BofA Merrill Lynch Global Research has revealed estimates for Reliance Jio Infocomm’s 4G subscriber base, revenue, profit, etc. in the next 8 years.

BofA Merrill Lynch Global Research has revealed estimates for Reliance Jio Infocomm’s 4G subscriber base, revenue, profit, etc. in the next 8 years.

The estimates indicate that Reliance Jio will not be overtaking established telecom operators such as Bharti Airtel and Vodafone-Idea Cellular combine in the next 8 years in terms of telecom revenue, mobile subscriber base and market share.

The research report released on March 22, 2017 assumes significance because Reliance Jio is trying to retain its 100 million 4G subscribers, who joined the network as free users during the promotion phase, as paid subscribers and generate its first revenue from telecom business.

Jio – Key assumptions (Base case)

Jio is estimated to have 75 million subscribers in fiscal 2018, 85 million in fiscal 2019, 102 million in fiscal 2020, 117 million in fiscal 2021, 132 million in fiscal 2022, 145 million in fiscal 2023, 155 million in fiscal 2024 and 158 million in fiscal 2025.

Jio is estimated to have market share of 6 percent in fiscal 2018, 7 percent in fiscal 2019, 8 percent in fiscal 2020, 9 percent in fiscal 2021, 10 percent in fiscal 2022, 11 percent in fiscal 2023, 11 percent in fiscal 2024 and 11 percent in fiscal 2025 in the Indian telecom market.

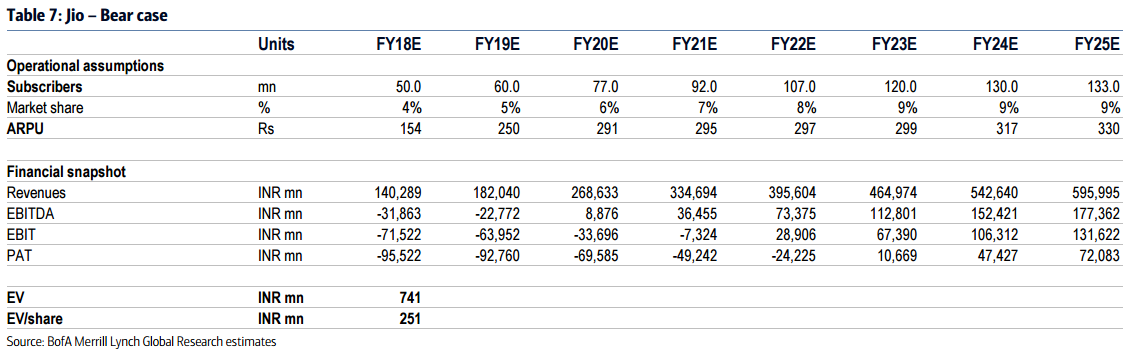

ARPU of Jio will be Rs 154 in fiscal 2018, Rs 250 in fiscal 2019, Rs 291 in fiscal 2020, Rs 295 in fiscal 2021, Rs 297 in fiscal 2022, Rs 299 in fiscal 2023, Rs 317 in fiscal 2024 and Rs 330 in fiscal 2025 in the Indian telecom market.

Annual revenue of Jio will grow from INR 163,620 million in fiscal 2018 to INR 257,882 million in fiscal 2019 and INR 356,914 million in fiscal 2020.

Reliance Jio is anticipated to make loss of INR 93,333 million in fiscal 2018. Jio will continue to make loss till fiscal 2022.

Jio – Key assumptions (Bull case)

Jio is estimated to have 100 million subscribers in fiscal 2018, 110 million in fiscal 2019, 127 million in fiscal 2020, 142 million in fiscal 2021, 157 million in fiscal 2022, 170 million in fiscal 2023, 180 million in fiscal 2024 and 183 million in fiscal 2025.

Jio is estimated to have 100 million subscribers in fiscal 2018, 110 million in fiscal 2019, 127 million in fiscal 2020, 142 million in fiscal 2021, 157 million in fiscal 2022, 170 million in fiscal 2023, 180 million in fiscal 2024 and 183 million in fiscal 2025.

Jio is estimated to have market share of 9 percent in fiscal 2018, 9 percent in fiscal 2019, 10 percent in fiscal 2020, 11 percent in fiscal 2021, 12 percent in fiscal 2022, 12 percent in fiscal 2023, 13 percent in fiscal 2024 and 13 percent in fiscal 2025 in the Indian telecom market.

ARPU of Jio will be Rs 154 in fiscal 2018, Rs 250 in fiscal 2019, Rs 291 in fiscal 2020, Rs 295 in fiscal 2021, Rs 297 in fiscal 2022, Rs 299 in fiscal 2023, Rs 317 in fiscal 2024 and Rs 330 in fiscal 2025 in the Indian telecom market.

Annual revenue of Jio will grow from INR 186,951 million in fiscal 2018 to INR 333,725 million in fiscal 2019 and INR 445,195 million in fiscal 2020.

Reliance Jio is anticipated to make loss of INR 91,145 million in fiscal 2018. Jio will continue to make loss till fiscal 2020.

Jio – Key assumptions (Bear case)

Jio is estimated to have 50 million subscribers in fiscal 2018, 60 million in fiscal 2019, 77 million in fiscal 2020, 92 million in fiscal 2021, 107 million in fiscal 2022, 120 million in fiscal 2023, 130 million in fiscal 2024 and 133 million in fiscal 2025.

Baburajan K

editor@telecomlead.com