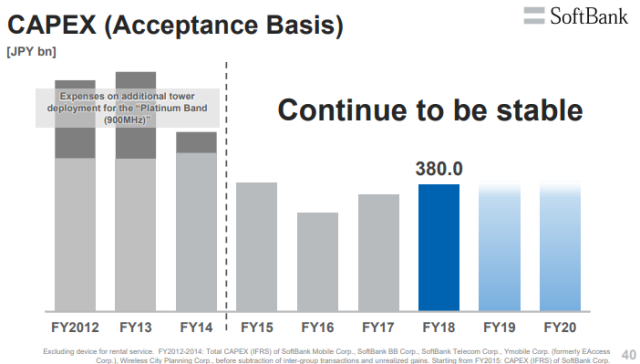

SoftBank CEO Ken Miyauchi indicated that the Japanese telecom operator will be retaining its Capex in fiscal 2019 and fiscal 2020 in line with the 2018 levels despite its 5G investment plans.

SoftBank’s lack of interest in enhancing its Capex during the current fiscal and the next fiscal indicates that the third largest mobile network operator in Japan will be waiting for more time to evaluate the 5G market.

SoftBank’s lack of interest in enhancing its Capex during the current fiscal and the next fiscal indicates that the third largest mobile network operator in Japan will be waiting for more time to evaluate the 5G market.

SoftBank, the third largest operator in Japan, aims to spend 380 billion yen in 2018 as compared with 350 billion yen in 2017.

Ken Miyauchi, during an analyst call today, said new services and the adoption of high-speed 5G networks meant the smartphone market had ample room for growth. 61 percent is the smartphone penetration in Japan. “5G smartphones in a few years will probably take over the entire world.”

SoftBank earlier indicated that it may not consider Huawei for supplying the 5G equipment due to security concerns shutting the doors for the China-based network maker. SoftBank is yet to reveal its network partners for the 5G launch.

SoftBank said its telecom service revenues increased 4.3 percent to 1,482,368 million yen. Mobile communications revenue rose 2.2 percent due to increase in smartphone customers and changes in the installment contract period for devices.

Broadband revenue increased 14.8 percent mainly due to an increase in subscribers to the SoftBank Hikari fiber-optic service.

The operating expense (Opex) was 1,462,416 million yen, an increase of 12,759 million (0.9 percent) mainly due to increases in cost of sales for smartphones in mobile communications and the SoftBank Hikari service as telecommunications network charges.

SoftBank booked a 24 percent rise in quarterly profit as users switched to data-heavy plans, pinning future growth on the rise of 5G services in the mobile carrier’s first earnings report as a public company, Reuters reported.

Operating profit reached 191.6 billion yen ($1.74 billion) in October-December, SoftBank said in a stock exchange filing.

The results cover a turbulent three months during which SoftBank suffered a network outage, fielded ongoing government calls for lower prices, and faced scrutiny over ties to Huawei Technologies – a Chinese company whose telecoms equipment Western powers fear could be used for espionage.

SoftBank founder Masayoshi Son will be under more pressure in Japanese telecom market because e-commerce firm Rakuten becomes the fourth major wireless carrier pledging low prices from October.

Nomura Securities analyst Daisaku Masuno wrote in a report that SoftBank should be able to grow as market uncertainty fades through appealing to heavy users through its 50 gigabyte data plan while offering low prices through its Y!mobile brand.

SoftBank maintained its forecast for operating profit to rise 10 percent to 700 billion yen for the year through March.

Baburajan K