Samsung Electronics has outlined ambitious targets for 2026, with a strong focus on artificial intelligence, advanced semiconductor technologies, and sustained profitability across its major business divisions. The company expects AI-driven demand to remain the primary growth engine through 2026, shaping product strategy, capital allocation, and market expansion plans.

Device Solutions Division Targets AI-Led Structural Growth

Looking ahead to the first quarter of 2026, Samsung’s Device Solutions (DS) Division expects AI and server demand to continue rising, creating further opportunities for structural growth. The division plans to prioritize profitability by emphasizing high-performance and high-value-added products.

For full-year 2026, the DS Division aims to lead the AI era through stronger product competitiveness, particularly by expanding sales of AI-related offerings across both DRAM and NAND. Rapidly growing demand from data centers, AI training, and inference workloads is expected to support long-term revenue expansion.

Memory Business Accelerates HBM4 and AI-Focused Products

Samsung expects the AI boom to continue driving favorable market conditions in early 2026. The Memory Business plans to maintain its focus on high-value-added memory products designed for AI applications.

In Q1 2026, Samsung is on track to begin delivering HBM4 products, including versions offering industry-leading 11.7Gbps performance. The company aims to reestablish leadership in the high-end HBM market as AI accelerators and servers increasingly adopt next-generation memory.

Throughout 2026, the Memory Business plans to deepen partnerships with customers by supplying competitive HBM4 and expanding sales of AI-related products such as DDR5, SOCAMM2, and GDDR7. On the NAND side, Samsung intends to proactively address AI-driven demand by scaling up high-performance TLC products for Key Value SSDs used in inference workloads.

System LSI Focuses on Recovery and Differentiation

Samsung expects earnings at the System LSI Business to recover in Q1 2026, supported by new product launches. The company also plans to reinforce its image sensor leadership by expanding its 200MP lineup.

For 2026, the System LSI Business is targeting earnings improvement by expanding sales of differentiated system-on-a-chip products with stronger performance and stabilized yields. In image sensors, Samsung plans to strengthen fine-pixel technology and sustain leadership through Nanoprism technology, which enhances light sensitivity.

Foundry Targets Double-Digit Growth in 2026

The Foundry Business expects sequential revenue decline in Q1 2026 due to seasonal weakness, although orders are projected to increase, driven mainly by high-performance computing and mobile customers.

For full-year 2026, Samsung Foundry is targeting double-digit revenue growth and improved profitability, supported by advanced process nodes. The company plans to ramp up second-generation 2nm production and prepare for performance- and power-optimized 4nm processes. It also aims to strengthen competitiveness by integrating logic, memory, and advanced packaging technologies into optimized customer solutions.

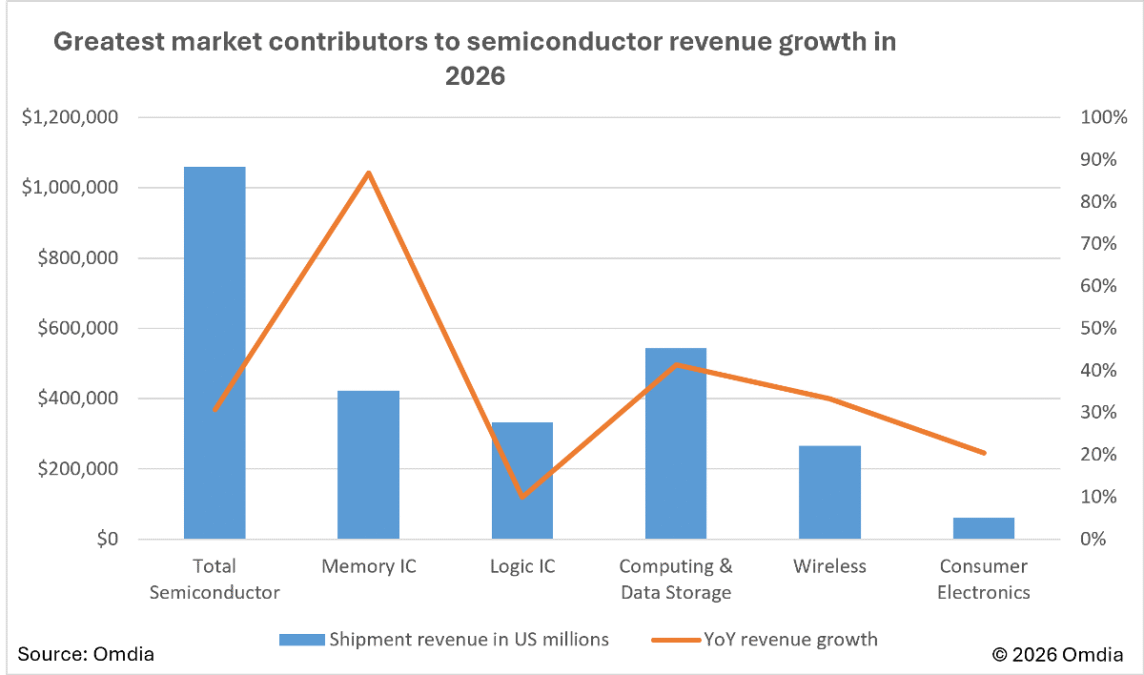

Global semiconductor revenues are set to surpass $1 trillion in 2026, driven mainly by strong growth in memory and logic IC revenues fueled by rising AI demand, according to Omdia report. Consumer electronics and wireless segments are also expected to support revenue growth, helped by higher memory prices, the rollout of next-generation foldable smartphones, and a rebound in connected consumer devices.

