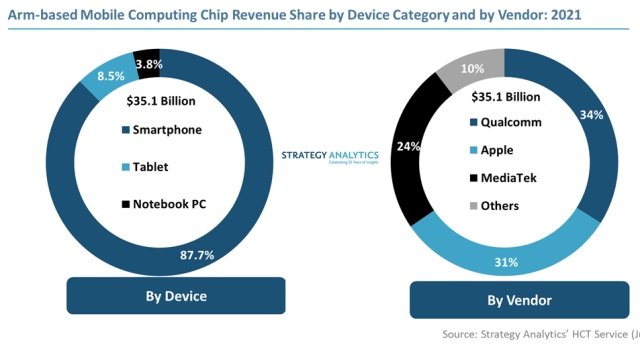

The Arm-based mobile computing chip market (smartphones, tablets and notebook PCs) grew 27 percent to $35.1 billion in 2021, according to Strategy Analytics.

Qualcomm, Apple and MediaTek captured the top-three revenue share ranking spots in the Arm-based mobile computing chip (AP) market in 2021.

Qualcomm, Apple and MediaTek captured the top-three revenue share ranking spots in the Arm-based mobile computing chip (AP) market in 2021.

Qualcomm led the Arm-based mobile computing chip market with a 34 percent revenue share, followed by Apple with 31 percent and MediaTek with 24 percent.

Smartphone, tablet, and notebook PC processors accounted for 88 percent, 9 percent and 3 percent of total Arm-based mobile computing chip revenue in 2021.

The report said Arm-based mobile computing market outperformed the x86-based mobile computing market in revenues and units. The total Arm-based mobile computing chip revenue was almost 20 percent higher than that of x86 (excluding chipsets and discrete GPUs) in 2021.

Arm-based mobile computing posted robust revenue growth in 2021, driven by growth in smartphone applications processors. MediaTek led the overall Arm-based mobile computing market in units while Qualcomm led in revenues. MediaTek led the Arm-based smartphone, Android tablet and Chromebook processor segments in unit terms in 2021.

Apple established itself as a distant market leader in Arm-based notebook PC processors with almost 90 percent revenue share. Apple’s M-series processors set the benchmark and gave Apple a 2–3-year lead over the rest of the Arm-based PC processor vendors.

Qualcomm captured just 3 percent revenue share in the Arm-based notebook PC processor market in 2021 and lags Apple in CPU performance.

Qualcomm continues to invest in notebook PC processors with its Nuvia CPU cores.

Arm-based notebook PC processor offers an attractive opportunity to Qualcomm, given the company’s growing collection of high-performance processor assets including CPU, GPU, AI, audio, imaging, connectivity, gaming and security, Sravan Kundojjala, author of the report and Director of Handset Component Technologies service at Strategy Analytics, said.