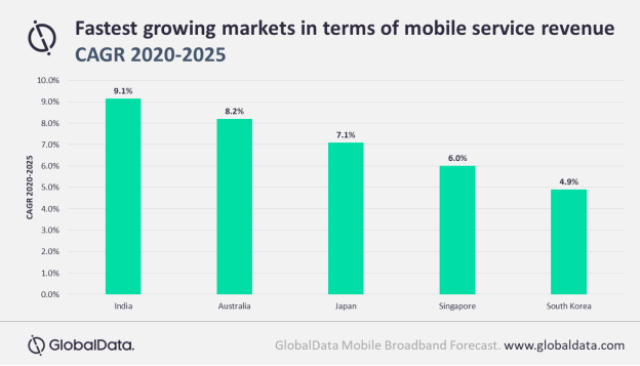

Mobile services revenue in the Asia Pacific region will increase from $307.4 billion in 2020 to $390.9 billion in 2025 at a compounded annual growth rate (CAGR) of 4.9 percent, said GlobalData.

India will achieve CAGR of 9.1 percent in terms of mobile service revenue over 2020-2025, primarily supported by an increase in adoption of 4G mobile. Australia will achieve revenue CAGR of 8.2 percent over the forecast period, where operators are aggressively investing in 5G.

India will achieve CAGR of 9.1 percent in terms of mobile service revenue over 2020-2025, primarily supported by an increase in adoption of 4G mobile. Australia will achieve revenue CAGR of 8.2 percent over the forecast period, where operators are aggressively investing in 5G.

Mobile data services segment represents the largest revenue contributor to mobile services market in Asia Pacific. Mobile data ARPU will grow from S$3.49 in 2020 to $4.44 by 2025, supported by an increase in the adoption of higher ARPU 4G and 5G mobile service plans offered by operators.

Handsets will account for 90.9 percent of the mobile subscriptions in 2020 in Asia Pacific and will remain the leading mobile device category through 2025. M2M / IoT subscription share will increase from 6.5 percent in 2020 to 10.2 percent by 2025 as operators continue to develop vertical-specific solutions.

4G will account for the largest share of mobile subscriptions in Asia-Pacific over 2020-2025, supported by efforts by operators to expand LTE coverage and deliver high speed services to users.

Telenor and Ooredoo in Myanmar and NTT and Rakuten in Japan have been investing in LTE network expansion.

During 2019-2020, several operators in the Asia-Pacific region rolled-out 5G services. 5G connections will witness significant growth over the forecast period and account for 1.6 billion by 2025.

“The Covid-19 pandemic has posed challenges for operators in terms of 5G development and will cause delays in the rollout of 5G services. Operators should deploy 5G networks in high-density urban areas as more industrial use cases can help the monetization of 5G,” Aasif Iqbal, telecom analyst at GlobalData, said.