Latin America’s mobile network industry is undergoing a transformation as mobile operators balance the maturity of LTE with the gradual adoption of 5G. According to the Global mobile Suppliers Association (GSA), global 5G network rollouts have gained significant traction, but Latin America is advancing at a slower pace than North America, Europe, or Asia–Pacific.

5G Rollouts: Slow but Strengthening

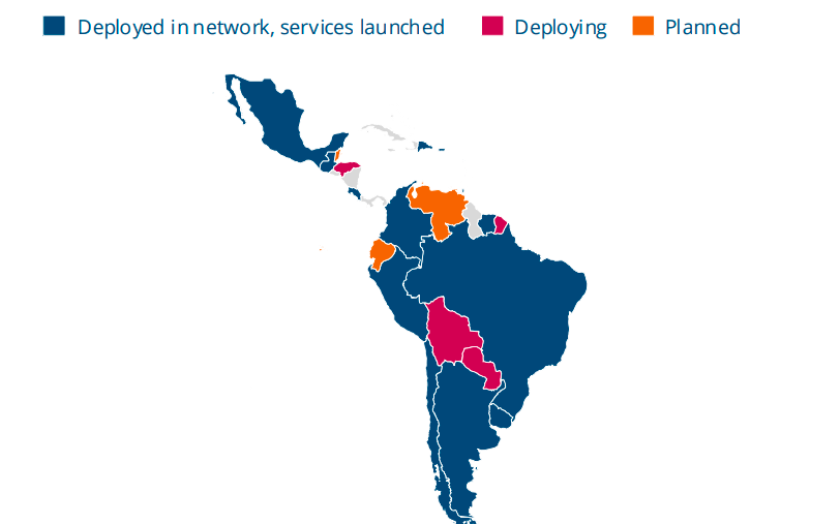

As of June 2025, 84 operators across 31 Latin American countries — just over 13 percent of the global total — are investing in 5G mobile or fixed wireless access services. By August 2025, 37 operators in 18 countries (10 percent of the global total) had launched 5G networks in Latin America. The near-term pipeline is expanding, with 11 telecom operators in 10 countries currently deploying and 19 operators in 13 countries planning 5G launches. Upcoming spectrum auctions in Argentina, Costa Rica, and Uruguay are expected to accelerate deployments.

Limited 5G Standalone Adoption

5G standalone (SA) networks, which deliver enhanced reliability, lower latency, and improved security without relying on LTE cores, remain scarce. Globally, 173 operators in 70 countries are investing in 5G SA, but Latin America accounts for only 11 operators in six countries (5 percent of the global total). So far, just five operators in three countries have launched SA networks. Short-term growth remains minimal, with Peru being the only market currently testing the technology.

LTE: The Regional Backbone

LTE remains the dominant mobile technology in Latin America, providing the foundation for 5G migration. By August 2025, 167 operators in 52 countries across the region were investing in LTE, and 145 had launched services. Brazil leads with over 95 percent population coverage and heavy capacity upgrades. Mexico has expanded LTE reach through the Red Compartida wholesale initiative, while Chile, Colombia, and Peru maintain high adoption levels.

Spectrum auctions in the 700 MHz and 2.5 GHz bands have been critical for rural LTE coverage, although Central America and some Caribbean markets still face infrastructure and regulatory challenges. Globally, LTE growth is slowing as 5G emerges, with only 14 operators in nine countries deploying new LTE networks in 2025.

Emerging Opportunities: Fixed Wireless, Private Networks, and Satellites

5G fixed wireless access (FWA) is gaining interest as operators test and plan new services to meet residential and enterprise broadband needs. Private mobile networks for mining, ports, and manufacturing are also growing, highlighting the role of advanced connectivity in industrial sectors. Additionally, satellite partnerships are improving rural and remote coverage, complementing terrestrial networks.

Meanwhile, the phased shutdown of 2G and 3G networks in Argentina, Colombia, and Venezuela is freeing up spectrum for LTE and 5G expansion.

Latin America’s 5G market is gathering momentum, with major telecom operators steadily expanding commercial networks and forging partnerships with global equipment vendors. Below is a snapshot of the most recent deployments and the companies enabling them.

Mexico

America Movil (Telcel) has accelerated its nationwide rollout, extending 5G coverage to more than 125 cities and surpassing 10 million 5G subscribers. The company works with Ericsson and Huawei to build out radio access and core infrastructure, ensuring strong urban and suburban coverage.

Brazil

Brazil leads the region in scale and speed of 5G adoption, thanks to aggressive investments from its three largest carriers:

Claro Brasil has achieved nationwide 5G availability and was an early adopter of Dynamic Spectrum Sharing to bring service to Sao Paulo and Rio de Janeiro. Ericsson supplies key network equipment and spectrum-sharing technology.

Vivo (Telefonica Brasil) operates more than 17,000 5G cell sites across 562 cities, reaching over 63 percent of the population. Recent network expansions are being delivered with Nokia as the primary vendor.

TIM Brasil covers more than 700 municipalities and serves roughly 11.6 million 5G users. In 2025 it selected Nokia to expand its 5G radio access network across multiple states.

Brazil is a hotspot for private 5G. For example, Nestle deployed a private standalone 5G network at its Cacapava factory in partnership with Ericsson, Claro, and Embratel to support Industry 4.0 applications. Agricultural equipment maker Jacto launched a private 5G/LTE network with Nokia to power robotics and smart-factory automation.

Argentina

Claro Argentina has begun 5G infrastructure rollouts across key metropolitan areas, partnering with Nokia for the first commercial phases of its network expansion.

Uruguay

ANTEL made history with the region’s first commercial 5G call and continues to expand service using Nokia radio, optical transport, and support solutions.

Outlook: Steady Progress Toward Next-Gen Connectivity

Latin America is steadily moving toward an advanced mobile ecosystem. LTE maturity provides a strong base, while increasing 5G deployments, private network initiatives, and satellite collaborations are bridging the digital divide. Although 5G standalone adoption lags, continued investments and regulatory support signal a stronger growth trajectory through the late 2020s.

Baburajan Kizhakedath