“We expect mean net leverage for the sector to remain stable at around 5.7x-5.8x (2017: 5.7x), as CFFO will improve along with blended tariff as competition eases,” said Nitin Soni of Fitch Ratings.

The declining trend in revenue and EBITDA will reverse in 2018. The average blended tariff will grow by 3 percent-4 percent from the lows of around INR145 as Reliance Jio may gradually discontinue promotions and discounts.

Telecom operators will monetise tower assets and use cash proceeds to deleverage. Neutral Mean CFFO will benefit from lower competition and growing data consumption. However, mean FCF will still remain negative as CFFO is likely to fall short of Capex needs.

Capex/revenue will remain at around 21 percent against 21 percent in 2017 and 29 percent in 2016 to support fast-growing data traffic. Spectrum acquisitions could be minimal in 2018. The regulatory decision to allow deferred spectrum payments over 16 years rather than 10 will provide some relief to FCF.

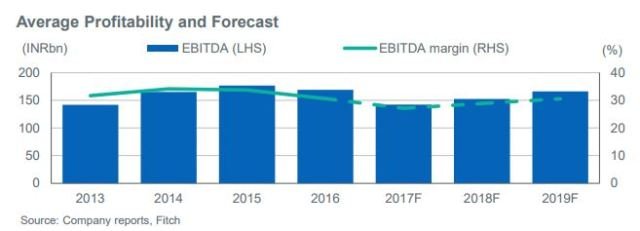

EBITDA margin will improve to around 29 percent from 27 percent in 2017 on higher tariffs despite a cut in the mobile termination rate to INR0.06 from INR0.14 from October 2017.

Competition will ease as three large telecom operators have emerged out of the industry shakeout; their combined revenue market share (RMS) will increase to around 90 percent in 2018 against 80 percent in 2017.

Smaller telecom operators such as Tata Teleservices, Telenor and Videocon exited the industry during 2017, selling their spectrum assets to incumbents.

Pricing power will return gradually as Jio’s subscriber base reaches around 200 million and revenue market share rises to around 15 percent towards end-2018.

Industry revenue will grow by around the mid-single-digit percentage after a decline in 2017, driven mainly by increased data consumption and higher blended tariffs. Data traffic could continue to grow by 50 percent-60 percent in 2018 as cheaper 4G smartphones proliferate.

The incumbents are likely to respond with their own bundled cheap 4G smartphone to Jio’s recently launched $22 handset. The industry will continue to add at least 5-6 million smartphones each month.