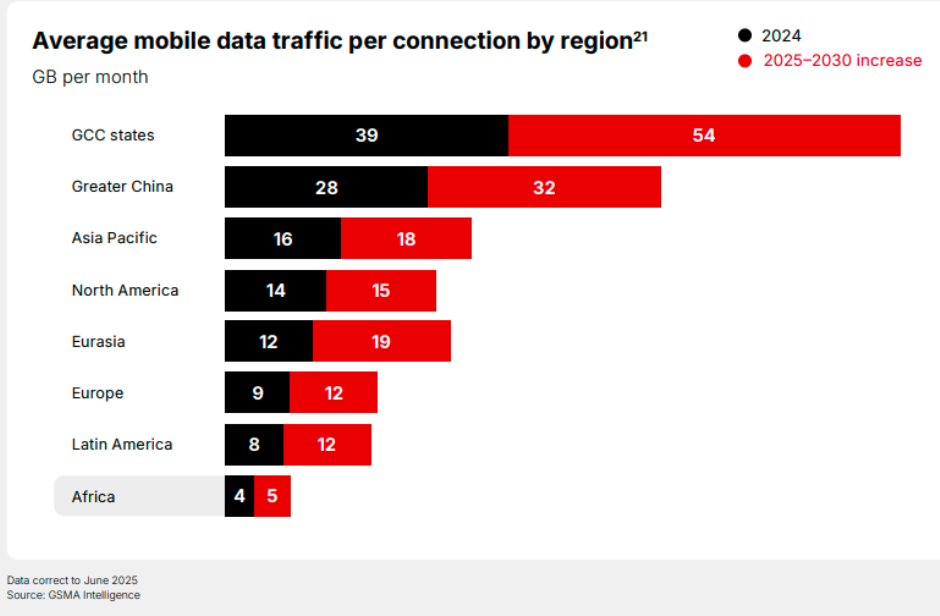

GSMA Intelligence earlier said mobile operator capex in the Africa continent during 2024–2030 will be $77 billion. Operator revenues in the Africa continent will be reaching $79 billion in 2030 as compared with $52 billion in 2024.

Fixed Broadband and FWA Drive Expansion

Fixed broadband revenue is set to climb at a 4.4 percent annual rate from 2025 to 2030, outpacing traditional fixed voice services. Growth is driven by expanding fiber-to-the-home and fiber-to-the-building networks, along with rising demand for fixed wireless access in regions where fiber rollout is limited or cost-prohibitive.

ICASA data shows that fixed broadband subscriptions rose from 1.4 million in 2023 to 2.7 million by the end of 2024, with about 2.47 million FTTH/B connections. Neha Mishra, Telecom Analyst at GlobalData, notes that fiber remains the leading broadband technology in South Africa due to increasing demand for high-speed connectivity and coordinated efforts by government and operators to expand access.

Government support is accelerating this trajectory. In July 2025, South Africa allocated ZAR710 million (USD 37.9 million) to the SA Connect Programme to expand fiber networks across schools, healthcare facilities, and underserved areas, enhancing national digital inclusion.

Fixed wireless access is also gaining momentum, forecast to grow at a 9.1 percent annual rate over the next five years as rural and semi-urban households adopt wireless broadband. The rise of 5G-powered FWA is strengthening the segment by offering a faster, more flexible alternative to wired broadband.

Telkom leads the fixed broadband, reporting 554,953 fiber subscribers and a mobile base of 23.2 million in 2025. The company allocated about 27 percent of total FY2025 capital expenditure to fiber deployment, accelerating the shift from legacy copper networks to modern high-speed infrastructure.

Mobile Market Grows with 5G Momentum

South Africa’s mobile services market is expected to rise from USD 7.1 billion in 2025 to USD 7.5 billion in 2030, representing a 1.1 percent annual growth rate. Voice revenue is projected to decline at a 1 percent rate as consumers increasingly rely on OTT communication platforms. In contrast, mobile data revenue is set to grow at 2.1 percent annually, driven by expanding LTE networks and the adoption of premium 5G plans.

Monthly mobile data usage is expected to surge from 5.5GB in 2025 to 14.3GB in 2030, reflecting rising consumption of video, social media, and richer digital content.

4G will remain South Africa’s dominant mobile technology, supported by network enhancements and coordinated efforts to phase out 2G and 3G networks. Meanwhile, 5G is expected to grow the fastest, reaching about 34 percent of all mobile connections by 2030 as coverage expands and more affordable 5G devices enter the market.

Vodacom is leading the mobile market in terms of mobile subscriptions and service quality, supported by sustained investment in 4G and 5G infrastructure.

MTN South Africa has 40.1 million mobile phone customers on its network in Q3 2025.

Capex Surge Supports Network Modernization

Telkom’s FY2025 capital expenditure reached R6.09 billion, including R1.39 billion for fiber and R2.79 billion for mobile network upgrades. Vodacom spent around R11.6 billion on network expansion and technology upgrades during the same period.

MTN’s Capex in South Africa is expected to reach R 6 billion in 2025 as compared with R 16.3 billion in 2024.

Overall, South Africa’s major operators invested an estimated R27 billion in 2025 to expand capacity and modernize infrastructure.

Strategic Priorities Reshaping the Market

Operators are increasingly deploying hybrid broadband strategies that combine fiber and fixed wireless access to expand high-speed coverage efficiently, according to the latest Opensignal report. Smart capex management is emerging as a core priority, focusing on cost optimization and targeted investments.

Network performance and reliability are becoming key competitive differentiators, with MTN and Vodacom leading in 4G and 5G user experience. Operators are also strengthening partnerships and acquisitions to accelerate fiber deployments and are expanding their portfolios of digital services, enterprise solutions, and sustainability initiatives.

According to GSMA, the Independent Communications Authority of South Africa increased licensing and application fees by 4.4 percent effective April 2025. This covers spectrum fees, equipment approvals and other regulatory services, adding to operators’ operational costs and potentially affecting network expansion.

Outlook to 2030

With accelerating fiber deployment, rising FWA adoption, expanding 5G coverage, and strong capex commitments, South Africa’s telecom sector is positioned for sustained growth through 2030. A combined focus on hybrid broadband models, network modernization, and digital services will support stronger ARPU prospects, broader digital inclusion, and the country’s long-term digital transformation.

Fasna Shabeer