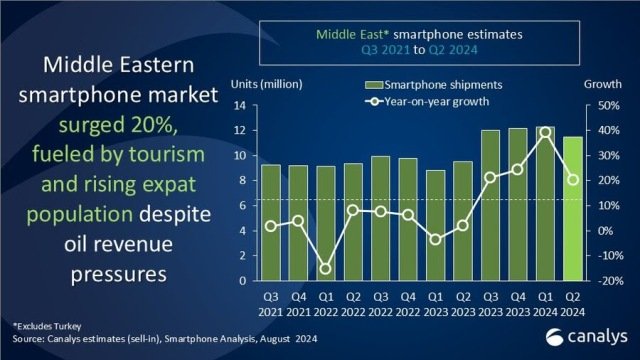

Smartphone shipments in the Middle East (excluding Turkey) grew 20 percent to 11.5 million units in Q2 2024, the latest Canalys report said.

The growth in the smartphone business in top countries in the Middle East was 13 percent in Saudi Arabia, 19 percent in United Arab Emirates, 22 percent in Iraq, 14 percent in Qatar and 17 percent in Kuwait.

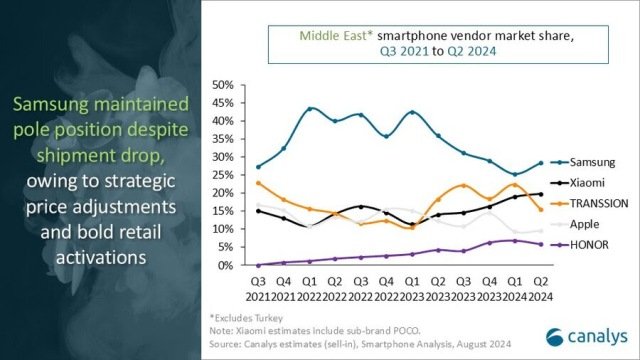

The top smartphone brands in the Middle East are Samsung (3.3 million / 28 percent share), Xiaomi (2.3 million / 20 percent), Transsion (1.8 million / 16 percent), Apple (1.1 million / 10 percent), Honor (0.7 million / 6 percent) and others (2.4 million / 21 percent) in Q2 2024.

Top Smartphone Brands in Middle East

In Q2 2024, the Middle East’s smartphone market saw significant shifts, with Samsung retaining its leading position despite a slight decline in shipments. The top five brands were:

Samsung: Leading with a 28 percent market share, Samsung shipped 3.3 million units in Q2, driven by its mid-tier Galaxy A series and the premium Galaxy S24. However, shipments dipped by 5 percent. The second half of 2024 is expected to bring growth through aggressive retail activations and strategic pricing. While the new Z Fold series has yet to gain traction, demand for the S24 series remains strong.

Xiaomi: Surging to second place with a 20 percent market share and 2.3 million units shipped, Xiaomi saw a remarkable 70 percent growth. This success was fueled by affordable models like the Redmi A3, 13C, and 13 4G, though the brand’s average selling price (ASP) dropped by 14 percent due to a focus on the sub-US$200 segment.

TRANSSION: Holding a 16 percent market share with 1.8 million units shipped, TRANSSION secured third place with a 3 percent growth rate. Its success was largely due to aggressive pricing and the popularity of its Infinix brand, which accounted for nearly 49 percent of its volume.

Apple: Despite a decline in shipments, Apple maintained a 10 percent market share with 1.1 million units shipped, largely driven by the iPhone 13 and 14. The second half of 2024 is expected to see increased demand for upcoming iPhone models, particularly among the region’s affluent population.

HONOR: With a 6 percent market share and 0.7 million units shipped, HONOR experienced substantial growth, particularly in Saudi Arabia and Iraq, thanks to an expanded retail presence.

Other brands collectively held a 21 percent market share, with Motorola notably expanding its distribution channels, leading to robust shipment growth for its Edge series. As the year progresses, the Middle East’s smartphone market is poised for further developments, particularly with new product launches and strategic market positioning.

Baburajan Kizhakedath