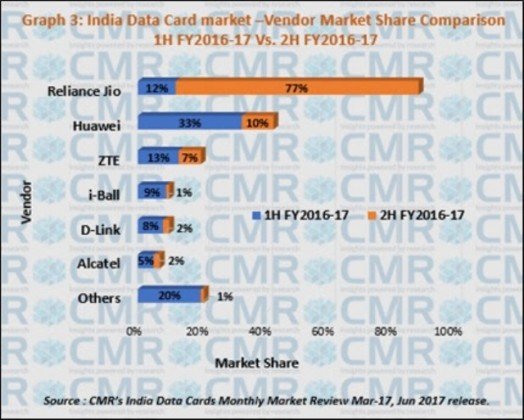

Reliance Jio’s share in India data card market grew from 12 percent in H1 FY2016-2017 to 77 percent in H2 FY2016-2017 – beating Huawei.

4G data cards became mainstream with 228 percent sequential increase in H2 FY2016-2017.

Market share of Mi-Fi based LTE devices rose from 71 percent in H1 FY2016-2017 to 94 percent in the second half.

Meanwhile, smartphone market share of Reliance Jio nosedived in 2016.

Indian Data Cards market rose 107 percent in H2 FY2016-2017 to 3.6 million over H1 FY2016-2017, according to CMR.

CyberMedia Research did not provide the data card market statistics for fiscal 2016, and comparison between fiscal 2016 and fiscal 2017. The report directly jumped on to reveal the figures for first half and second half of fiscal 2017.

4G data card shipments achieved 228 percent sequential growth to 3.3 million in H2 FY2016-2017. 4G replaced 3G as the most favored technology in the data cards market. 3G shipments declined sequentially by 67 percent in H2 FY2016-2017.

“Mi-Fi devices led the growth of 4G technology in H2 FY2016-2017. LTE based Mi-Fi devices rose sequentially by 333 percent in H2,” said Shipra Sinha, lead analyst, Industry Intelligence and Channels Research Practices, CyberMedia Research.

Reliance Jio replaced Huawei as the most favored vendor in H2. Share of Reliance Jio grew to 77 percent due to free data services along with comparatively lower price of its Mi-Fi data cards.

ZTE India’s data card shipments rose 6 percent sequentially in H2, while other vendors like Alcatel, D-Link fell in the second half.

Reliance Jio’s JioFi 3 was the fastest moving model followed by JioFi 2 on number two position.

Huawei E3372H-607 was on the third spot.

Data cards with data rate of 150 Mbps contributed around 92 percent to overall shipments in H2 FY2016-2017.

Around 59 percent of data cards were sold with operator bundling in H1 FY2016-2017 that increased to around 95 percent in H2 FY2016-2017.