TelecomLead.com Research team has analyzed the business performance of Chunghwa Telecom, Taiwan Mobile and FarEasTone during Q2 2024 in Taiwan.

Chunghwa Telecom is the leading operator in Taiwan, followed by Taiwan Mobile and FarEasTone.

Chunghwa Telecom achieved 1.2 percent increase in revenue to NT$54.12 billion for the second quarter of 2024.

Chunghwa Telecom Chairman and CEO Shui-Yi Kuo emphasized the company’s strong performance in the mobile sector, particularly postpaid mobile ARPU (Average Revenue Per User), which has achieved the highest year-over-year growth in Taiwan’s telecom industry for six consecutive quarters.

Chunghwa Telecom’s Consumer Business Group (CBG) revenue rose 2.6 percent to NT$33.60 billion, driven by a 3.8 percent increase in mobile service revenue, attributed to 5G migration and growth in postpaid subscribers.

Chunghwa Telecom’s fixed broadband services experienced growth, thanks to increasing demand for higher-speed packages of 300Mbps and above. Sales revenue, bolstered by strong Apple iPhone demand, rose by 2.4 percent.

Taiwan Mobile’s total revenue was NT$47.743 billion for the second quarter of 2024, marking a notable increase from NT$43.546 billion in Q2 2023. Taiwan Mobile’s service revenue surged by 26 percent.

Taiwan Mobile’s smartphone postpaid ARPU grew by more than 6 percent, driven by expanding 5G adoption, which now represents 38 percent of the smartphone postpaid user base, and 40 percent when including T Star users.

Other growth areas include a 2 percent increase in revenue for momo e-commerce platform and a 4 percent growth in broadband subscribers.

Far EasTone’s revenue reached NT$24.97 billion in Q2 2024 against NT$21.698 billion in Q2 2023.

Far EasTone’s 5G penetration surpassed 40 percent among postpaid customers, while its enterprise-focused “new economy” segment demonstrated robust growth, particularly through key government and ICT projects.

Second-quarter marked the 15th consecutive quarter of revenue growth for Far EasTone, solidifying its market position in Taiwan’s telecom sector.

GlobalData on Taiwan telecom market

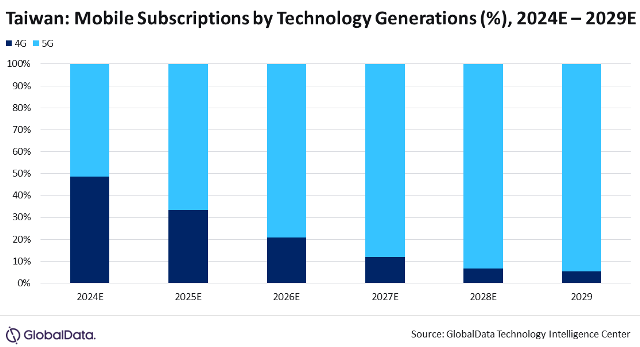

Taiwan’s mobile service revenues are expected to grow at a compound annual growth rate (CAGR) of 3.9 percent, rising from $6 billion in 2024 to $7.3 billion by 2029, according to a forecast by GlobalData. The growth will be driven by the increasing adoption of mobile data services, with the uptake of higher ARPU 5G services playing a significant role.

While mobile voice service revenue is projected to decline at a CAGR of 4.3 percent due to a shift towards OTT/Internet-based communication platforms, mobile data service revenue is expected to increase by 5.9 percent annually. The report highlights a projected surge in average monthly mobile data usage, from 35 GB in 2024 to 42.4 GB in 2029, driven by rising consumption of online entertainment and social media content on smartphones.

GlobalData Telecom Analyst Kantipudi Pradeepthi said 5G subscriptions are poised to dominate the market, accounting for over 95 percent of total mobile subscriptions by 2029. The main strategy of Chunghwa Telecom, Taiwan Mobile and FarEasTone is to enhance focus on 5G monetization in order to drive revenue.

Chunghwa Telecom is set to maintain its market leadership, fueled by its 5G network expansion and diverse mobile value-added services.

Baburajan Kizhakedath