MediaTek has reported first-quarter revenue of NT$153.3 billion, representing an 11.1 percent increase sequentially and a 14.9 percent rise year-over-year, reflecting strong adoption of advanced connectivity technologies.

Outlook

Looking ahead, MediaTek projects second-quarter revenue between NT$147.2 billion and NT$159.4 billion, representing down 4 percent to up 4 percent sequentially and a year-over-year increase of 16-25 percent, signaling confidence in ongoing market demand and strategic product positioning.

MediaTek expects growth in its flagship and premium segments in the second quarter, driven by increased adoption of its AI SoCs, including the Dimensity 9400+ and Dimensity 8000 series. However, due to slowing demand in the mainstream and entry-level segments following a strong first quarter, the company anticipates Mobile revenue will remain flat or decline slightly quarter-over-quarter.

The anticipation of up to 25 percent increase in revenue is despite the fact that Donald Trump’s tariffs will have some impact on the smartphone industry.

Rick Tsai, MediaTek CEO, said: “The tariff situation has created uncertainties. We are closely observing their impact on global economies and working with our global supply chain partners and customers to navigate the uncertainties.”

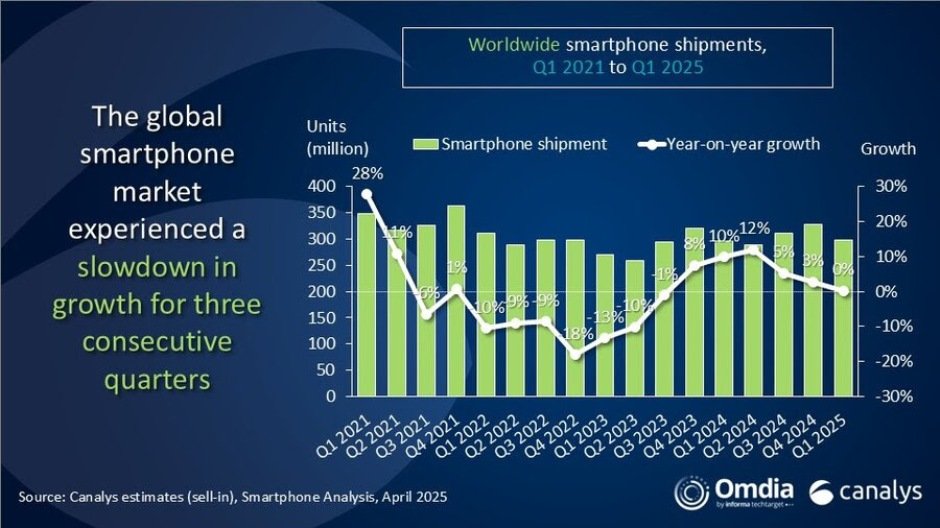

Toby Zhu, Principal Analyst at Canalys (now part of Omdia), said smartphone brands remain optimistic about a market rebound in Q2 and the second half of the year, despite weak Q1 performance. Signs of recovery in regions like Southeast Asia and Latin America, along with falling inventory levels and upcoming mid- and low-end product launches, are boosting confidence.

However, phone vendors still face key challenges, including cautious hardware upgrades in mass-market segments to control costs, intensifying competition in the US$200–$400 range, and potential cost pressures from growing global trade tensions and localized manufacturing requirements, Toby Zhu said.

MediaTek’s strategy centers on driving revenue growth through diversification and innovation across key technology segments, with a particular emphasis on AI integration and next-generation wireless standards like Wi-Fi 7.

Its Mobile Phone segment, which contributed 56 percent of total revenue, saw 6 percent growth both sequentially and annually, driven by higher demand in the mainstream and entry-level markets despite a slight decline in flagship demand.

The Smart Edge Platforms group exhibited the most robust performance, growing 32 percent year-over-year and 23 percent sequentially, now accounting for 39 percent of total revenue due to improved product mix and early demand pull-ins.

Meanwhile, the Power IC group made up 5 percent of revenue, with a 7 percent year-over-year increase but a 9 percent sequential decline attributed to seasonal effects.

MediaTek’s operational efficiency improved with net income of NT$29.5 billion, up 23.3 percent quarter-over-quarter despite a 6.7 percent year-over-year drop, while operating income surged 40.4 percent sequentially.

Although gross margin declined to 48.1 percent, down 0.4 percentage points from the prior quarter and 4.3 points year-over-year, the company continues to manage its cost structure, as seen in a reduction in quarterly operating expenses.

Baburajan Kizhakedath