Display Business Expands Premium and QD-OLED Strategy

Samsung Display Corporation (SDC) anticipates soft smartphone demand in Q1 2026 and plans to offset this by supplying displays for new major flagship smartphone launches. In large displays, the company aims to proactively respond to new QD-OLED product launches and expand sales.

In 2026, SDC plans to reinforce leadership in the smartphone display market through differentiated technologies. It also intends to maintain premium TV leadership by focusing on new high-brightness products, while expanding monitor sales through differentiated performance advantages.

MX Business Pushes Mobile AI Leadership

In Q1 2026, the Mobile eXperience (MX) Business plans to strengthen its AI smartphone leadership with the launch of the Galaxy S26 series, delivering advanced Agentic AI experiences. The division aims to sustain profitability through flagship sales expansion, resource optimization, and improved supply stability amid global competitive uncertainties.

Over the full year, the MX Business plans to consolidate its mobile AI leadership by introducing next-generation AI experiences and innovating slimmer and lighter device form factors. Samsung also aims to drive growth across all segments through AI-driven product sales and new market expansion, while maintaining a strong focus on profitability through process optimization despite ongoing cost pressures.

Networks Business Targets New Orders Despite Headwinds

In Q1 2026, Samsung’s Networks Business aims to drive revenue growth by securing new orders, even as the global telecommunications industry faces investment headwinds. Throughout 2026, the business plans to leverage its leadership in vRAN and ORAN technologies to enter new markets, while ensuring profitability through cost optimization.

Overall, Samsung Electronics’ 2026 targets reflect a clear strategy centered on AI-driven demand, leadership in advanced semiconductors, and disciplined execution to balance growth with profitability across its portfolio.

Samsung Revenue Growth Driven by Memory Boom, HBM Demand, and Premium Product Mix

Samsung Electronics has reported strong revenue and profit growth for the fourth quarter of 2025, supported mainly by a sharp rebound in its semiconductor business, rising demand for high-bandwidth memory (HBM), and steady performance from premium mobile and display products.

The South Korean technology giant posted quarterly revenue of KRW 93.8 trillion, up 9 percent quarter on quarter. Operating profit surged to an all-time high of KRW 20.1 trillion in Q4 2025. For the full year, Samsung recorded KRW 333.6 trillion in revenue and KRW 43.6 trillion in operating profit.

Memory and HBM Lead Revenue Expansion

The primary driver of Samsung’s revenue growth was the Device Solutions (DS) Division, which includes semiconductors. The division delivered KRW 44.0 trillion in revenue and KRW 16.4 trillion in operating profit during the quarter.

DS division sales rose 33 percent quarter on quarter, with the Memory Business achieving record quarterly revenue and operating profit. Growth was fueled by expanded sales of HBM and other high-value-added memory products, alongside a broad recovery in memory market prices. Strong demand from artificial intelligence, data center, and high-performance computing customers played a critical role in lifting margins and volumes.

Displays and Mobile Provide Stable Contribution

Samsung Display Corporation (SDC) reported KRW 9.5 trillion in consolidated revenue and KRW 2.0 trillion in operating profit for Q4 2025. Performance was supported by stable demand for high-end displays, particularly for premium devices.

The Mobile eXperience (MX) and Networks businesses together generated KRW 29.3 trillion in consolidated revenue and KRW 1.9 trillion in operating profit. While smartphone shipments declined sequentially as the impact of new model launches tapered off, the MX business still delivered double-digit annual profit in 2025. This was driven by flagship smartphone growth and steady sales of tablets and wearable devices.

DX Division Faces Competitive Pressure

The Device eXperience (DX) Division saw an 8 percent sequential decline in revenue during the quarter. Samsung attributed the slowdown to reduced launch effects from new smartphone models and intensified competition across key consumer electronics categories.

In the smartphone market, Samsung captured an 18 percent global share in the fourth quarter of 2025, supported by strong sales in the sub-$300 segment, led by the Galaxy A17 4G and 5G models. Samsung had 16 percent share in Q4-2024, according to Omdia.

Networks Business Eyes New Orders

Samsung’s Networks Business showed improvement in both quarter-on-quarter and year-on-year earnings in Q4 2025, supported by stronger sales in North America. Looking ahead to the first quarter of 2026, the company plans to pursue new orders despite ongoing investment headwinds in the global telecommunications sector. Samsung aims to drive longer-term revenue growth by leveraging its leadership in vRAN and ORAN technologies, while maintaining profitability through cost optimization.

Record R&D Spending to Sustain Growth Samsung significantly increased investment in innovation to support future growth. Research and development spending reached KRW 10.9 trillion in Q4, up KRW 2 trillion from the previous quarter. Full-year R&D investment hit a record KRW 37.7 trillion, underscoring the company’s focus on advanced semiconductors, AI-related technologies, and next-generation networks.

BABURAJAN KIZHAKEDATH