The GSMA Intelligence’s analysis reveals that lowering smartphone prices could play a transformative role in bridging the global mobile internet usage gap. According to the report, devices are considered affordable when they cost 15–20 percent of monthly GDP per capita.

In 2024, nearly 48 percent of low- and middle-income countries (LMICs) had entry-level, internet-enabled devices priced below 15 percent of the average monthly income, while 57 percent had devices available below 20 percent of monthly income.

Key Findings on Device Affordability

The median price of an entry-level smartphone in LMICs rose from $50 in 2023 to $54 in 2024.

Median affordability remained steady at just under 16 percent of average monthly income.

South Asia showed the most improvement in affordability, despite historically being the least affordable region.

37 percent of LMICs recorded improved affordability, 36 percent remained stable, and 27 percent experienced worsening affordability.

Regions like Europe & Central Asia and Sub-Saharan Africa saw significant gains, with over 40 percent of LMICs improving affordability.

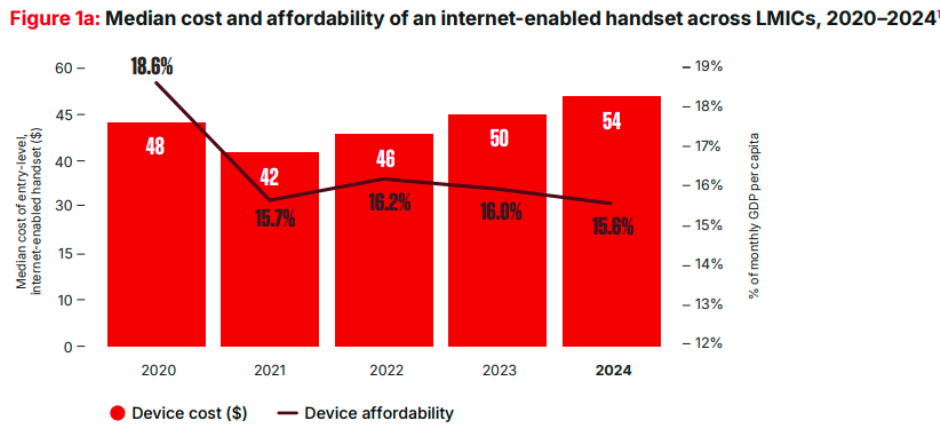

Median Cost and Affordability of an Internet-Enabled Handset Across LMICs (2020–2024)

The GSMA Intelligence data shows that while entry-level smartphone prices in low- and middle-income countries (LMICs) have increased since 2020, affordability has remained relatively stable.

In 2020, the median cost of a handset was $48, accounting for 18.6 percent of monthly GDP per capita.

Prices dropped to $42 in 2021, improving affordability to 15.7 percent.

From 2022 to 2023, handset prices rose again — reaching $46 and $50, with affordability hovering around 16 percent.

In 2024, the median cost increased further to $54, but affordability slightly improved to 15.6 percent of monthly GDP per capita.

Overall trend:

Between 2020 and 2024, the cost of entry-level internet-enabled handsets increased by 12.5 percent, yet affordability improved by three percentage points, suggesting income growth and stable market conditions helped offset rising device prices in LMICs.

The Potential of Cheaper Devices

The GSMA estimates that:

A $30 handset could make smartphones affordable for 1.6 billion individuals currently excluded from the digital economy.

A $20 handset could connect up to 2 billion people who are still offline.

Smartphone Market Rebound in 2024

After two years of decline, the global smartphone market recovered in 2024 with 1.2 billion units shipped, marking a 4 percent year-on-year increase.

This resurgence was partly supported by macroeconomic stability—median inflation across LMICs fell to 4.3 percent in 2024, down from 6.2 percent in 2023 and 8.5 percent in 2022.

Beyond Price: Financing and Perceived Value Matter

While lowering device prices is critical, the GSMA emphasizes two complementary strategies:

Device financing and subsidy schemes — allowing users to pay over time rather than upfront.

Enhancing device value and usability — ensuring devices meet the needs of local users to boost adoption and long-term engagement.

Conclusion

GSMA’s findings highlight that affordable smartphones are central to digital inclusion. By reducing device costs and improving financing access, LMICs can help billions join the digital economy, driving progress toward universal internet connectivity.

Baburajan Kizhakedath