The latest IDC report has revealed the size of the Indian smartphone market in 2024 and the major suppliers in the 5G smartphone market.

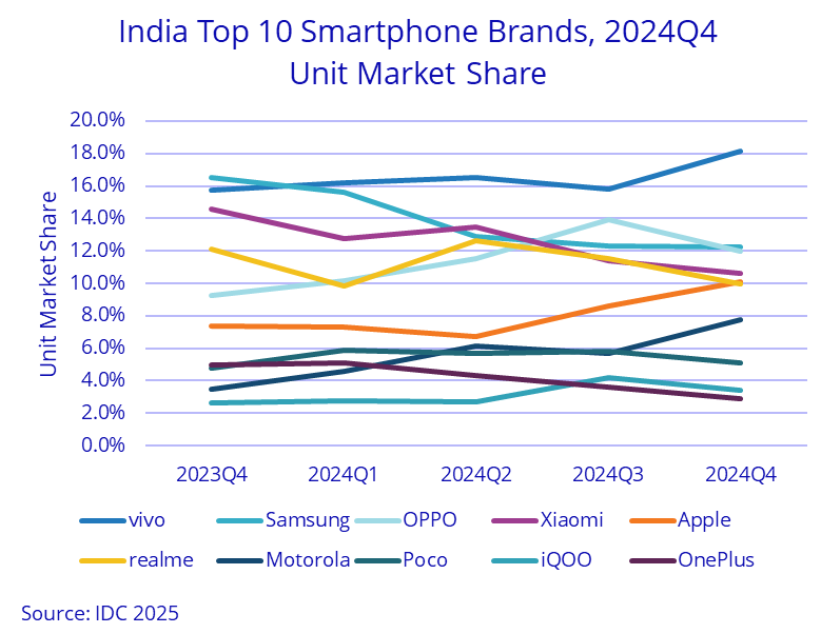

Vivo has led the Indian smartphone market in 2024 with a 16.6 percent share, up from 15.2 percent in 2023, surpassing Samsung, which dropped to 13.2 percent from 17.0 percent.

OPPO secured third place, increasing its share from 10.4 percent to 12.0 percent, while Xiaomi maintained its 12.0 percent share.

Realme saw a decline from 12.5 percent to 11.0 percent. Apple gained momentum, reaching 8.2 percent from 6.4 percent, marking a strong growth trajectory.

Motorola experienced a significant rise, doubling its share from 2.7 percent to 6.0 percent.

Poco grew from 4.9 percent to 5.6 percent, while OnePlus dropped from 6.1 percent to 3.9 percent. iQOO improved from 2.3 percent to 3.3 percent.

Vivo overtook Samsung as the market leader, while Nothing, Motorola, and iQOO saw the highest growth.

The combined share of other brands increased from 10.0 percent to 8.2 percent, reflecting a consolidation among the top players.

India’s smartphone market grew 4 percent YoY in 2024, with shipments reaching 151 million units. The first half saw a 7 percent increase, while the second half slowed to 2 percent. In 4Q24, shipments declined 3 percent to 36 million units.

Apple became the fourth-largest market in India, shipping a record 12 million units with 35 percent growth. The company entered the top 5 brands for the first time with a 10 percent share.

The average selling price (ASP) hit a new high of $259, though its 2 percent growth was lower than in previous years. The entry-premium ($200-$400) segment grew the most, surging 35.3 percent to a 28 percent share.

5G smartphones dominated, making up 79 percent of shipments, with 120 million units shipped. 5G ASPs dropped 19 percent YoY to $303, while budget 5G phones ($100-$200) nearly doubled in share to 47 percent.

Shipments to offline and online channels grew at the same 4 percent rate, maintaining their 51 percent-49 percent split.

Feature phone shipments fell 11 percent YoY to 54 million units, with Transsion leading at 30 percent market share. India’s total mobile phone shipments declined 1 percent YoY to 205 million. Growth in 2025 will depend on the mass segment ($100-$200) and entry-premium models, while AI features will expand beyond flagships.

Baburajan Kizhakedath