Indian smartphone vendors experienced a robust revival in the fourth quarter of 2023, capitalizing on heightened demand during the festival season. Shipments of smartphone surged to 38.9 million units, marking 20 percent year-on-year rebound, according to the latest research from Canalys.

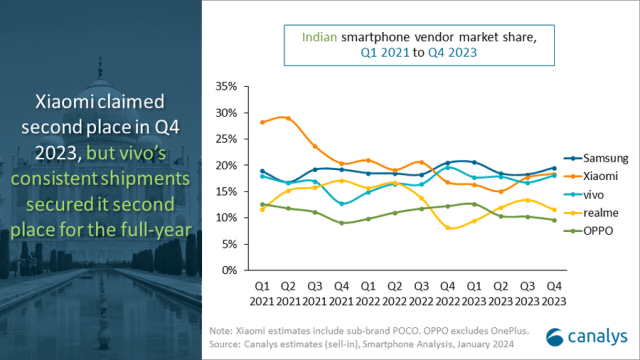

In Q4 2023, Samsung maintained its leadership position with a market share of 20 percent, shipping 7.6 million units.

In Q4 2023, Samsung maintained its leadership position with a market share of 20 percent, shipping 7.6 million units.

Xiaomi continued its strong performance, securing the second spot with 7.2 million units.

Vivo claimed the third position with shipments of 7.0 million units.

Realme and OPPO (excluding OnePlus) rounded out the top five, shipping 4.5 million and 3.7 million units, respectively.

For the entire year of 2023, India’s smartphone market demonstrated stability with 148.6 million shipments overall, experiencing only a minor drop of 2 percent. Despite challenges such as inventory issues, minimal inflation improvements, and fluctuating demand throughout the year, the market showcased resilience, thanks to improved consumer confidence in the latter part of the year.

Sanyam Chaurasia, Senior Analyst at Canalys, highlighted the positive impact of growing investment in mainline retail space on vendors and the overall market’s stability. Chaurasia emphasized the need for brands to focus on bolstering the confidence of their channel partners to enhance their positions in the premium space.

Xiaomi and Realme saw their highest offline shipment share in Q4, with both brands contributing equally to offline and online channels.

Xiaomi and Realme saw their highest offline shipment share in Q4, with both brands contributing equally to offline and online channels.

In terms of market share, the premium segment experienced robust growth in Q4, driven by easy financing options, incentive schemes for retailers, and rising disposable income. Apple capitalized on the festive sales during Diwali in November 2023, pushing the latest iPhone 15 series and contributing over 50 percent to its shipments in Q4. Samsung aggressively targeted retail goals for its premium Galaxy S23 series, and the launch of the Galaxy S23 FE in Q4 further boosted shipments.

Looking ahead to 2024, Canalys noted that vendors enter an “Election Year” with improved indicators for the consumer market, manageable inflation, steady interest rates, and clear visibility of a stable government.

Canalys anticipates the Indian smartphone market to grow by mid-single digits in 2024, driven by affordable 5G smartphones and the replacement cycle following the pandemic. However, managing the rising bill of materials costs poses a significant challenge for vendors this year.