Research agency IDC has revealed the share of Cisco, Huawei, HPE and Juniper Networks in the enterprise and service provider router market in Q4 2016.

Cisco

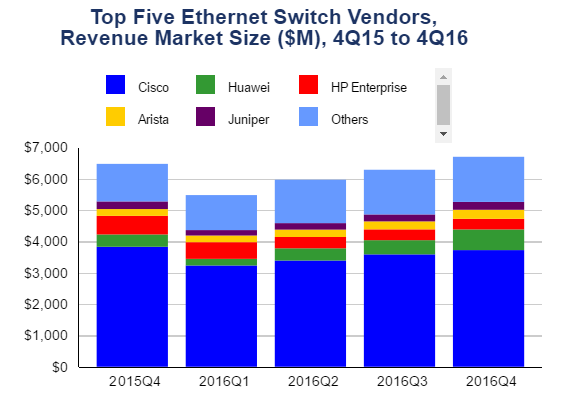

Cisco revenue in the Ethernet switching market fell 2.8 percent in Q4 2016. Cisco’s share in Ethernet switching market dropped to 55.6 percent from 57 percent in Q3 2016 and down from 59.1 percent in Q4 2015.

Cisco’s Ethernet switching revenue declined 3.7 percent in 2016. Cisco’s Ethernet switching market share fell to 57 percent in 2016 compared to 60.6 percent in 2015.

Cisco has 53 percent share in the 10GbE market in Q4, finishing essentially flat over the previous quarter.

Cisco’s service provider and enterprise router revenue decreased 4.8 percent, while its market share fell to 42.2 percent in Q4 from 45 percent. Cisco’s combined router revenues dropped 5.1 percent to $6.54 billion in 2016.

Huawei

Huawei’s Ethernet switch revenue grew 67.8 percent in Q4 2016, for a market share of 9.9 percent. Huawei’s Ethernet switch revenues rose 61.8 percent for a market share of 7 percent in 2016 from 4.4 percent in 2015.

Huawei’s enterprise and SP router revenue increased 16.2 percent for market share of 18.8 percent of the total router market in Q4 compared to 16.5 percent. Huawei’s router revenues grew 21.2 percent, with market share of 17.7 percent.

HPE

Hewlett Packard Enterprise’s (HPE) Ethernet switch revenue fell 2.2 percent in Q4 and its market share fell to 5 percent from 5.5 percent share in Q3.

Arista Networks performed well, with its Ethernet switching revenue rising 33 percent and earning a market share of 4.3 percent. Arista grew 33.1 percent and recorded market share of 4.1 percent last year, said IDC.

Juniper Networks

Juniper Networks’ Ethernet switching increased 2.9 percent in Q4, while decreasing 2.8 percent in 2016. Juniper’s revenue from combined service provider and enterprise router rose 6.5 percent, with market share of 16.9 percent. Juniper’s router revenues increased 3.5 percent, for a market share of 16.1 percent in 2016.

“Digital and network transformation initiative s and emerging ‘software-defined’ architectures are leading to myriad new opportunities for networking vendors, service providers, systems integrators, and enterprises,” said Petr Jirovsky, research manager, Worldwide Networking Trackers at IDC.

Market analysis

The Ethernet switch market revenue rose 3.5 percent to $6.7 billion in the fourth quarter of 2016 and grew 2.4 percent to $24.4 billion in 2016, said IDC.

Enterprise and service provider (SP) router market revenue grew 1.5 percent to $3.87 billion in Q4 2016 and rose 1.3 percent to $14.58 billion in 2016.

Router market

The combined enterprise and service provider router market grew 1.5 percent in Q4 and 1.3 percent in 2016.

Service provider router market rose 2 percent in Q4 and 0.9 percent in 2016.

Enterprise routing fell 0.3 percent in Q4 and increased 2.4 percent in 2016.

Ethernet switch market

The growth of Ethernet switch market was 23.9 percent in India in Q4 and 34.2 percent in the United Arab Emirates.

North America’s Ethernet switch market decreased 2.6 percent in Q4, with Canada experiencing a 5.7 percent annualized decline for the second consecutive quarter. Ethernet switch market in North America increased 0.4 percent in 2016. Latin America’s Ethernet switch market declined 4.4 percent, said IDC.

“As the Ethernet switching market reaches a greater level of maturity from 1GbE to 10GbE, it is increasingly characterized by customers moving more quickly to higher speeds at lower port costs, especially in the datacenter,” said Rohit Mehra, vice president, Network Infrastructure at IDC.

10Gb Ethernet switch revenue increased 3.4 percent to $2.42 billion, while 10Gb Ethernet switch port shipments grew 18.9 percent to over 11.7 million ports in Q4. IDC said 10Gb Ethernet revenues increased 1.5 percent in 2016, with port shipments increasing 19.4 percent.

40Gb Ethernet revenue did not grow and reached $696.6 million in Q4, while port shipments fell just below 1.4 million, dipping 1 percent. 40Gb Ethernet revenues grew 19.6 percent in 2016, with shipments increasing 59 percent.

10Gb and 40Gb Ethernet are joined by emerging 100Gb Ethernet (revenue up 377.5 percent and shipments up 613.7 percent on annualized basis in 4Q16) to be the primary drivers of the overall Ethernet switch market.

1Gb Ethernet switch revenue decreased 2.2 percent in Q4, despite 18.4 percent increase in port shipments. 1Gb Ethernet revenues fell 4.0 percent in 2016, while port shipments grew 13.4 percent, said IDC.