Western Digital has posted revenue of $3.46 billion (up 14 percent QoQ and up 23 percent YoY) in its fiscal third quarter thanks to an increase in demand for its data storage products from cloud service providers.

The financial performance is the latest sign that demand for memory chips is improving, after earnings of larger rivals Micron Technology and Samsung Electronics also showed a rebound in prices of the semiconductors, Reuters news report said.

The financial performance is the latest sign that demand for memory chips is improving, after earnings of larger rivals Micron Technology and Samsung Electronics also showed a rebound in prices of the semiconductors, Reuters news report said.

Western Digital

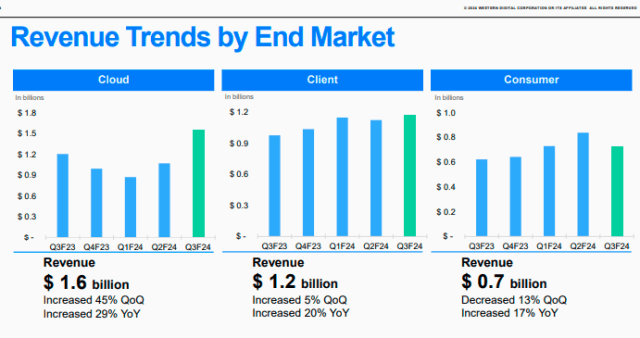

Cloud $1,553 million (up 29 percent)

Client $1,174 million (up 20 percent)

Consumer $730 million (up 17 percent)

At $1,553 million (up 29 percent), Western Digital’s Cloud business represented 45 percent of revenue primarily due to higher nearline shipments and improved nearline per unit pricing with flash revenue up

At $1,174 million (up 20 percent), Western Digital’s Client business represented 34 percent of revenue. Sequentially, the increase in flash ASP more than offset a decline in flash bit shipments while HDD revenue decreased. The year-over-year increase was driven by growth in both flash and HDD ASPs and flash bit shipments.

At $730 million (up 17 percent), Western Digital’s Consumer business represented 21 percent of total revenue. Sequentially, both flash and HDD were down at approximately similar rates and in line with seasonality. The year-over-year increase was driven by growth in flash bit shipments and ASP.

Western Digital expects fiscal fourth quarter 2024 revenue to be in the range of $3.60 billion to $3.80 billion.

“We are in the early innings of unlocking the full potential of this company, and as industry supply and demand dynamics continue to improve, we will remain disciplined around our capital spending,” said Western Digital CEO David Goeckeler.

David Goeckeler is set to lead the company’s flash memory business after its planned separation from the traditional hard-disk drive unit, expected to complete in the second half of 2024.