Stephane Teral, senior research director, mobile infrastructure and carrier economics at IHS Markit, has revealed that mobile infrastructure spending dropped 10 percent in 2016 to $43 billion.

Stephane Teral, senior research director, mobile infrastructure and carrier economics at IHS Markit, has revealed that mobile infrastructure spending dropped 10 percent in 2016 to $43 billion.

$48 billion was the total mobile infrastructure revenue in 2015.

Slowdown in telecom market in China, which is home to telecom operators such as China Mobile, China Unicom and China Telecom, was the main reason for the 10 percent drop in the mobile infrastructure revenue globally. All regions performed negatively last year.

Telecom software revenue that goes with 2G, 3G and 4G networks grew 2 percent in 2016 to $15.5 billion, mostly driven by LTE-A (LTE-Advanced) upgrades.

The below given charts from Vodafone Group and Telecom Italia indicate about their growth strategy and investment pattern in mobile networks.

Ericsson, Huawei and Nokia have grabbed the top three spots in the mobile infrastructure market in 2016. The Chinese vendors such as Huawei and ZTE were hit by the decline in China, a market where they are the most exposed.

Ericsson, Huawei and Nokia have grabbed the top three spots in the mobile infrastructure market in 2016. The Chinese vendors such as Huawei and ZTE were hit by the decline in China, a market where they are the most exposed.

Ericsson regained the lead in mobile infrastructure market from Huawei.

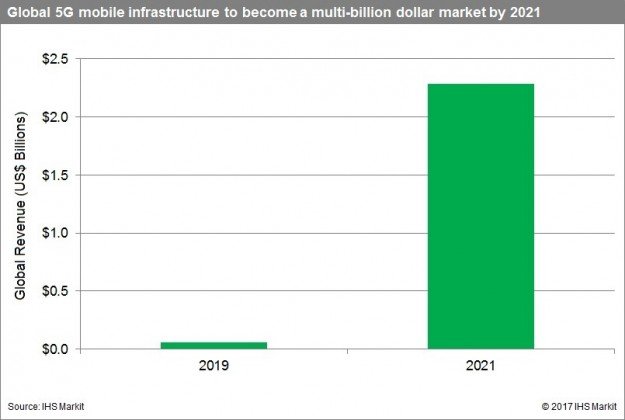

IHS Markit, analyzing the total size of the mobile infrastructure market for 2016, noted that 5G mobile infrastructure is projected to be a multibillion-dollar market by 2021.

Q4 2016

Macrocell mobile infrastructure market rose 7 percent quarter on quarter and fell 14 percent to $11 billion in Q4 2016 — driven by strong activity in a few Asian countries such as India, Myanmar and Vietnam.

The 14 percent drop, dragged down by all regions – confirms that the market has entered the post-LTE-peak era.

Indian telecom operators such as Bharti Airtel, Idea Cellular, Reliance Jio Infocomm, Vodafone India were busy building out their mobile data networks in most quarter of 2016.

The above chart from Vodafone Group indicates about the telecom operator’s willingness to make investment in data networks.

IHS Markit said the global LTE infrastructure revenue rose 6 percent quarter-over-quarter driven by E-UTRAN (evolved UMTS terrestrial radio access networks), and fell 16 percent year-over-year. 2G / 3G mobile infrastructure market increased 10 percent sequentially, kept alive by W-CDMA (wideband code division multiple access) in Japan.

As of January 30, 2017, 581 total commercial LTE networks have been launched. All indicators point to a year of LTE decline in 2017 as a result of diminishing rollouts worldwide.

LTE infrastructure market will decline at a CAGR of 12.4 percent from 2016 to 2021, sinking to $12 billion from its peak of $25.9 billion in 2015.

Baburajan K

editor@telecomlead.com