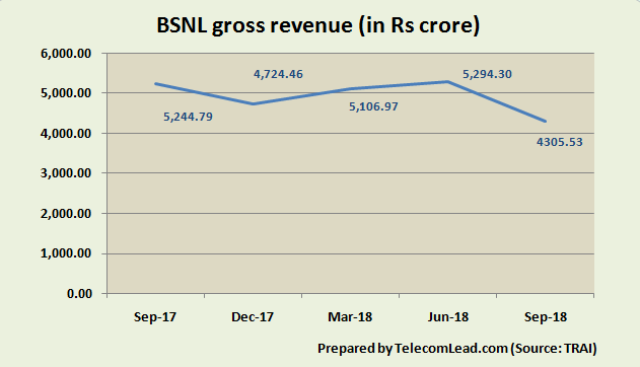

BSNL reported gross revenue of Rs 4305.53 crore in the September quarter of 2018 against Rs 5,244.79 crore in the September quarter of 2017, TRAI report shows.

BSNL’s gross revenue was Rs 5,294.3 crore in the June quarter of 2018 as compared with Rs

5,106.97 crore in the March quarter of 2018 and Rs 4,724.46 crore in the December quarter of 2017.

BSNL has 9.73 percent share in the Indian mobile phone services market in August 2018 as against Airtel’s 29.64 percent. BSNL has 20.35 million broadband – wireless and wireline – subscribers.

BSNL has 52.79 percent share in the Indian fixed phone services market in August 2018. BSNL has 9.16 million wired broadband customers as against Bharti Airtel’s 2.24 million customers in the wired broadband market.

BSNL has 11.19 million mobile data customers. Reliance Jio, the market leader, has 239.23 million mobile data customers.

India added 9.8 million wireless subscribers in the telecom sector. Jio added 12.2 million subscribers, led by the launch of 4G feature phones, while other telcos either reported flat subscriber growth or a decline, India Ratings and Research said.

Jio’s wireless market share for August 2018 increased to 20.5 percent from 19.6 percent in July 2018. BSNL’s subscriber base fell 0.6 percent.

Intense competition, Jio’s aggressive marketing strategy and aggressive tariff plan among the key incumbents have led to a decline in overall ARPU levels over the last two years. ARPU for key players fell to 100-105 during 1QFY19 from 140-150 in 4QFY17.

Key telecom operators are now focussing low tariff plans coupled with large data allowance at a low price, putting downward pressure on ARPU levels. Indian telcos are focussing on providing content freebies to increase subscriber stickiness through OTT platforms.