The total mobile services revenue in Saudi Arabia is poised to climb at a compound annual growth rate (CAGR) of 6.3 percent, soaring from $12.7 billion in 2023 to a projected $17.3 billion in 2028. This surge is primarily attributed to the escalating embrace of mobile data services across the nation.

While mobile voice service revenue in Saudi Arabia is predicted to decline at a CAGR of 3.2 percent between 2023 and 2028, in sync with the dwindling mobile voice average revenue per user (ARPU) levels, the revenue stemming from mobile data services is expected to witness the most rapid growth, with a CAGR of 9.6 percent. This surge is fueled by the burgeoning adoption of 5G services in Saudi Arabia, GlobalData’s Saudi Arabia Mobile Broadband Forecast (Q3 2023) indicates.

While mobile voice service revenue in Saudi Arabia is predicted to decline at a CAGR of 3.2 percent between 2023 and 2028, in sync with the dwindling mobile voice average revenue per user (ARPU) levels, the revenue stemming from mobile data services is expected to witness the most rapid growth, with a CAGR of 9.6 percent. This surge is fueled by the burgeoning adoption of 5G services in Saudi Arabia, GlobalData’s Saudi Arabia Mobile Broadband Forecast (Q3 2023) indicates.

Projections further reveal a striking surge in average monthly mobile data usage in Saudi Arabia, forecasted to ascend from 44.3 GB in 2023 to a robust 89.8 GB in 2028. This surge is propelled by the escalating consumption of high-bandwidth online video services and social media content on smartphones in Saudi Arabia.

Notably, operators like Zain KSA are enticing consumers with data-centric plans, such as offering an additional 150GB for social media apps like Youtube and Facebook, bundled with a prepaid mobile internet plan priced at SAR458.85 ($122) valid for three months.

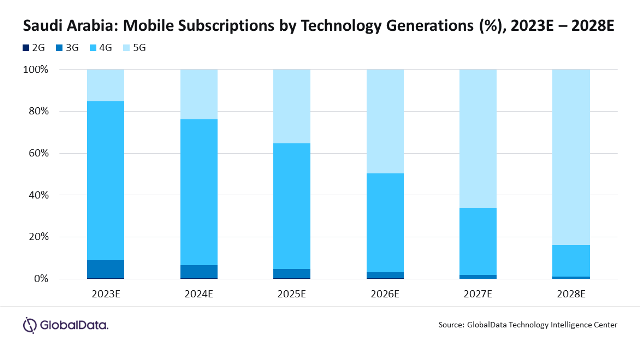

Telecom Analyst Kantipudi Pradeepthi from GlobalData underscores the dominance of 4G technology in Saudi Arabia’s mobile subscriptions until 2025. However, the forecast predicts a pivotal shift as 5G subscriptions are poised to overtake 4G, constituting an 84 percent share of total mobile subscriptions by 2028. This shift is propelled by the aggressive 5G network expansion initiatives by both the telecom regulator and mobile operators.

Saudi Telecom Company (STC) emerged as the dominant force in mobile services subscriptions in 2023, closely followed by Mobily. STC is anticipated to uphold its supremacy through 2028, leveraging its strategic focus on expanding 5G services and exploring opportunities within the M2M/IoT segment in Saudi Arabia.