The latest IDC report, prepared by Apirat Ratanavichit, research analyst at IDC, has revealed how affordable 5G Android models are driving the smartphone market in Thailand.

The size of the smartphone market in Thailand has reached 16.9 million units in 2024, registering growth of 17.1 percent. The first half of the year saw a 14 percent increase in shipments, with growth accelerating to 20 percent in the second half. The fourth quarter recorded 4.7 million shipments, a 27 percent increase, driven by the influx of affordable models.

Despite economic challenges, the smartphone market in Thailand was supported by vendor competition and the expansion of financing programs.

Entry-level smartphones (<$200) made up 56.9 percent of the smartphone market in Thailand, up from 54.8 percent in 2023. The premium segment ($1,000+) in the smartphone market in Thailand declined in share to 9 percent, down from 12 percent the previous year.

Ultra-low-end smartphones (<$100) in the smartphone market in Thailand grew from 11 percent to 14 percent market share. Mid-to-high-end ($400-$800) in the smartphone market in Thailand increased from 9.5 percent to 12.8 percent.

The average selling price (ASP) in the smartphone market in Thailand dropped 7.5 percent to $336.

5G smartphone penetration in the smartphone market in Thailand increased to 45.6 percent, up from 43.2 percent in 2023, driven by affordable 5G Android models.

Growth in the smartphone market in Thailand is expected to continue as vendors leverage government stimulus programs and financing plans. Despite macroeconomic uncertainties, competition remains high, with vendors focused on affordability and accessibility.

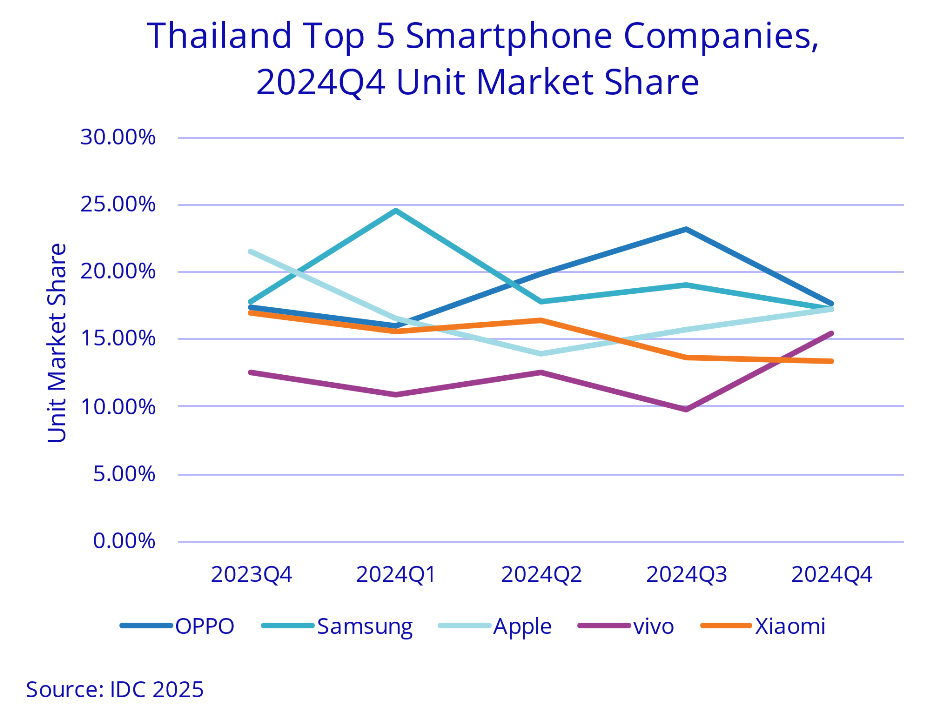

In Thailand’s smartphone market for 2024, Samsung led with a 19.4 percent market share, slightly declining from 19.7 percent in 2023, with shipments increasing from 2.8 million to 3.3 million units.

OPPO followed closely in second place with a 19.2 percent share, down from 19.6 percent in 2023, also shipping 3.3 million units in the smartphone market in Thailand.

Apple ranked third with a 15.9 percent share, a decrease from 17.6 percent the previous year, despite an increase in shipments from 2.5 million to 2.7 million units.

Xiaomi has secured the fourth spot in the smartphone market in Thailand, growing its share from 14.2 percent in 2023 to 14.7 percent in 2024, with shipments rising from 2.1 million to 2.5 million units.

Vivo has rounded out the top five, increasing its market share from 10.2 percent to 12.3 percent with shipments rising from 1.5 million to 2.1 million units.

Other brands collectively held an 18.4 percent market share, slightly lower than 18.7 percent in 2023.

Baburajan Kizhakedath