India’s wireless or mobile subscriber base continued its gradual expansion in November 2025, supported mainly by urban growth, according to the latest data released by the Telecom Regulatory Authority of India (TRAI).

Wireless subscribers show modest monthly growth

TRAI said the total number of wireless subscribers increased from 1,171.87 million at the end of October 2025 to 1,173.88 million at the end of November 2025. This reflects a monthly growth rate of 0.17 percent.

Urban wireless subscriptions rose from 639.99 million to 641.83 million during the period, registering a monthly growth rate of 0.29 percent. Rural wireless subscriptions increased marginally from 531.88 million to 532.06 million, with a growth rate of 0.03 percent.

At the end of November 2025, urban subscribers accounted for 54.68 percent of the total wireless subscriber base, while rural subscribers made up the remaining 45.32 percent.

Top telecom operators in India

Top telecom operators in India – based on the number of mobile subscribers – are Reliance Jio (486.089 million), Airtel (394.880 million), Vodafone Idea (199.712 million) and BSNL (92.963 million) at the end of November 2025.

Reliance Jio has increased the number of mobile subscribers to 484.700 million in November 2025 from 486.089 million in October 2025.

Bharti Airtel has increased the number of mobile subscribers to 394.880 million in November 2025 from 393.664 million in October 2025.

Vodafone Idea’s mobile subscriber base fell to 199.712 million from 200.723 million.

BSNL increased the number of mobile subscribers to 92.963 million from 92.541 million.

Wireless tele-density trends

India’s overall wireless tele-density declined slightly from 82.57 percent at the end of October 2025 to 82.51 percent at the end of November 2025.

Urban wireless tele-density increased from 124.97 percent to 125.55 percent, indicating continued multi-SIM usage and higher adoption in cities. In contrast, rural wireless tele-density fell from 58.63 percent to 58.37 percent during the same period, highlighting the ongoing challenges in expanding mobile penetration in rural areas.

Circle-wise performance

TRAI noted that, except for Himachal Pradesh, Jammu and Kashmir, Assam, and Haryana, all other licensed service areas reported growth in wireless subscribers during November 2025. This indicates broad-based expansion across most telecom circles despite regional variations.

