The global foundry industry recorded a 27% year-on-year (YoY) revenue increase in Q3 2024, with quarter-on-quarter (QoQ) growth of 11%, according to Counterpoint Research’s Foundry Quarterly Tracker. The surge was driven by robust demand for AI semiconductors and a faster-than-anticipated recovery in the Chinese market.

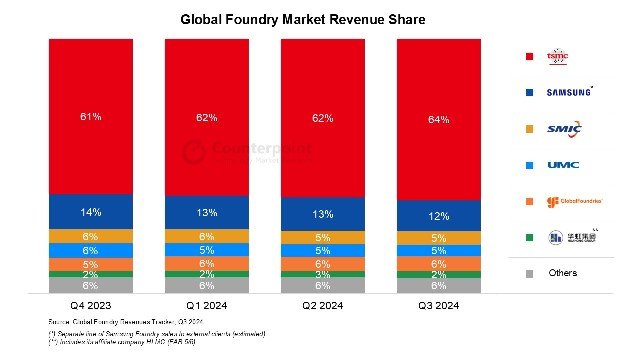

Advanced nodes, including TSMC’s N3 and N5 processes, played a major role in the industry’s expansion, fueled by their application in AI accelerators and smartphones. TSMC’s strong performance boosted its revenue share to 64% in Q3, up from 62% in Q2. The company expects continued growth in AI-related demand, which already constitutes mid-teens of its 2024 revenue.

Chinese foundry players, such as SMIC and HuaHong, outperformed global competitors in mature-node utilization rates, which exceeded 90%. This recovery was driven by local demand and semiconductor localization efforts. However, increased capacity in mature nodes is expected to heighten competition in 2025.

The report noticed mixed performance across major players.

For Samsung foundry, revenue increased slightly but fell short of expectations due to weaker seasonal demand for Android smartphones. The company is advancing its 2nm GAA process, targeting mass production by 2025.

GlobalFoundries delivered strong results in Q3, driven by stable automotive demand and a recovery in smartphones, but expects seasonal declines in its smartphone segment for Q4.

UMC recorded steady growth, particularly in its 22/28nm nodes, but anticipates pricing pressure from a one-time wafer price adjustment in 2025.

SMIC saw robust revenue growth with high utilization rates, especially in the 28nm and 40nm nodes, supported by domestic demand.

Challenges in mature nodes

While AI semiconductors drove leading-edge growth, the mature-node segment faces oversupply challenges. Utilization rates for global mature-node foundries, excluding China, remained weak at 65%–70%. Increased competition from China’s expanded capacity is expected to intensify pressures, the report said.

Counterpoint analyst Adam Chang commented, “AI is a major catalyst for the semiconductor industry’s growth, particularly for advanced nodes like TSMC’s N5. However, oversupply in mature nodes and increased competition pose profitability challenges in that segment.”

The industry remains optimistic about continued growth, particularly in AI and advanced semiconductors, despite ongoing challenges in non-AI markets and mature-node oversupply.