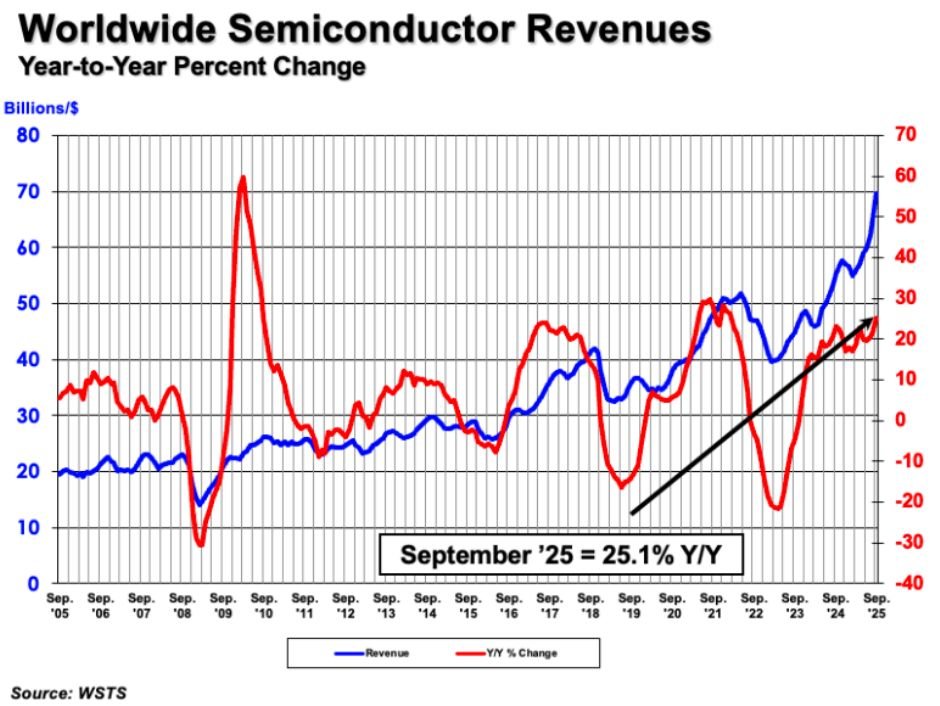

Worldwide semiconductor sales have reached $208.4 billion in the third quarter of 2025, marking a 15.8 percent increase from the previous quarter (Q2 2025), the Semiconductor Industry Association (SIA) said. The industry recorded robust year-on-year and month-to-month growth, reflecting accelerating recovery and rising demand across key chip categories such as memory and logic.

According to data compiled by the World Semiconductor Trade Statistics (WSTS) organization, global semiconductor sales totaled $69.5 billion in September 2025, a 25.1 percent increase compared to $55.5 billion in September 2024, and a 7 percent increase over August 2025. These figures are based on a three-month moving average and signal continued momentum in the global chip market.

SIA, which represents 99 percent of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip companies, highlighted that the latest results show a broad-based recovery led by demand from both consumers and enterprises.

“Global chip sales continued to grow in the third quarter of this year, significantly outpacing sales from Q2,” said John Neuffer, SIA president and CEO. “Market growth was driven by increased demand across a range of semiconductor products, including memory and logic. Year-to-year growth was fueled by sales into the Asia Pacific region and the Americas.”

Regional Semiconductor Market Performance

Regional analysis of semiconductor sales showed strong double-digit growth in most key markets:

Asia Pacific/All Other: Up 47.9 percent year-on-year

Americas: Up 30.6 percent

China: Up 15.0 percent

Europe: Up 6.0 percent

Japan: Down 10.2 percent

On a month-to-month basis, chip sales in September 2025 also rose across all major regions:

Americas: Up 8.2 percent

Asia Pacific/All Other: Up 8.0 percent

China: Up 6.0 percent

Europe: Up 5.5 percent

Japan: Up 1.6 percent

Outlook for the Semiconductor Industry

The sustained rise in semiconductor sales indicates ongoing recovery following supply chain challenges and market fluctuations in 2022 and 2023. The memory market, particularly DRAM and NAND, has rebounded sharply as AI infrastructure, cloud computing, and high-performance devices continue to drive demand. Logic chips, used in smartphones, data centers, and automotive systems, also contributed significantly to Q3 growth.

Analysts expect global semiconductor revenue to continue rising into 2026 as investments in AI chips, automotive semiconductors, and advanced manufacturing nodes gain momentum. Government-backed initiatives in the United States, Europe, and Asia to strengthen semiconductor supply chains are also expected to support long-term industry growth.

With chipmakers ramping up production and consumer electronics showing signs of revival, the semiconductor industry appears poised for a sustained expansion phase heading into 2026.

Fasna Shabeer