European Union is expected to urge Germany to take stronger action in reducing its reliance on Huawei equipment in its 5G network, Reuters news report said.

Telecom operators in Germany are in the process of enhancing their 5G network to improve ARPU. Deutsche Telekom has reported 94 percent household coverage for 5G. Vodafone’s 5G household coverage is 80 percent, while Telefonica O2 has reached 75 percent.

This call comes in light of concerns about potential sabotage or espionage, leading the EU to establish security measures for 5G networks three years ago, including restrictions on vendors like Huawei.

When the second review of the 5G toolbox is presented, Germany and a few other countries are likely to be criticized for inadequate progress. Telecom operators, including Deutsche Telekom, may also face scrutiny from EU officials.

Huawei, which denies allegations of facilitating spying or sabotage on behalf of Beijing, stated that it is unaware of the contents of the forthcoming progress report.

The company emphasized that in its two decades of operations in Europe, no evidence has emerged indicating the presence of backdoors in its equipment. However, industry analyst Paolo Pescatore expressed the view that such a report would further diminish Huawei’s prospects in Europe.

The issue of Huawei’s involvement extends beyond 5G networks and encompasses broader digital infrastructure. In March, German state rail operator Deutsche Bahn faced backlash when it was revealed that it had adopted Huawei equipment for digitalization purposes.

Countries like Denmark and Portugal have already expanded restrictions on vendors considered high risk, going beyond the scope of 5G.

During upcoming government consultations between China and Germany on June 20, the Huawei matter is expected to be a contentious topic. Beijing is likely to lobby Berlin to ensure that any new EU-wide regulations on Chinese technology are not overly stringent.

Mikko Huotari of the Mercator Institute for China Studies highlighted the significance of Huawei’s role in 5G as well as broader digital infrastructure.

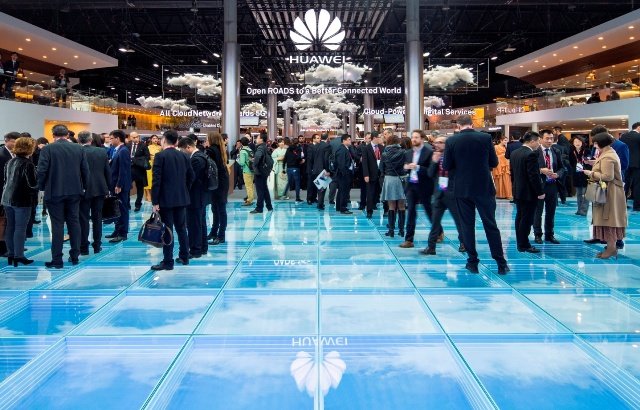

Over the past decade, telecom providers turned to Huawei as a cost-effective alternative to Nokia and Ericsson, providing equipment of comparable quality. However, due to concerns over Huawei’s alleged ties to Chinese security services, the West has increasingly limited its use in 5G networks. Critics argue that these restrictions are protectionist measures favoring non-Chinese competitors, a claim rejected by Huawei and the Chinese government.

In 2021, Berlin passed a law imposing strict criteria for telecommunications equipment used in the critical components of 5G networks. However, compared to other countries, Germany defined these components narrowly and did not consider existing equipment.

The government has admitted uncertainty regarding the percentage of Huawei gear already integrated into 5G networks and its potential security risks. As a result, Germany initiated a review of telecom suppliers, which is expected to conclude this summer.

Removing Huawei equipment from European countries would likely incur substantial costs in the billions of euros, placing additional burdens on heavily indebted telecom companies. The U.S. has already allocated $5.6 billion in aid to support the replacement of Chinese gear.

Analysts suggest that operators would face significant challenges in ensuring minimal disruptions to their networks. Nevertheless, the removal of Huawei equipment could create opportunities for rival companies.