GSMA said 5G will account for almost all mobile Capex in US and Canada during 2022-2025 as telecom operators step up deployments of mid-band spectrum, taking overall population coverage to 92 percent in Canada and 100 percent in the US by 2025.

The total mobile Capex in US and Canada during 2022-2025 will be $204 billion, GSMA said. Operators will be spending 99 percent of the mobile Capex on the deployment of 5G network.

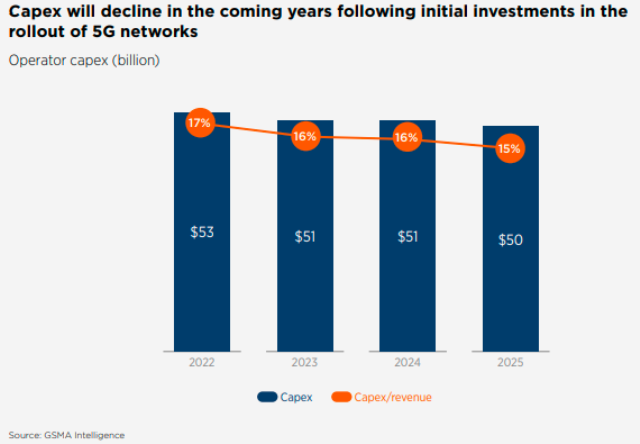

Mobile operator Capex will decline to $50 billion in 2025 as compared with $53 billion in 2022, $51 billion in 2023 and $51 billion in 2024. Mobile Capex to revenue ratio will dip to 15 percent in 2025 from 17 percent in 2022 and 16 percent in 2023 and 16 percent in 2024.

Mobile operator revenue in US and Canada will grow to reach $333 billion in 2025 against $294 billion in 2022.

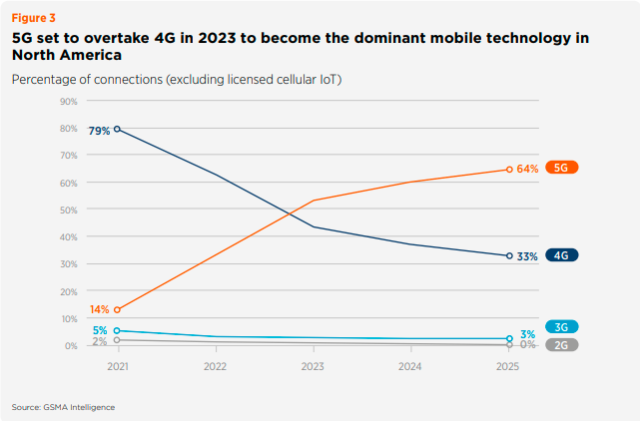

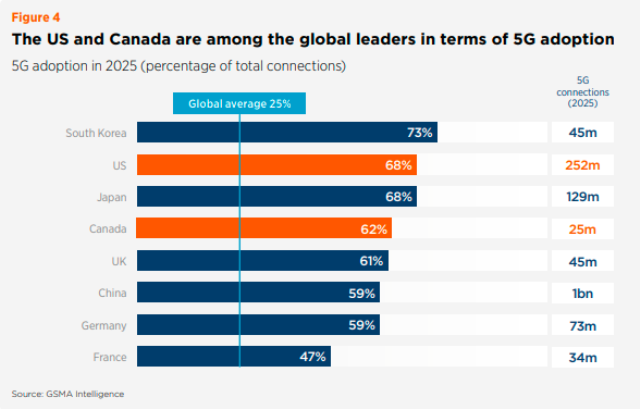

5G will account for almost two-thirds of total mobile connections across North America by 2025, the equivalent of nearly 280 million connections, according to the latest Mobile Economy North America Report released by GSMA.

1 in 4 mobile connections in the US is a 5G connection. By 2030, 5G is expected to contribute $122 billion to GDP in the US. There are 214 operators from 81 countries offering commercial 5G services, the report shows.

5G will overtake 4G in 2023 to become the dominant mobile technology in North America. Smartphones will account for nearly 9 in 10 connections on average in North America by 2025.

Mobile connectivity and smart technology could enable global savings of around 11 giga tonnes of carbon emissions by 2030, helping achieve net zero goals, Mats Granryd, GSMA’s Director General, said at GSMA MWC Las Vegas, a telecom event in partnership with CTIA.

The North American mobile ecosystem directly generated around $300 billion of economic value in 2021, with mobile operators accounting for the majority.

In 2021, the mobile ecosystem directly employed more than 850,000 people in North America and supported another 1.4 million jobs indirectly.

In 2021, the mobile ecosystem contributed almost $110 billion to the funding of the public sector through consumer and operator taxes.

In the first five months of 2022, more than $120 billion was invested in building out metaverse technology and infrastructure, more than double the $57 billion invested in 2021.