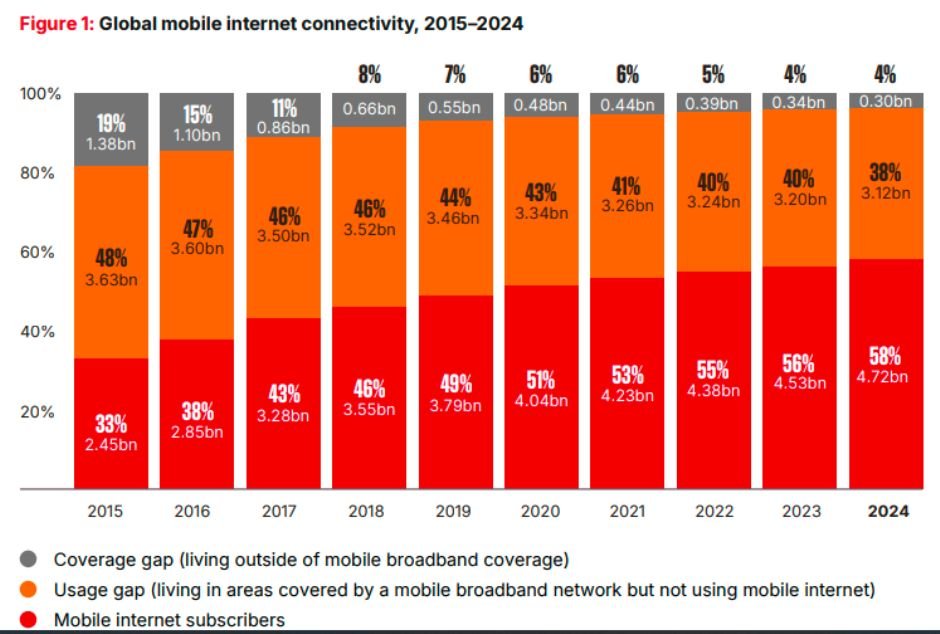

Mobile internet adoption rebounded strongly in 2024, adding 200 million new users after two years of slower growth, according to GSMA Intelligence.

The total number of people using mobile internet on personal devices rose to 4.7 billion (58 percent of the global population), while another 710 million (9 percent) accessed the internet through shared or secondary devices. Nearly 90 percent of this growth came from low- and middle-income countries (LMICs), where the majority of the unconnected population still lives.

Despite near-universal coverage, a significant 3.1 billion people (38 percent of the global population) remain offline even though they live within mobile broadband coverage. This is known as the usage gap, which dropped to 38 percent in 2024 from 40 percent in 2023. However, the usage gap is still 10 times larger than the coverage gap, which is just 4 percent globally.

Regional Disparities in Mobile Internet Adoption

Mobile internet usage varies widely by region:

Sub-Saharan Africa: Lowest adoption at 25 percent, with the largest coverage gap of 10 percent.

North America, Europe & Central Asia, East Asia & Pacific: Adoption exceeds 75 percent.

Southeast Asia: Recorded the fastest growth in 2024.

Latin America & Caribbean: Growth was modest, despite broader coverage.

Among least developed countries (LDCs), landlocked developing countries (LLDCs), and small island developing states (SIDS), adoption remains critically low at 25 percent, 29 percent, and 38 percent, respectively, with no progress since 2021.

Rural, Gender, and Device Gaps

Rural vs. Urban: The connectivity gap remains significant—48 percent in Sub-Saharan Africa and 29 percent in the Middle East & North Africa.

Gender Gap: Women in LMICs are 14 percent less likely to use mobile internet than men, with inequalities widening in South Asia (32 percent) and Sub-Saharan Africa (29 percent).

Device Gap: Out of 3.1 billion unconnected people within coverage, 1 billion own devices but cannot use them for internet, while 2 billion have no device at all.

Smartphones and Network Transitions Driving Adoption

Smartphones remain the biggest enabler of mobile internet access. In 2024, 250 million new smartphone users came online, bringing the global total to 4.4 billion (54 percent of the population). Over 80 percent of subscribers now use 4G or 5G smartphones, but older technologies still dominate in many developing regions:

60 percent in Sub-Saharan Africa rely on 3G and feature phones.

34 percent in Latin America & Caribbean still use legacy devices.

30 percent in the Middle East & North Africa remain dependent on older phones.

On the network side, 4G now covers 93 percent of the global population (7.6 billion people), but investment is shifting toward 5G expansion, which reached 54 percent of the world (4.4 billion people) in 2024. More than 700 million new people gained 5G coverage in 2024, while 169 2G/3G sunsets were recorded across 75 countries — mostly after 5G rollouts.

Mobile Data Usage and Network Quality

Data demand continues to climb:

Global average usage: 16 GB per user per month in 2024.

High-income markets: 25 GB per user per month.

LMICs: 14 GB per user per month.

Network performance also improved, with average global download speeds rising from 51 Mbps in 2023 to 64 Mbps in 2024. However, disparities persist:

High-income markets: Over 120 Mbps.

LDCs, LLDCs, SIDS: Below 30 Mbps.

Other LMICs: 44 Mbps.

Conclusion

The 2024 rebound in mobile internet adoption highlights progress in digital inclusion, but the 3.1 billion people still offline underscores the scale of the challenge. Addressing device affordability, gender inequality, and rural access is now as critical as expanding network coverage. As 5G deployment accelerates and 4G reaches maturity, bridging the usage gap will be the key priority for governments, telecom operators, and global development organizations.

Baburajan Kizhakedath