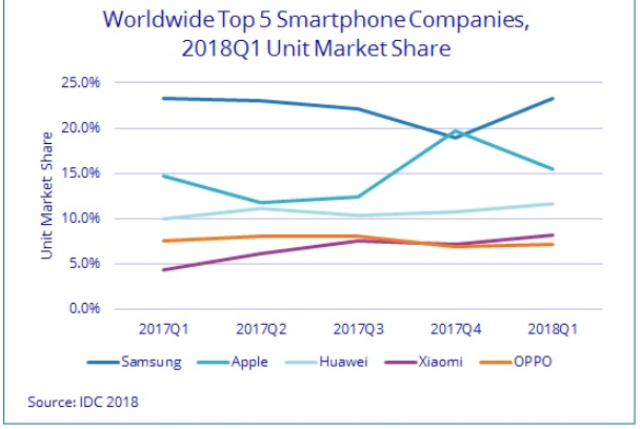

The chart prepared by analyst firm IDC shows how bad was Q1 2018 for Apple and the best for Samsung.

IDC said smartphone vendors shipped 334.3 million units (–2.9 percent) during the first quarter of 2018 vs 344.4 million units in the first quarter of 2017.

China market was the biggest driver of this decline with shipment volumes dipping below 100 million in the quarter, which hasn’t happened since the third quarter of 2013.

“Despite new flagships from the likes of Samsung and Huawei, along with the first full quarter of iPhone X shipments, consumers looked unwilling to shell out big money for the latest and greatest devices on the market,” said Anthony Scarsella, research manager with IDC’s Worldwide Quarterly Mobile Phone Tracker.

“Despite new flagships from the likes of Samsung and Huawei, along with the first full quarter of iPhone X shipments, consumers looked unwilling to shell out big money for the latest and greatest devices on the market,” said Anthony Scarsella, research manager with IDC’s Worldwide Quarterly Mobile Phone Tracker.

Samsung, which regained top position, has grabbed 23.3 percent share despite posting a 2.4 percent decline from Q1 2017.

The new S9 and S9+ led the way as the new flagships launched a quarter early for the Korean giant compared to last year’s S8/S8+.

Apple has shipped 52.2 million iPhones achieving 2.8 percent year-over-year increase from 50.8 million last year. But Apple faced quarter on quarter de-growth.

The costly iPhone X combined with sales of the iPhone 8 and 8 Plus helped grow ASPs 11.1 percent to $728, up from $655 last year.

Huawei has 11.7 percent share. Outside of China, Huawei is gaining market share across the Western Europe region. It is particularly strong in Spain, Germany, and Italy. Huawei also reintroduced its Honor brand in a couple of markets in Southeast Asia, where the high-end P series and Mate series are less popular.

Huawei has 11.7 percent share. Outside of China, Huawei is gaining market share across the Western Europe region. It is particularly strong in Spain, Germany, and Italy. Huawei also reintroduced its Honor brand in a couple of markets in Southeast Asia, where the high-end P series and Mate series are less popular.

Xiaomi, the fourth largest smartphone maker, focuses on online channels to grow the phone business in India, its second largest market. Xiaomi also recently announced PCB assembly in India, becoming the second vendor after Samsung to do so.

OPPO, which held the fifth position with its year-over-year decline of 7.5 percent, has also pruned some of its retail partnerships to focus on those with higher contribution to sales. OPPO has also shifted some focus to online channels to counter Xiaomi’s strong growth in the India market.

Baburajan K