Telecom major AT&T has revealed its main achievements – including growth in fiber and mobile subscriber additions – during the second-quarter of 2024.

First, AT&T added 419,000 postpaid phone connections with an expected industry-leading postpaid phone churn of 0.70 percent.

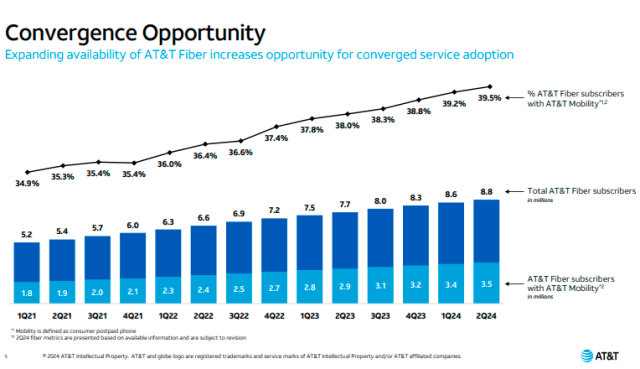

Second, AT&T added 239,000 Fiber connections. AT&T added 200,000+ fiber connections for 18 consecutive quarters.

Third, AT&T added 139,000 AT&T Internet Air connections.

AT&T’s consumer broadband revenues rose 7 percent to $2.7 billion.

Fiber focus

AT&T does not reveal its specific investment in 5G and fiber. But the telecom giant is gaining from its investment in fiber.

John Stankey, AT&T CEO, said: “AT&T is leading the way in converged connectivity as customers increasingly seek one provider who can seamlessly connect them in their home, at work and on the go. This is proving to be a winning strategy.”

“Nearly four of every 10 AT&T Fiber households also choose AT&T wireless service. As the nation’s largest consumer fiber builder, we see this as an opportunity to grow subscribers and revenues, while deepening customer relationships,” John Stankey said.

AT&T’s top management has executed consistent and disciplined go-to-market strategy with a focus on profitable growth. They targeted underpenetrated segments and expanded converged customer opportunities. AT&T has generated value by creating and maintaining high-value, long-term customer relationships.

AT&T also achieved incremental run-rate cost savings target of $2 billion+ by mid-2026. AT&T is also driving efficiencies, enhanced customer experiences and scale benefits with AI. AT&T expanded 5G and fiber premium services, enabling transition from legacy infrastructure.

Capex

AT&T’s capital expenditures were $4.4 billion in the quarter versus $4.3 billion in the year-ago quarter.

AT&T’s capital investment totaled $4.9 billion versus $5.9 billion in the year-ago quarter. In the quarter, cash payments for vendor financing totaled $0.6 billion versus $1.6 billion in the year-ago quarter. AT&T did not reveal its payment to Nokia.

AT&T is expecting wireless service revenue growth in the 3 percent range, broadband revenue growth of 7 percent; Adjusted EBITDA growth in the 3 percent range and capital investment of in the $21-$22 billion range for the full year.

Opex

AT&T reported operating expenses of $24 billion versus $23.5 billion in the year-ago quarter due to Open RAN network modernization efforts, including restructuring costs and accelerated depreciation on wireless network equipment, and higher depreciation related to fiber and 5G investment.

Financial Performance

AT&T’s revenues for the second quarter fell 0.4 percent to $29.8 billion from $29.9 billion in the year-ago quarter due to lower Business Wireline service revenues and declines in Mobility equipment revenues.

AT&’s operating income was $5.8 billion versus $6.4 billion in the year-ago quarter. AT&T’s net income was $3.9 billion versus $4.8 billion in the year-ago quarter.

Baburajan Kizhakedath