SpaceX’s Starlink service continues to dominate the consumer-oriented satellite internet industry in Latin America, Ookla report said.

Starlink accounted for 98.2 percent of all consumer-focused satellite-based speed tests, far surpassing rivals Viasat and HughesNet, according to recent third quarter 2025 Speedtest data. Competition in the satellite internet industry in Latin America is expected to intensify later this year as Amazon prepares to bring its Project Kuiper low Earth orbit system to the region.

Rising Speeds Transforming Rural Connectivity

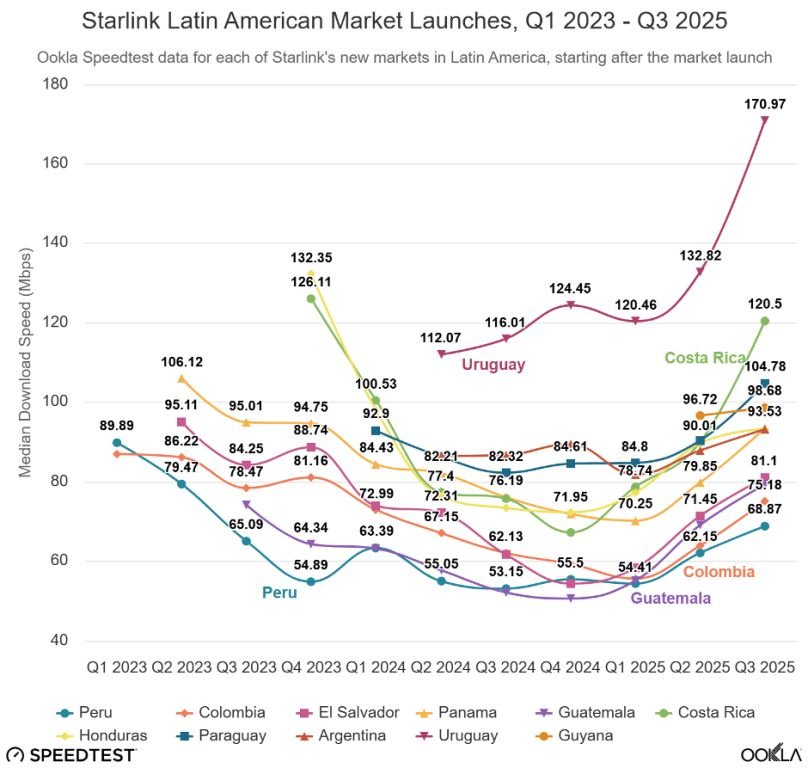

Access to high-speed broadband in remote areas of Latin America has been limited due to challenging terrain and a lack of fiber infrastructure. Satellite solutions are filling that gap. Download speeds across all consumer satellite services in the region jumped from 29.12 Mbps in early 2023 to 72.01 Mbps in the third quarter of 2025. This substantial improvement is a major boost for rural households that have long been underserved by traditional internet providers.

Majority of Latin America’s population live in rural areas, according to the GSMA’s Mobile Connectivity Index. In 2024, 12 percent of Brazil’s residents lived in rural communities. The figures were higher in other countries, including Mexico at 18 percent, Colombia and Peru at 21 percent, and Bolivia at 29 percent. As satellite speeds improve, millions in these regions stand to gain access to reliable broadband for the first time.

A Small but Rapidly Growing Share of the Broadband Market

Grandview Research report says satellite internet services in Latin America generated $562 million in revenues in 2024, roughly 1 percent of the $56 billion broadband market that also includes fiber and mobile broadband.

Globally, the OECD reported that satellite connections accounted for 1 percent of fixed broadband subscriptions in 2024. Despite its small base, the segment is gaining momentum as next-generation satellite constellations come online.

Starlink’s Aggressive Expansion Across the Region

Starlink’s growing footprint is supported by the deployment of 10,000 low Earth orbit satellites since 2019, launched through a rapid cadence of SpaceX missions. In 2025 alone, the company conducted more than 100 launch missions dedicated to building out its constellation. The GSMA estimates that Starlink now controls up to 90 percent of the world’s communication satellites when excluding major Chinese systems.

This massive infrastructure buildout has fueled strong subscriber growth. By November 2025, Starlink reported that it was providing connectivity to 8 million customers globally, up from 7 million at the end of August. This 14 percent rise in only 69 days highlights the accelerating global adoption of satellite broadband.

Latin America plays a meaningful role in this growth. Regulators in Brazil and Mexico reported that Starlink had 425,514 customers across both countries toward the end of 2024. That figure represented around 10 percent of Starlink’s global subscriber base at the time. The company first entered the region in 2021, launching in Chile before expanding rapidly to Mexico, Brazil, the Dominican Republic and beyond. Since 2023, Starlink has added 11 new Latin American markets, covering roughly one quarter of the region’s population.

Competitive Landscape Shifts as New Players Scale Up

Although Starlink dominates Latin America’s consumer satellite market, competition persists. Viasat currently counts about 157,000 satellite internet subscribers in the United States, down from 228,000 the previous year. HughesNet, owned by EchoStar, reported roughly 783,000 subscribers worldwide, compared to 912,000 a year earlier. Viasat and HughesNet do not disclose satellite internet subscribers in Latin America. Ookla data suggests their regional presence remains far smaller than Starlink’s.

Beyond consumer services, several satellite operators are active in wholesale connectivity. OneWeb Eutelsat operates a 600-satellite LEO constellation aimed at enterprise and carrier backhaul customers. Its connections occasionally appear in Latin American speed test data but not at statistically significant levels. SES also serves the region with a mix of GEO and MEO satellites, though observed speeds generally trail those of Viasat and HughesNet.

Next-Generation Starlink Network Could Boost Capacity Further

Looking ahead, Starlink is preparing a major upgrade to its constellation built around its larger and more advanced V3 satellites. These new spacecraft are expected to enhance network throughput, improve regional coverage, and reduce congestion. SpaceX’s next-generation Starship launch vehicle is poised to accelerate this shift by enabling the company to deploy far more satellites per mission than its current rockets allow.

A Transforming Market With Room for Growth

Satellite broadband in Latin America is evolving rapidly, driven by technological advances and growing demand for reliable connectivity in rural and remote areas. Starlink’s aggressive expansion and technical leadership position it strongly for continued growth, but emerging competitors like Amazon Kuiper and ongoing efforts by Viasat, HughesNet, OneWeb Eutelsat and SES will contribute to a more diverse and dynamic market.

Baburajan Kizhakedath