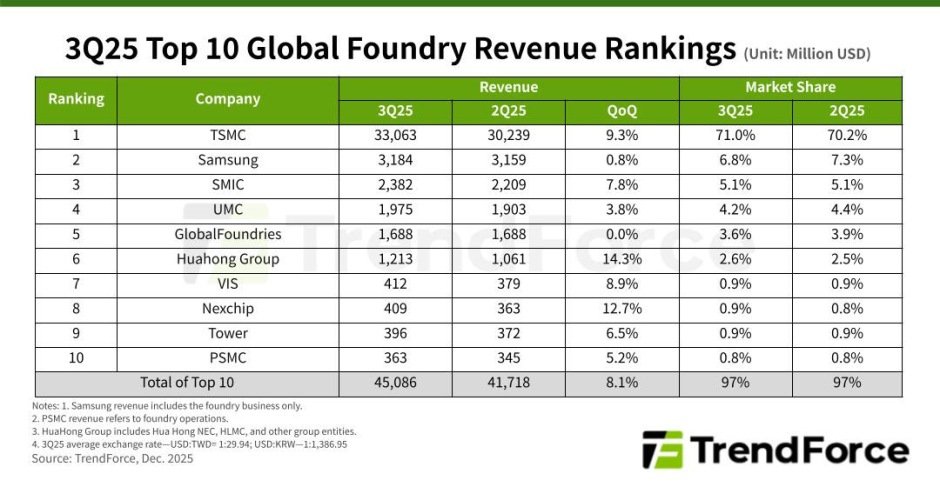

TrendForce’s latest analysis reveals that the global foundry industry maintained solid profitability in the third quarter of 2025, driven by surging demand for AI in high-performance computing (HPC) and next-generation consumer electronics chips and IC peripherals. Revenue growth was primarily supported by advanced processes at 7 nm and below, with high-value wafer production contributing significantly. Chinese foundries further expanded their footprint through strategic supply-chain diversification. As a result, the top 10 foundries collectively posted total revenue of nearly US$45.1 billion, up 8.1 percent quarter-on-quarter (QoQ).

Despite robust 3Q25 performance, TrendForce notes that expectations for 2026 demand are tempered by geopolitical uncertainties. Ongoing DRAM shortages and quarterly price hikes since mid-2025 continue to exert pressure on downstream production costs. While automotive and industrial-control sectors are expected to resume restocking toward the end of 2025, the overall increase in foundry utilization in 4Q25 is projected to be modest, signaling a slowdown in revenue growth among leading players.

TSMC Maintains Market Leadership with AI and Smartphone-Driven Revenue

TSMC, the industry frontrunner, reported 3Q25 revenue growth of 9.3 percent QoQ to slightly over $33 billion, fueled by strong smartphone shipments and NVIDIA’s Blackwell HPC platform entering peak mass production. Aggressive iPhone stockpiling by Apple also contributed to higher wafer shipments and average selling prices (ASPs). This performance raised TSMC’s market share slightly to 71 percent.

Samsung Foundry

Samsung Foundry, in contrast, saw only marginal gains in overall capacity utilization, resulting in flat revenue of $3.184 billion and a 6.8 percent market share, retaining the second spot. SMIC, benefiting from improved utilization, wafer shipments, and ASP, posted a 7.8 percent QoQ revenue increase to $2.382 billion, securing third place.

UMC and GlobalFoundries Benefit from Peripheral IC and Restocking Demand

UMC ranked fourth, driven by demand for peripheral ICs in new smartphones and PC/notebook models, along with early pull-in orders from Europe and the U.S. Mature-process restocking contributed to a 3.8 percent QoQ revenue rise to nearly $1.98 billion and a 4.2 percent market share. GlobalFoundries, while experiencing slightly higher wafer shipments from restocking related to new device launches, reported flat revenue at $1.69 billion, with market share declining to 3.6 percent amid rising competition.

China-Driven Growth Propels Nexchip into Top 10

HuaHong Group recorded $1.21 billion in revenue with a 2.6 percent market share, aided by its subsidiary HHGrace’s 12-inch capacity ramp-up and higher-priced wafer shipments. Vanguard posted $412 million in revenue, an 8.9 percent QoQ increase, supported by rising PMIC demand for new devices.

Nexchip achieved 12.7 percent QoQ growth to $409 million, fueled by strong consumer demand for DDIC, CIS, and PMIC ahead of new product launches and the “China for China” trend, surpassing Tower to claim the eighth position. Tower reported $396 million, up 6.5 percent QoQ, but dropped to ninth, while PSMC secured the tenth spot with $363 million, growing 5.2 percent QoQ on DRAM-related wafer demand and improved pricing.

Outlook

While 3Q25 results highlight resilience across advanced-node and high-value wafer production, the global foundry market faces cautious growth in 4Q25 and into 2026, constrained by geopolitical tensions, DRAM shortages, and cost pressures. Leading foundries are focusing on strategic capacity allocation, advanced-node utilization, and diversification to sustain market competitiveness.

Baburajan Kizhakedath