Sunrise has delivered its FY2025 results, highlighting stable revenue, improving ARPU trends, strong subscriber momentum and disciplined Capex and Opex as the company shifts from integration to cash flow generation and shareholder returns.

Revenue and profitability supported by cost efficiency

Sunrise reported total revenue of CHF 2.98 billion for FY2025, representing a 1.1 percent year-on-year decline. The decrease was mainly driven by softer fixed-line subscription revenue and weaker handset sales as consumer demand for devices remained subdued.

Despite revenue pressure, profitability improved due to aggressive cost discipline and integration synergies.

Key financial highlights include:

Adjusted EBITDAaL increased 0.9 percent to CHF 1.04 billion

Adjusted free cash flow rose 4.7 percent to CHF 379.7 million, reaching the high end of guidance

These results reflect Sunrise’s transition toward a cash flow focused operating model.

Subscriber growth and ARPU stabilisation drive performance

Customer growth remained a core strength in 2025, led by mobile postpaid and SME demand.

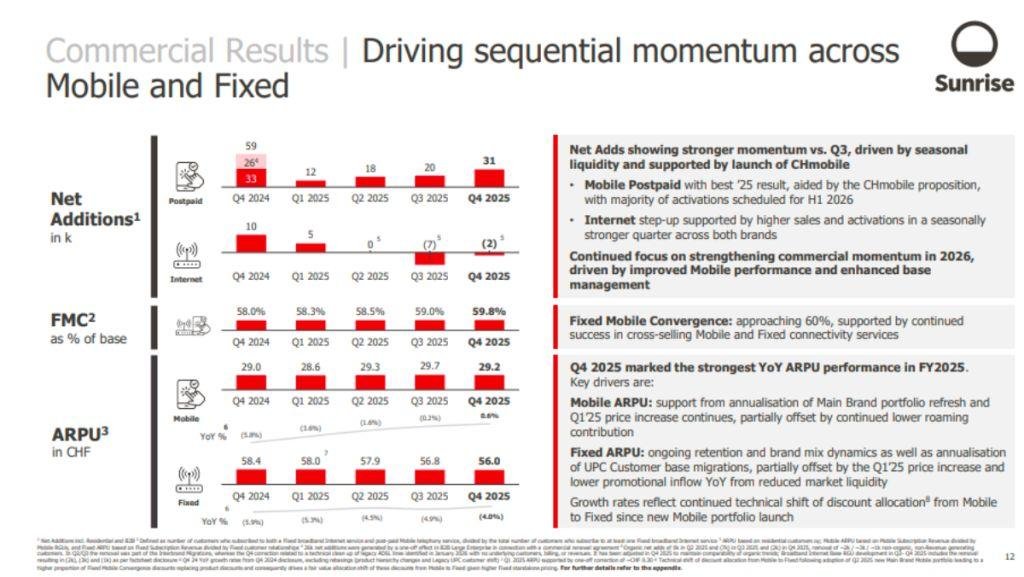

Mobile subscribers and FMC momentum

Mobile postpaid net additions reached 82,000 for the year

Fixed-Mobile Convergence rose to 59.0 percent

SME demand and flanker brands supported growth in the value segment

Higher convergence continues to improve customer stickiness and reduce churn.

Broadband and TV base stabilise after UPC migration

Broadband customers remained stable at around 1.29 million

TV subscribers reached approximately 0.97 million

Migration of legacy UPC customers is now complete, removing a key source of churn

ARPU trends improve

Mobile ARPU stabilised following price increases implemented in March 2025. Fixed ARPU also improved as Sunrise moved beyond the post-promotional repricing phase of its integrated customer base.

Capex discipline and Opex savings boost cash generation

Sunrise significantly reduced investment intensity and operating expenses following the completion of its integration phase. Capex of Sunrise was CHF113 million in Q4-2025, and CHF 479 million in 2025.

Capex efficiency

Capital expenditure declined 6.1 percent year-on-year

Capex intensity dropped below 15 percent of revenue

Spending is shifting from heavy integration toward maintenance and targeted 5G investments

Opex reductions

Operating expenses declined due to structural synergies, including:

Shutdown of the legacy UPC mobile core network

Lower network maintenance costs

Reduced marketing campaign spending

These measures are expected to support long-term margin expansion.

AI focus

Sunrise Communications is highlighting artificial intelligence as a core driver of cost efficiency, investment optimization and network expansion.

The company expects reduced capacity investment needs due to smarter demand forecasting and automation. AI is also lowering customer premises equipment (CPE) replacement requirements and shifting spending toward more targeted innovation initiatives.

AI-driven efficiencies are already reducing IT development costs, enabling Sunrise to streamline operations and improve productivity across technology teams. The savings generated are being redirected into strategic priorities, particularly expanding mobile network coverage and scaling new AI-led innovation projects.

Premium Challenger strategy drives multi-brand growth

Sunrise continues executing its Premium Challenger strategy through a tiered multi-brand approach.

Premium segment leadership

The Sunrise brand targets high-value customers with 5G Standalone leadership and high-speed Swiss Connect offerings.

Flanker brand positioning

Brands such as yallo and CHmobile compete in the budget segment, allowing Sunrise to capture price-sensitive customers while protecting the premium brand.

SME and B2B expansion

Sunrise is expanding ICT services for SMEs, including cybersecurity, cloud calling and integrated communications. This segment is becoming a major growth pillar.

2026 outlook: stable revenue and higher free cash flow

For 2026, Sunrise expects:

Largely stable revenue

Adjusted EBITDAaL of around CHF 1 billion

Capex intensity to remain below 15 percent of revenue

With integration largely complete, Sunrise is entering a new phase focused on profitability, customer value and shareholder returns.

BABURAJAN KIZHAKEDATH