AT&T continued to strengthen its fiber business in the fourth quarter of 2025, reinforcing fiber as a core pillar of its long-term broadband and connectivity strategy. The company delivered solid subscriber growth, double-digit fiber revenue expansion, improving margins, and deeper convergence between fiber and mobility services.

AT&T Fiber Subscriber Growth Remains Strong

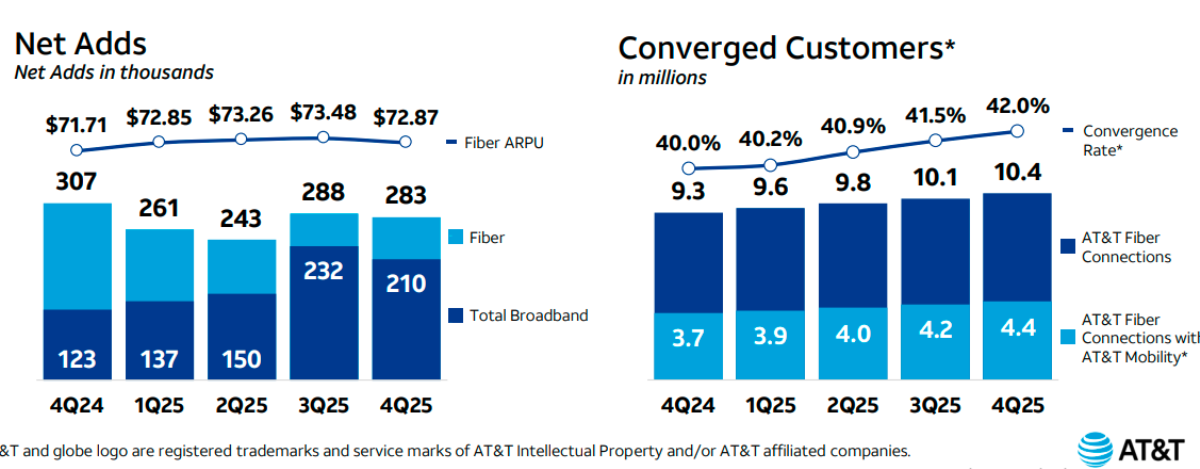

AT&T added 283,000 fiber subscribers in Q4 2025, highlighting sustained demand for high-speed fiber broadband across the US. Total AT&T Fiber subscribers reached 10.4 million by the end of 2025, while full-year net additions exceeded 1 million.

The company also continued to expand its network footprint. AT&T Fiber now reaches more than 32 million consumer and business locations, with over 3 million new locations added during 2025. This expanded reach positions AT&T to maintain momentum in fiber subscriber growth over the coming years.

In addition to fiber, AT&T Internet Air, the company’s fixed wireless broadband offering, delivered 221,000 net additions in the fourth quarter. While Internet Air supports overall broadband growth, fiber remained the primary driver of subscriber additions and revenue quality.

Fiber Revenue Growth and ARPU Stability

AT&T’s fiber revenue increased 13.6 percent year over year in Q4 2025, reaching approximately $2.2 billion for the quarter. Fiber accounted for a growing share of Consumer Wireline revenue, which remained stable at around $3.6 billion.

Average revenue per user for fiber stood at $72.87 in Q4 2025, demonstrating resilient pricing and effective upselling of higher-speed plans. Stable ARPU, combined with strong subscriber growth, supported the company’s long-term fiber revenue outlook.

In the business segment, revenue from fiber and advanced connectivity services rose 6.8 percent year over year, reflecting increased enterprise demand for high-capacity, reliable connectivity.

Margin Expansion and EBITDA Growth

AT&T’s fiber-led growth continued to support profitability in the Consumer Wireline segment. EBITDA rose to about $1.4 billion in Q4 2025, representing a 12.5 percent increase compared to the prior year.

EBITDA margin improved to 38.4 percent, driven by scale benefits from a larger fiber base, higher fiber penetration, and disciplined cost management. The improving margin profile underscores the operating leverage embedded in AT&T’s fiber expansion strategy.

Convergence Drives Customer Value

Convergence remains a key strategic focus for AT&T. By bundling fiber broadband with mobility services, the company aims to improve customer retention, lifetime value, and competitive positioning.

AT&T reported 4.4 million converged customers in Q4 2025, while the consumer convergence rate reached about 40.2 percent, up roughly 200 basis points year over year. AT&T Fiber connections rose to approximately 10.4 million, reflecting the growing overlap between fiber and mobility subscribers.

AT&T Broadband Outlook Through 2028

Looking ahead, AT&T expects continued growth from its advanced connectivity portfolio. The company projects service revenue growth of more than 5 percent in 2026, followed by low single-digit annual growth through 2028. Adjusted EBITDA is expected to grow more than 6 percent in 2026, with mid- to high-single-digit annual growth projected through 2028.

With strong fiber net additions, double-digit fiber revenue growth, expanding margins, and rising convergence, AT&T’s fiber business remains central to its broadband strategy and long-term financial performance.

BABURAJAN KIZHAKEDATH