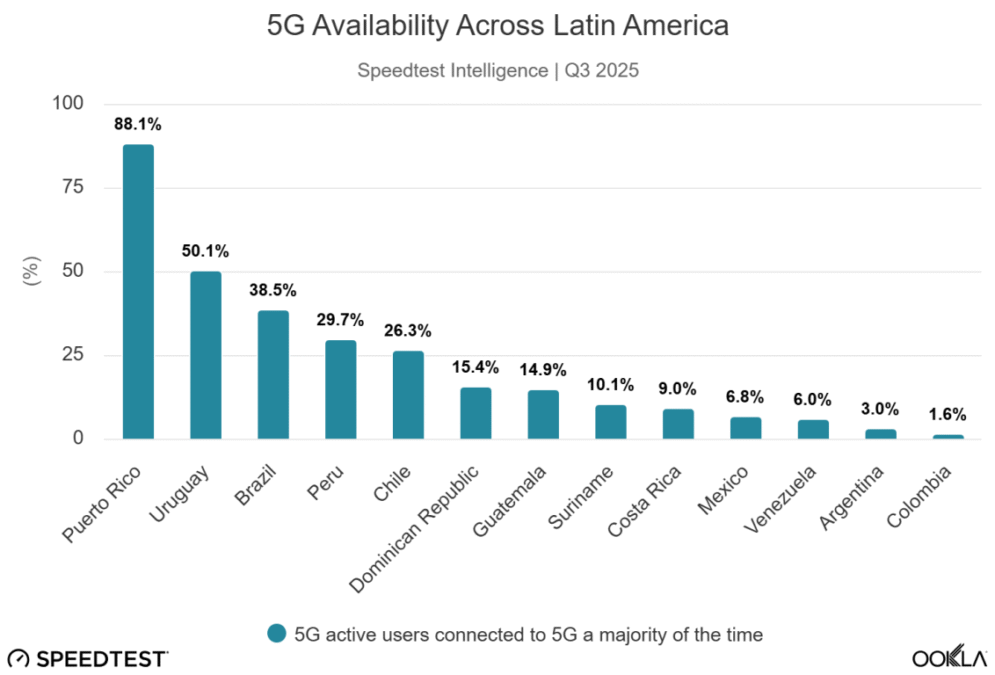

5G availability across Latin America remains uneven, with a wide gap between early leaders and lagging markets, according to Speedtest Intelligence data for Q3 2025, Ookla said in its report.

Puerto Rico stands out with the highest 5G availability, with 88.1 percent of active users connected to 5G for the majority of the time. Uruguay ranks second at 50.1 percent, followed by Brazil at 38.5 percent. Peru and Chile form the next tier, with availability of 29.7 percent and 26.3 percent respectively.

Most other markets show significantly lower levels of consistent 5G access. The Dominican Republic and Guatemala record availability of around 15 percent, while Suriname and Costa Rica are near or below 10 percent. Mexico and Venezuela remain under 7 percent, highlighting slower nationwide rollout and adoption.

At the bottom of the ranking, Argentina and Colombia report very limited 5G availability, at 3.0 percent and 1.6 percent respectively, indicating that 5G is still largely in early deployment stages in these countries.

Overall, the data underscores that while some Latin American markets are approaching mature 5G usage, much of the region is still in the early phases of 5G expansion and monetisation.

5G speed

The 5G speed landscape across Latin America in Q3 2025 shows significant variation, according to Speedtest Intelligence data.

Brazil leads the region with the highest median 5G download speed at 430.83 Mbps, followed by the Dominican Republic (385.01 Mbps) and Costa Rica (377.42 Mbps). Argentina (343.57 Mbps) and Uruguay (327.28 Mbps) also show strong 5G speeds, indicating robust network performance in these markets.

Mid-tier markets include Paraguay (289.77 Mbps), Guatemala (278.56 Mbps), and Guyana (226.06 Mbps), offering moderate 5G speeds for users. Venezuela (207.32 Mbps) and Colombia (205.60 Mbps) hover just above 200 Mbps.

At the lower end, Suriname (170.83 Mbps), Mexico (157.88 Mbps), and Chile (153.56 Mbps) deliver modest speeds, while Puerto Rico records 133.34 Mbps despite having the highest 5G availability. El Salvador (79.19 Mbps) and Peru (59.37 Mbps) report the slowest median 5G speeds, highlighting early-stage deployment or network limitations in these countries.

Overall, the data reveals that high 5G availability does not always correspond with the fastest speeds, as countries like Puerto Rico show high availability but relatively lower median speeds, while Brazil combines both high availability and top speeds.

América Móvil leads Latin America’s 5G rollout but is slowing capital expenditures, from $8.6 billion in 2023 to a projected $6.7 billion in 2025, following earlier heavy investments in spectrum and infrastructure. Telefonica has exited several Latin American markets to focus on Europe and Brazil, opening space for Millicom to emerge as the region’s second-largest operator, though it currently prioritizes fiber and 4G over immediate 5G deployment.

The region faces strategic choices in 5G equipment, particularly regarding Chinese suppliers like Huawei. While U.S. cybersecurity warnings persist, many countries, including Brazil, Peru, and Mexico, continue to use Huawei gear. Ericsson and Nokia also hold significant positions, supplying 5G networks for operators such as Entel Chile, Movistar Argentina, Claro, and TIM Brasil.

BABURAJAN KIZHAKEDATH