Alphabet’s Google made an offer this year to sell its advertising marketplace, AdX, in an attempt to resolve an EU antitrust investigation, Reuters news report said. However, the proposal was rejected by European publishers as insufficient.

The investigation, sparked by a complaint from the European Publishers Council, led the European Commission to charge Google with favoring its own advertising services. This marks the Commission’s fourth antitrust case against the US-based tech giant.

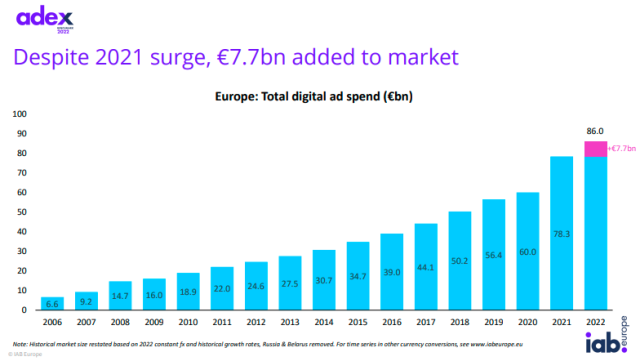

The digital advertising market in Europe has reached €96.9 billion (up 11.1 percent) in 2023.

For the first time in an antitrust case, Google has offered to divest a part of its business. However, publishers have expressed dissatisfaction with the offer, arguing that Google’s presence in multiple layers of the ad-tech supply chain creates inherent conflicts of interest. They are calling for broader divestment beyond AdX.

AdX, or Ad Exchange, is Google’s real-time marketplace where advertisers can purchase unsold ad space from publishers. While the European Commission’s competition chief, Margrethe Vestager, suggested last year that Google divest its sell-side tools, DFP and AdX, it appears unlikely the Commission will force such an action at this stage.

Instead, the Commission may issue orders requiring Google to halt anti-competitive practices within the next few months, with the possibility of a divestment order if compliance fails.

Google’s digital advertising revenue in 2023, which includes earnings from services like Gmail, YouTube, and Ad Manager, amounted to $237.85 billion — about 77 percent of its total revenue — cementing its position as the dominant player in global digital advertising.

A Google spokesperson defended the company’s practices, calling the Commission’s case flawed and emphasizing the competitive nature of the ad-tech sector. The European Commission and the European Publishers Council declined to comment.