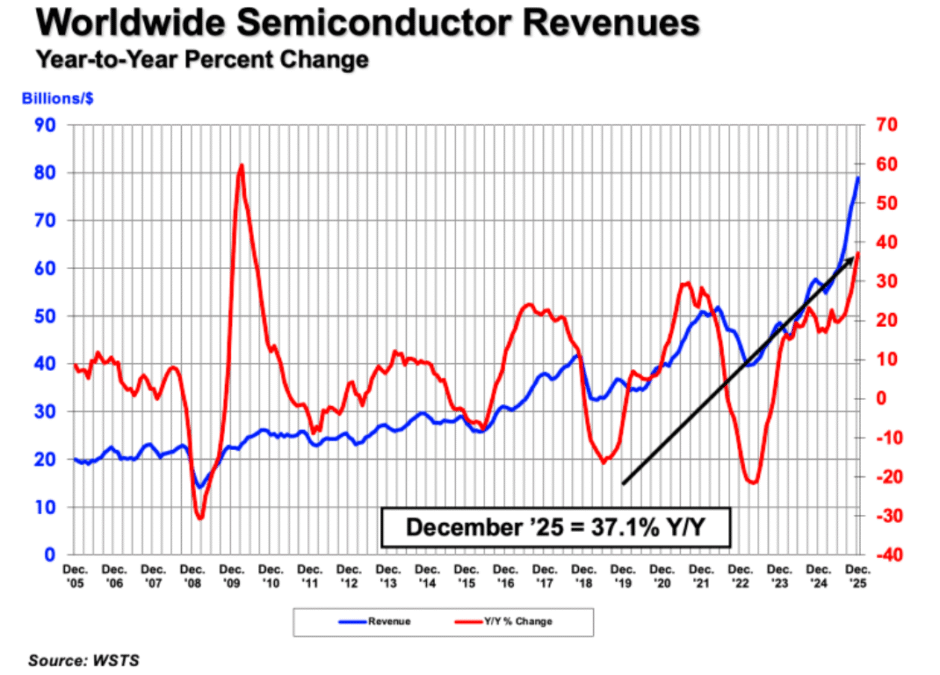

The global semiconductor industry delivered its strongest year ever in 2025, with total sales reaching $791.7 billion, according to the Semiconductor Industry Association (SIA). The milestone represents a 25.6 percent increase from the 2024 total of $630.5 billion, underscoring the growing importance of chips across artificial intelligence, cloud computing, IoT, automotive technology and next-generation connectivity.

The data, compiled by the World Semiconductor Trade Statistics (WSTS) organization, highlights the accelerating pace of digital transformation across industries and signals continued strong growth ahead. SIA represents 99 percent of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms, making its global outlook a key indicator of the health of the semiconductor ecosystem.

Semiconductor industry approaches $1 trillion milestone

SIA President and CEO John Neuffer said the industry is on track to reach an unprecedented milestone in the near future.

Global semiconductor sales are projected to approach $1 trillion in 2026, fueled by rising demand from AI infrastructure, edge computing, 6G research, autonomous driving and next-generation consumer electronics.

Semiconductors remain the foundational technology powering nearly all modern digital systems, from smartphones and data centers to electric vehicles and industrial automation.

The surge in demand reflects a multi-year technology investment cycle driven by generative AI, high-performance computing and increased electrification across industries.

Strong quarterly and monthly momentum

The semiconductor market maintained strong momentum throughout 2025:

- Fourth-quarter sales reached $236.6 billion, rising 37.1 percent year over year

- Q4 sales increased 13.6 percent compared to the third quarter of 2025

- December 2025 sales totaled $78.9 billion, up 2.7 percent month over month

Monthly figures represent a three-month moving average, providing a stable indicator of market trends. The consistent growth in quarterly and monthly sales highlights sustained demand across both enterprise and consumer markets.

Regional semiconductor growth trends in 2025

Semiconductor sales growth varied across regions, reflecting different economic cycles, manufacturing investments and technology adoption rates.

Regions with strong annual growth

- Asia Pacific and All Other markets grew 45.0 percent

- Americas increased 30.5 percent

- China rose 17.3 percent

- Europe grew 6.3 percent

Japan was the only region to record a decline, with sales falling 4.7 percent during the year.

December month-to-month performance

- Americas sales rose 3.9 percent

- China increased 3.8 percent

- Asia Pacific and All Others grew 2.5 percent

- Europe declined 2.2 percent

- Japan fell 2.5 percent

The regional data highlights continued leadership from Asia Pacific markets and strong growth momentum in the Americas, driven by AI data center investments and domestic semiconductor manufacturing initiatives.

Logic and memory chips lead semiconductor market growth

Several semiconductor product segments delivered standout performance in 2025, particularly logic and memory chips, which are essential for AI workloads, cloud infrastructure and advanced computing.

Logic chips dominate global sales

Logic semiconductors became the largest product category in 2025:

- Sales increased 39.9 percent year over year

- Total revenue reached $301.9 billion

Logic chips are widely used in CPUs, GPUs, AI accelerators and networking equipment, making them critical for data centers and AI workloads.

Memory market rebounds strongly

Memory chips recorded the second-highest sales:

- Revenue reached $223.1 billion

- Sales grew 34.8 percent year over year

The rebound in memory demand reflects recovery in the PC and smartphone markets along with massive investments in AI servers and hyperscale cloud infrastructure.

AI, IoT and automotive technology fuel semiconductor demand

The surge in semiconductor revenue reflects rapid adoption of emerging technologies:

- Generative AI and machine learning workloads

- Internet of Things deployments across industries

- Autonomous and electric vehicles

- Advanced connectivity including 5G and future 6G

- Smart manufacturing and robotics

As these technologies mature, semiconductor demand is expected to grow across every major sector of the global economy.

Policy and supply chain priorities for future growth

SIA emphasized the importance of government policy in sustaining long-term semiconductor leadership, particularly in the United States.

A competitive semiconductor ecosystem is increasingly viewed as essential for:

- Economic growth and job creation

- National security and supply chain resilience

- Technological leadership in the global digital economy

Public and private investments in domestic manufacturing, research and workforce development are expected to remain a key focus in the coming years.

Outlook: sustained growth and industry transformation

The semiconductor industry’s record performance in 2025 marks a major turning point for the global technology sector. With sales projected to approach $1 trillion in 2026, the industry is entering a new phase of expansion driven by AI, automation and digital transformation.

BABURAJAN KIZHAKEDATH