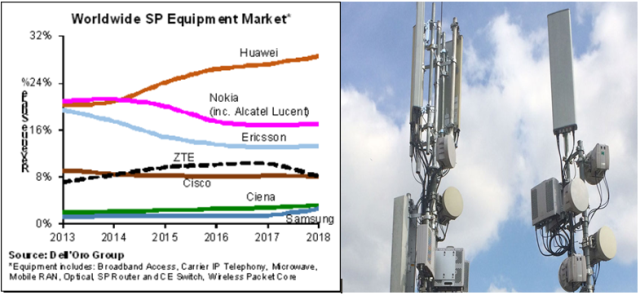

Huawei has grabbed 29 percent share of the global telecom equipment market, increasing its market share by 8 percentage points since 2013.

The top seven telecom equipment manufacturers are Huawei, Nokia, Ericsson, Cisco, ZTE, Ciena, and Samsung in 2018, according to Dell’Oro Group.

Huawei’s revenue share improved in 2018 — gaining about two percentage points of share annually in each of the past five years. Huawei improve revenue share despite challenges in the US and some of the European telecom markets due to security issues.

During this period, Ericsson’s and Nokia’s market share declined about one percentage point annually on average until 2018 when both vendor held their market share flat.

ZTE’s share which had typically been at 10 percent dropped two percentage points in 2018 due to the U.S. ban that caused the company to shut down portions of its business during the second quarter.

The latest GSMA report indicates that mobile operator Capex reached $161 billion in 2018 and forecast to touch $161 in 2019 and $160 billion in 2020. The focus of mobile operators will be in making investment in 3G, 4G and 5G roll outs and network optimization.

5G market

Huawei has signed 30 plus 5G commercial contracts. Huawei has delivered over 40,000 5G base stations for commercial use. Huawei has 50 plus 5G engagements with customers.

Nokia has 20 plus 5G contracts, and almost 100 5G engagements with customers.

Samsung Electronics shipped 36,000 5G base stations – mainly to operators in the US and Korea — in 2018.

According to TelecomLead.com estimates, Huawei generated revenue of around $38 billion from carrier business, $10 billion from enterprises and $52 billion from phones and other devices — in 2018.

Huawei said in December that it expects total revenue to increase 21 percent to $109 billion in 2018.

Nokia Networks business revenue was 20.121 billion euro (–2 percent) or $22.82 billion last year. Ericsson’s revenue was SEK 210.8 billion (+3 percent) or $22.58 billion in 2018.

The telecom equipment market grew 1 percent in 2018 – after three years of decline — due to demand for broadband access, optical transport, microwave, and mobile RAN, Dell’Oro Group said. The report did not reveal the specific revenue.

The revenue from remaining equipment — Carrier IP Telephony, Wireless Packet Core, SP Router and Carrier Ethernet Switch – fell in the year. The two largest equipment markets in the year were Mobile RAN and Optical Transport.

The mobile RAN market will continue to perform better due to the strong focus on LTE and LTE-Advanced, the shift toward 5G NR.

The worldwide Optical Transport market continued to expand for a fourth consecutive year driven by strong sales of DWDM equipment in China and to large Internet content providers for data center interconnect.

Baburajan K