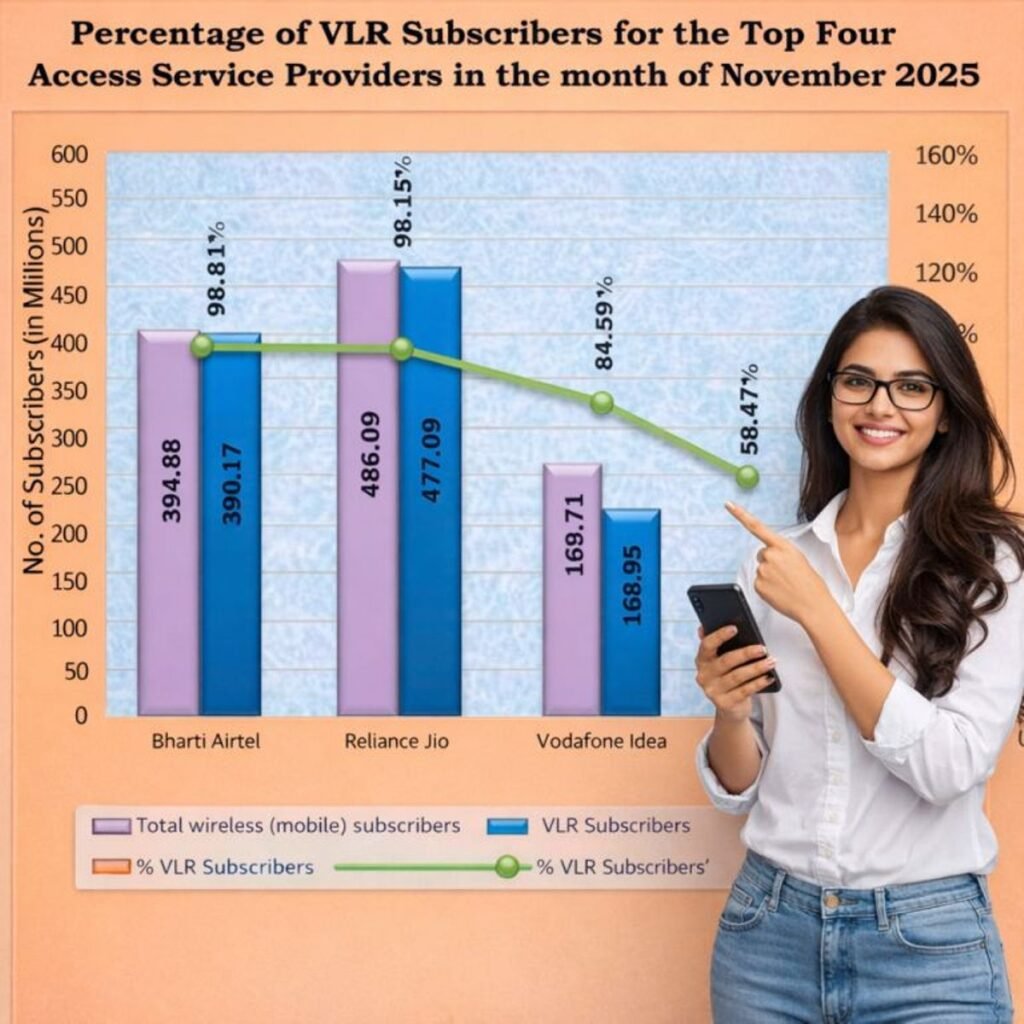

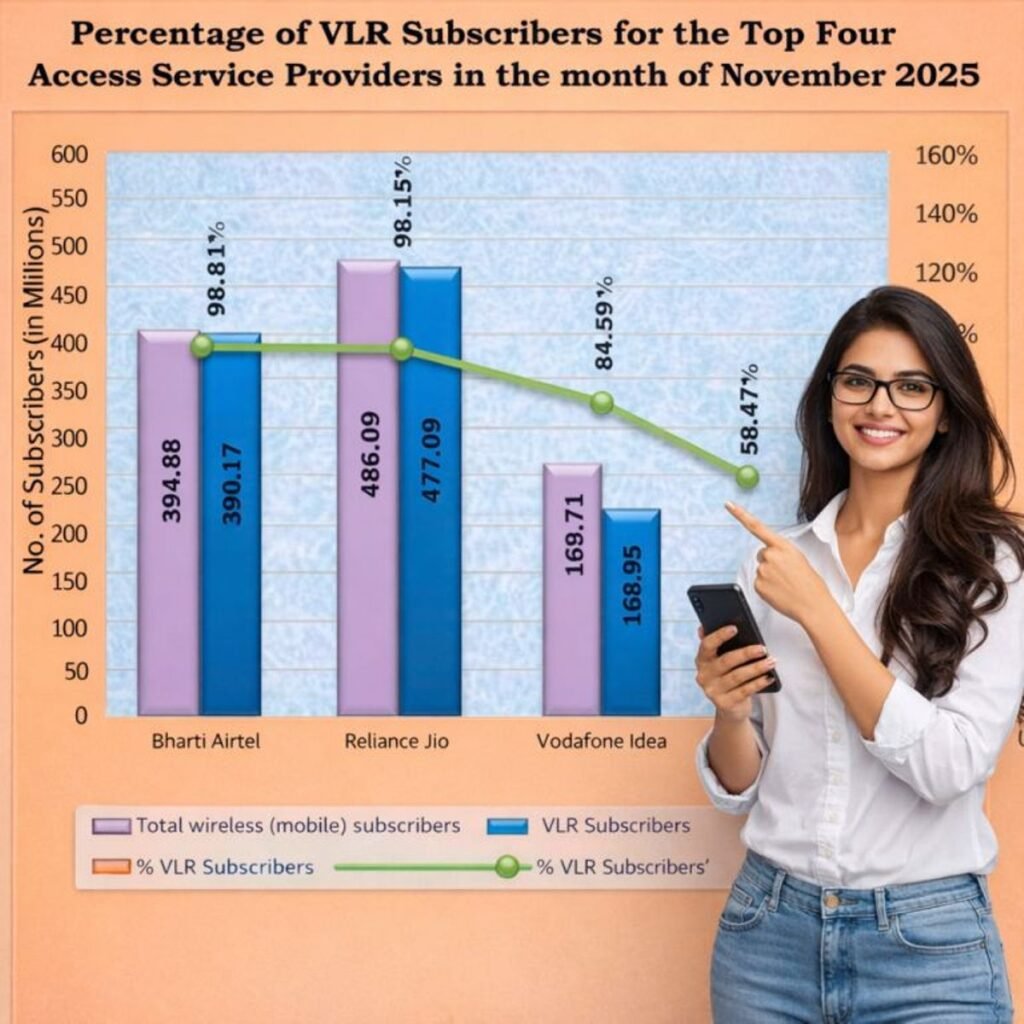

Active subscriber base remains strong

Out of the total 1,173.88 million wireless subscribers, around 1,090.91 million were active on the date of peak visitor location register in November 2025. Active subscribers accounted for approximately 92.93 percent of the total wireless subscriber base.

Among operators, Bharti Airtel reported the highest proportion of active subscribers, with 98.81 percent of its total wireless subscriber base active on the peak VLR date. In contrast, BSNL recorded the lowest proportion, with active subscribers accounting for 58.47 percent of its total wireless base during the same period.

Mobile number portability activity

Mobile number portability continued to see significant traction in November 2025. About 14.69 million subscribers submitted MNP requests during the month.

Of the total requests, around 7.94 million came from MNP Zone I, which covers northern and western India, while Zone II, comprising southern and eastern India, accounted for about 6.74 million requests.

In Zone I, UP East recorded the highest number of MNP requests at 1.97 million, followed by UP West with 1.35 million. In Zone II, Madhya Pradesh led with 1.40 million requests, followed closely by Bihar with 1.33 million requests.

Outlook

The November 2025 data indicates steady but slowing growth in India’s wireless market, with urban areas driving most of the additions. Declining rural tele-density and variations in active subscriber ratios across operators remain key areas of focus as telecom companies and policymakers work to strengthen mobile connectivity nationwide. BABURAJAN KIZHAKEDATH