Reliance Jio has achieved more than 20 percent of subscribers in nine circles out of 22 circles in India.

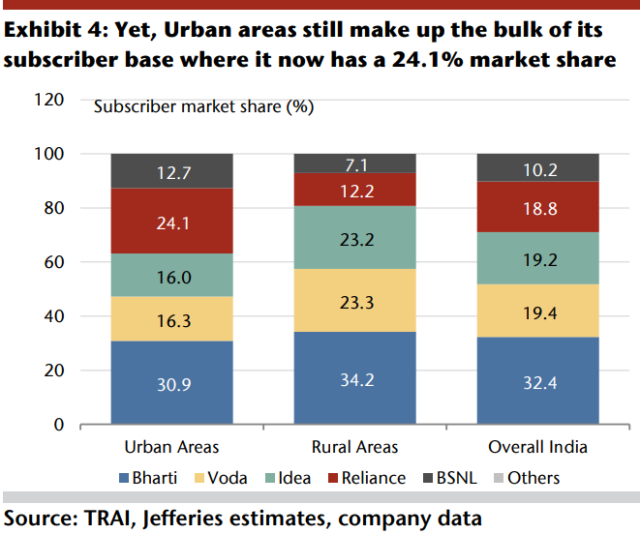

Mukesh Ambani-promoted Reliance Jio mainly focuses on urban areas that make up the bulk of its subscriber base grabbing 24.1 percent market share. A shift to rural areas will assist RIL in selling more JioPhones ensuring more growth in Jio 4G subscribers across the country.

Mukesh Ambani-promoted Reliance Jio mainly focuses on urban areas that make up the bulk of its subscriber base grabbing 24.1 percent market share. A shift to rural areas will assist RIL in selling more JioPhones ensuring more growth in Jio 4G subscribers across the country.

“Its focus on subscribers may keep pricing soft with Capex likely elevated as it spends to maintain its network edge,” Jefferies India’s equity analyst team members Somshankar Sinha, Piyush Nahar and Pratik Chaudhuri said in a recent report.

The below chart shows the Capex of Reliance Jio in the next 5-6 years indicating that there will be no significant growth in investment in its all-India 4G networks to build momentum in the growth of mobile data subscribers.

Reliance’s focus on subscribers may delay a recovery in industry revenues which were flat quarter on quarter in Q1 fiscal 2019.

Reliance’s focus on subscribers may delay a recovery in industry revenues which were flat quarter on quarter in Q1 fiscal 2019.

The report said Reliance Jio did well with its market share reaching 21.9 percent as Idea Cellular and Vodafone losing share in Q1 fiscal 2018-19.

Jio needs to revised strategies for Mumbai and Delhi, two lucrative telecom circles for all telecom operators, to gain growth. Jio strategy to target 50 percent RMS may require soft pricing and access to more spectrum, the report said.

Reliance Jio leads on revenue in seven of 22 circles and is second in another 11 though it lost share in metros. The other circles are making up but it is well short of its 50 percent RMS target. Reliance Jio spent $2.5 billion in Q1 fiscal 2018-19 alone, taking its telecom Capex to $42.5 billion.

Reliance Jio spent $2.5 billion in Q1 fiscal 2018-19 alone, taking its telecom Capex to $42.5 billion.

The main challenge for Reliance Jio is to add active 4G subscribers. The chart shows the number of in-active subscribers on Jio 4G network.

The report said Reliance Jio’s target to achieve 50 percent revenue share will be a huge task for the team to achieve.

Baburajan K