Chinese technology giants, including Huawei and Baidu, as well as some startups, are accelerating their procurement of high bandwidth memory (HBM) semiconductors from Samsung Electronics. This strategic move is in anticipation of potential U.S. restrictions on the export of these chips to China, according to a report by Reuters.

Since the beginning of the year, Chinese companies have significantly increased their purchases of AI-capable semiconductors, contributing to approximately 30 percent of Samsung’s HBM chip revenue in the first half of 2024.

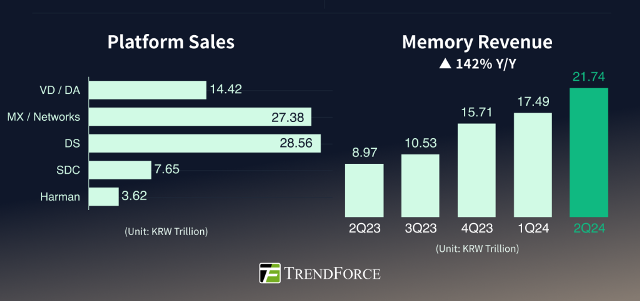

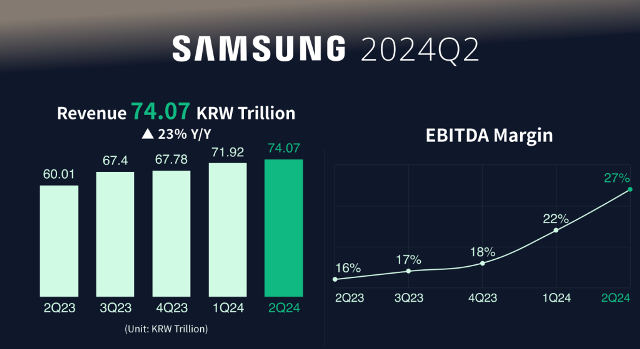

In the second quarter, Samsung’s Device Solutions (DS) Division reported consolidated revenue of KRW 28.56 trillion and an operating profit of KRW 6.45 trillion, marking a quarter-on-quarter growth of 23.4 percent and 2377 percent, respectively. The memory market’s resurgence has been driven by strong demand for HBM, conventional DRAM, and server SSDs, spurred by continued AI investments from cloud service providers and businesses, TrendForce report said.

Looking ahead to the second half of 2024, Samsung anticipates that AI servers will represent a larger market share as major cloud service providers and enterprises expand their AI investments. These AI servers, equipped with HBM, will also feature high content-per-box in terms of conventional DRAM and SSDs, ensuring robust demand across all memory products, including HBM, DDR5, and server SSDs.

Samsung plans to actively expand its production capacity to increase HBM3e sales. The company will also focus on high-density products, such as server modules based on the 1b-nm 32Gb DDR5 in server DRAM. Notably, Samsung’s HBM3 chips were recently approved by NVIDIA, initially for exclusive use in the AI giant’s H20, a less advanced GPU designed for the Chinese market.

These developments highlight China’s efforts to maintain its technological ambitions amid escalating trade tensions with the U.S. and other Western nations. The tensions are also affecting the global semiconductor supply chain.

The U.S. is expected to announce an export control package this month, introducing new restrictions on China’s semiconductor industry. This package will likely set parameters for restricting access to high bandwidth memory chips. The U.S. Department of Commerce stated last week that it continuously assesses the evolving threat environment and updates export controls to protect national security and safeguard the technological ecosystem.

HBM chips are vital for developing advanced processors, such as Nvidia’s GPUs used in generative AI work. Currently, only three major chipmakers produce HBM chips: South Korea’s SK Hynix and Samsung, and U.S.-based Micron Technology.

Chinese demand has primarily focused on the HBM2E model, two generations behind the most advanced HBM3E version, due to the global AI boom causing a supply shortage of the latest model. Huawei has been utilizing Samsung’s HBM2E semiconductors for its Ascend AI chip.

Chinese firms like Huawei and memory chipmaker CXMT have made progress in producing HBM2 chips, which are three generations behind HBM3E. However, these efforts might be affected by the new U.S. regulations.

The restrictions on HBM sales to China could impact Samsung more significantly than its competitors, who rely less on the Chinese market. Micron ceased selling its HBM products to China last year, while SK Hynix, a major supplier to Nvidia, focuses more on advanced HBM chip production. Earlier this year, SK Hynix announced adjustments to expand HBM3E output, with their HBM chips sold out for this year and nearly sold out for 2025.