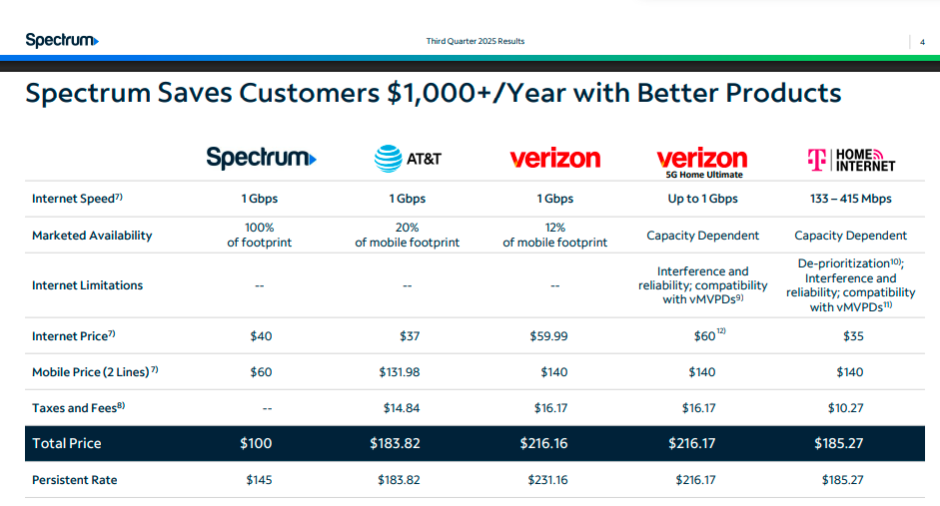

Spectrum is intensifying its value-focused positioning in Q3 2025, stating that U.S. households can save more than US$1,000 per year compared to AT&T, Verizon and T-Mobile, if they switch to Spectrum’s integrated broadband + mobile model.

The operator is emphasising affordability, gigabit accessibility across its footprint, fewer billing surprises and simplified package convergence — which together reinforce Spectrum’s “value delta” against more premium-priced incumbents.

Monthly Pricing Gap Creates Real Annual Savings

Spectrum’s combined monthly spend for broadband and two mobile lines sits around US$100. This price level contrasts sharply with national rivals, whose consumer averages are materially higher:

AT&T: US$183.82/month

Verizon (includes premium 5G Home tiers): US$216.16/month

T-Mobile: US$185.27/month

This difference, when annualised, means the average U.S. household could avoid more than US$1,000+ in annual telecom outlay simply by switching to Spectrum — without sacrificing gigabit access, speed performance or unlimited mobile data flexibility.

Spectrum’s pricing is straightforward:

US$40/month → 1 Gbps internet

US$60/month → two mobile lines

fees/taxes included upfront

no over-the-top add-ons & no hidden surcharges

This structure is being marketed as a reliable inflation shield at a time when U.S. households are cutting discretionary OTT and telecom spending.

Gigabit Access Is a Key Differentiator

Spectrum’s gigabit access is available to 100 percent of customers in its network footprint. Competitors do not offer this scale:

AT&T: gigabit access covers only ~20 percent

Verizon: ~12 percent

T-Mobile: capacity-based 5G Home → 133–415 Mbps, prone to deprioritization during congestion

This availability gap allows Spectrum to maintain a single nationwide pricing narrative, while wireless-first rivals are still splitting their messaging between premium gigabit pockets and lower-tier 5G markets.

Convergence Strategy is Central to the Value Pitch

Spectrum Mobile uses Verizon’s nationwide network, giving customers access to wide 4G/5G coverage, hotspot support, and unlimited plans at US$20–$40 per line. With free international text/calling and low activation fees — the convergence math becomes simple: households avoid standalone wireless spend.

This is also why Spectrum is linking mobile as a “cost eliminator” instead of a separate product line.

U.S. Consumer Trend Context — 2025

U.S. households have shifted strongly into bill simplification and subscription compression during 2024–2025. Consumers are canceling duplicate OTT apps, removing premium add-ons, and consolidating connectivity into single platforms.

In this environment, Spectrum’s “don’t pay twice” message aligns directly with the dominant retail trend: fewer vendors = lower total wallet drain. This fuels search interest for “cheapest broadband bundles” — where Spectrum wants to rank higher organically.

Financial Context — Q3 2025

Charter — Spectrum’s parent — ended Q3 2025 with 29.8 million broadband subs. Broadband losses came in at ~109,000, similar to Q3 2024 — showing switching pressure remains but value remains stable.

Residential ARPU reached US$122.63/month, +1.0 percent YoY — equal to ~US$1,470 per household per year.

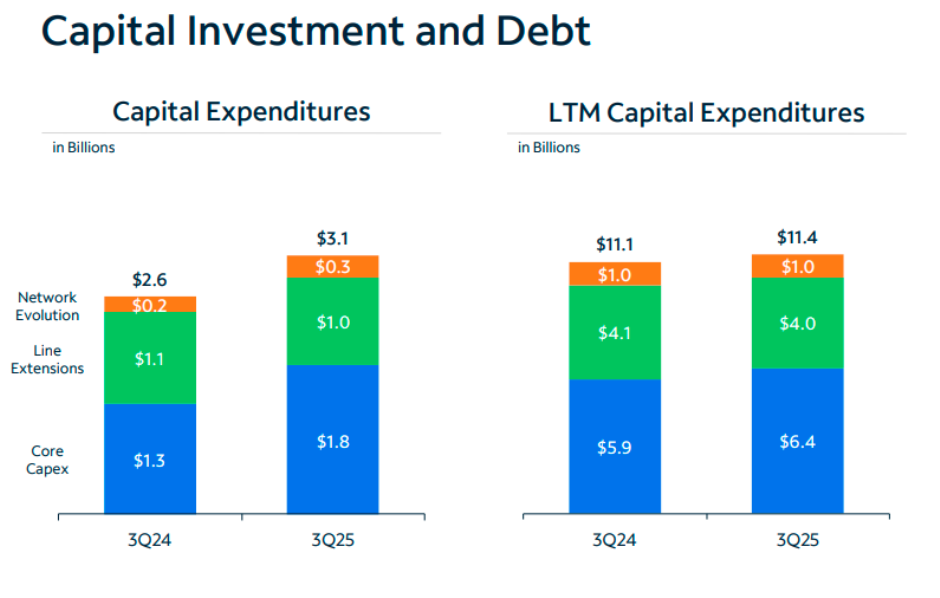

Capital Investment Reinforces Future Proofing

Charter invested US$3.05 billion in Q3 2025 capex, with full-year guidance around US$11.5 billion. Key capex focus areas include:

network evolution (multi-gig capability)

scalable video + broadband platforms

upgraded CPE that reduces future opex friction

Spectrum is shaping a consumer-centric pricing message built on the idea that broadband is the core product — and everything else (mobile + streaming) gets cheaper when it is integrated into a single platform. This message, supported by a clear numerical gap versus rivals, is emerging as the company’s strongest lever heading into 2026 — a year expected to push the next phase of U.S. fixed-mobile-convergence competition.

Fasna Shabeer