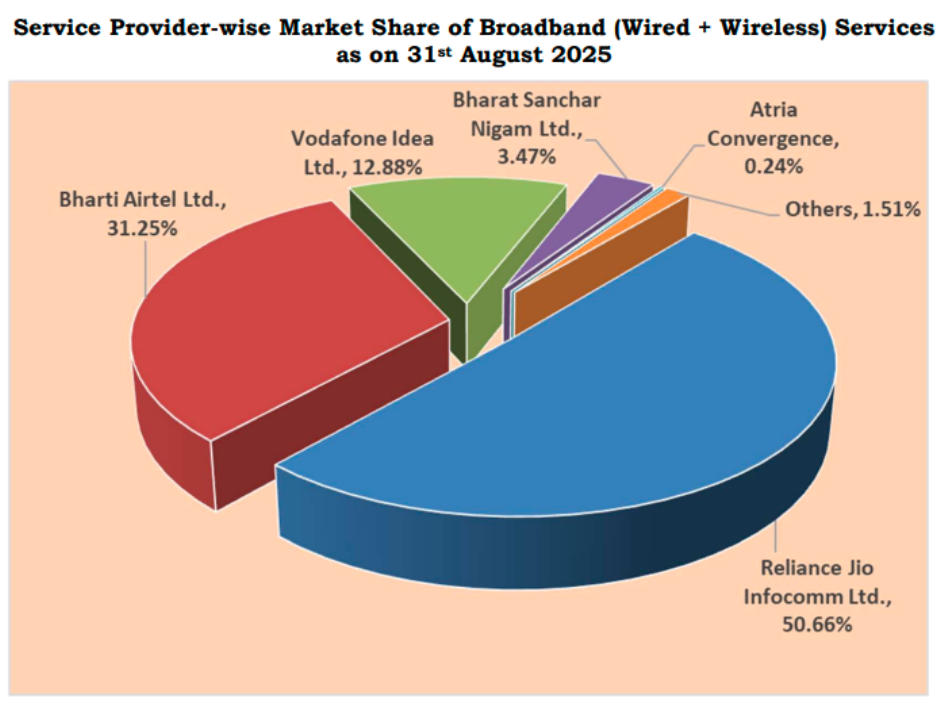

Reliance Jio has reinforced its dominance in India’s broadband market, capturing 50.66 percent market share as of August 31, 2025, according to the latest data from the Telecom Regulatory Authority of India (TRAI).

With a total subscriber base of 501.31 million, Jio continues to outpace all major rivals in both wired and wireless broadband segments, TRAI data indicated.

Bharti Airtel follows at a distant second with 309.22 million subscribers and 31.25 percent market share, while Vodafone Idea ranks third with 127.48 million subscribers and 12.88 percent share. State-run BSNL holds 3.47 percent, and Atria Convergence Technologies (ACT) accounts for 0.24 percent, together contributing to a combined 98.49 percent market share of the top five broadband players.

Jio Leads in Both Wired and Wireless Segments

Jio’s dominance spans both fixed (wired) and wireless broadband categories.

In the wired broadband market, Reliance Jio leads with 13 million subscribers, ahead of Airtel (9.68 million), BSNL (4.38 million), ACT (2.35 million), and Kerala Vision (1.40 million). The top five wired broadband players together account for 69.90 percent of the segment’s total subscribers.

In the wireless broadband space, Jio commands a staggering lead with 488.31 million users, followed by Airtel with 299.54 million, Vodafone Idea with 127.47 million, and BSNL with 29.93 million. This segment is almost entirely dominated by the top five players, holding 99.99 percent of the market.

Steady Subscriber Growth

Jio’s wireless subscriber base grew from 477.5 million to 479.4 million, demonstrating steady expansion even in a saturated market.

Airtel also showed modest growth, increasing from 391.48 million to 391.97 million subscribers.

BSNL added over 1.38 million new users, rising from 90.36 million to 91.74 million.

In contrast, Vodafone Idea witnessed a slight decline, falling from 203.85 million to 203.55 million users.

Jio’s Competitive Edge

Jio’s leadership is driven by its aggressive 5G rollout, pan-India fiber expansion, and bundled digital services spanning OTT, broadband, and IoT. Its strategic focus on affordability and coverage continues to attract both urban and rural users, strengthening its hold across India’s data-driven economy.

As India moves deeper into the 5G and fiber broadband era, Reliance Jio’s market strategy — integrating connectivity with digital ecosystems — positions it to remain the undisputed leader in the broadband space. With over half the nation’s broadband users already on its network, Jio’s influence is set to shape the next phase of India’s digital transformation.

Baburajan Kizhakedath