Indian telecom operators are facing challenges in migrating their 4G users to the 5G network, despite a growing data usage trend across the country, the latest data from the Telecom Regulatory Authority of India (TRAI) reveals.

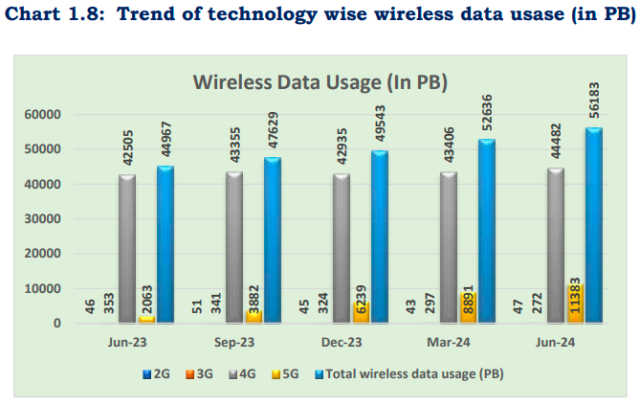

During the April-June quarter of 2024, 4G data usage contributed the majority at 79.17 percent of the total wireless data usage, while 5G usage made up only 20.26 percent. The adoption of older mobile technologies such as 2G and 3G remains minimal, with their contribution being 0.08 percent and 0.48 percent, respectively, TRAI report indicated.

TRAI did not reveal the total number of 4G and 5G subscribers in India. Indian telecom operators such as Bharti Airtel and Reliance Jio have started rolling out 5G network aiming to improve data speed and ARPU. But Vodafone Idea and BSNL do not have 5G presence.

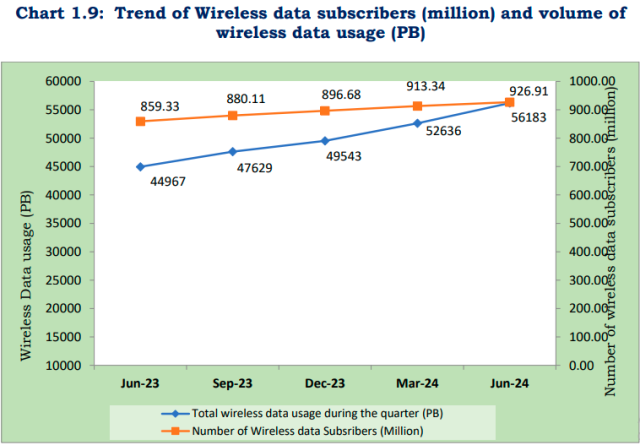

Total mobile data usage grew from 52,636 petabytes (PB) in the first quarter of 2024 to 56,183 PB in the second quarter, marking a 6.74 percent growth. In specific terms, 4G data rose to 44,482 PB from 43,406 PB. 5G data usage stood at 11,383 PB as compared with 8,891 PB.

TRAI said the number of mobile data subscribers in India increased from 913.34 million at the end of March 2024 to 926.91 million by June 2024. However, average data usage per subscriber per month remained relatively high at 21.30 GB.

Financial indicators showed growth, with the average revenue realization per gigabyte for wireless data reaching Rs 8.31 during the quarter. Additionally, the monthly average revenue per user (ARPU) for mobile services increased by 2.55 percent to Rs 157.45, with prepaid ARPU rising to Rs 154.80 and postpaid ARPU slightly increasing to Rs 189.17.

Despite this growth in usage and ARPU, the Gross Revenue (GR) of the Indian telecom sector saw a 2.16 percent quarter-on-quarter decline to Rs 86,031 crore, though it increased by 6.34 percent year-on-year. Adjusted Gross Revenue (AGR) saw a minor 0.13 percent quarter-on-quarter rise to Rs 70,555 crore, with year-on-year growth of 7.51 percent.

Among major telecom operators, Reliance Jio reported an AGR of Rs 25,891.37 crore (up 10.38 percent), Bharti Airtel posted Rs 22,209.15 crore (up 15.34 percent), while Vodafone Idea reported Rs 7,271.01 crore (up 0.04 percent). State-run BSNL faced a decline in AGR, down 7.03 percent to Rs 1,905.91 crore.

The data indicates that while the 5G network rollout has begun, Indian telecom operators still have a long way to go in transitioning their massive 4G user base to the faster 5G services.

Baburajan Kizhakedath