Telenet CEO John Porter has indicated that the telecom operator will be following “a go slow approach in the case of 5G.”

John Porter said the business model for 5G is a long way from getting solved. He said several operators made investment in 4G networks. But Facebook, Google, Apple, Amazon, Netflix, among others, have made returns from telecom operators’ investment in 4G.

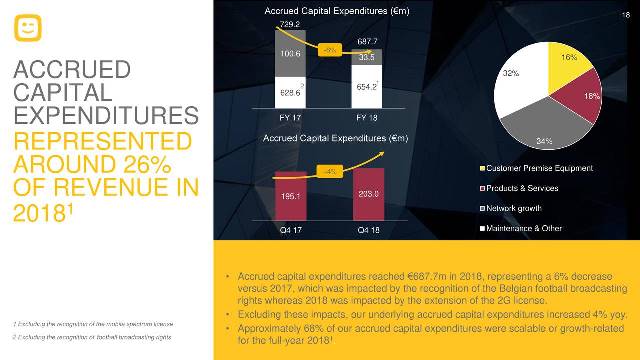

Brussels-based Telenet said capital expenditures (Capex) dropped 6 percent to €687 million in 2018, representing around 27 percent of revenue vs 29 percent in 2017.

Capital expenditures related to customer premises equipment, which includes spending on set-top boxes, modems and WiFi powerlines, represented €105.6 million (+23 percent) in 2018 and €19.4 million in Q4 2018.

The main focus of Capex was towards investments in both fixed and mobile infrastructures. Telenet deployed 413 new sites and upgraded around 94 percent of HFC nodes. Spending on network growth and upgrades was €220.2 million (–20 percent) in 2018 and €66.5 million in Q4.

Telenet said network-related Capex represented 34 percent of total capital expenditures. Capex for product and services, which reflects investments in product development and the upgrade of our IT platforms and systems, was €119.2 million (+23 percent) in 2018 and €35.5 million in Q4.

Telenet added 413 new sites last year on top of existing 2,800 mobile macro-sites, which are all upgraded.

Telenet said around 68 percent of total Capex in 2018 was scalable and subscriber-related with the vast majority of the investments were towards further modernization of both fixed and mobile infrastructure. The company will lower Capex to revenue ratio of around 20 percent in coming years.

Telenet CTO Micha Berger and Telenet CIO Sam Lloyd are guiding Telenet for transforming to digital first. Erik Van den Enden, CFO of Telenet, is aiming a 15 percent Opex savings by 2021 in IT and residential customer operations.

Telenet reported revenue of €2.534.8 billion (+1 percent) in 2018 and €642.3 million in Q4 2018. Telenet posted adjusted EBITDA of €1.324.1 billion (+ 9 percent) in 2018 primarily driven by reduced MVNO-related costs.

The loss of MEDIALAAN MVNO contract and the migration of SFR subscribers in Brussels have negatively impacted Telenet.

Baburajan K