The International Data Corporation (IDC) has released its latest projections for the smartphone market, indicating that global smartphone shipments are poised to experience a year-over-year decline of 4.7 percent in 2023.

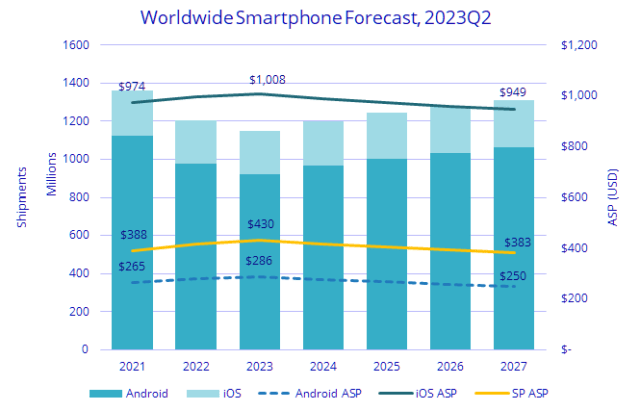

Despite this challenging landscape, IDC envisions a recovery for the smartphone market in the upcoming years. The organization projects a year-over-year growth of 4.5 percent in 2024, with subsequent years witnessing growth in the low single digits. This trajectory is anticipated to result in a five-year compound annual growth rate of 1.7 percent.

Nabila Popal, Research Director with IDC’s Mobility and Consumer Device Trackers, emphasized that while inventory levels have normalized, most Original Equipment Manufacturers (OEMs) remain cautious in their short-term business strategies. This caution has led to a delay in the anticipated recovery. However, Popal stressed that despite the prolonged refresh cycles, consumer willingness to pay higher prices for devices offers a silver lining and is expected to drive average selling prices up for the fourth consecutive year in 2023.

In terms of operating systems (OS), IDC predicts that iOS shipments will experience growth of 1.1 percent in 2023, leading to a historic high share of 19.9 percent. This growth is attributed to the resilience of iOS in the face of macroeconomic challenges compared to Android, which is expected to witness a 6.0 percent decline in shipments in 2023. Among the regions that will contribute significantly to the decline in Android shipments are China, Asia/Pacific (excluding Japan and China), and Latin America.

Ryan Reith, Group Vice President of Mobility and Consumer Device Trackers at IDC, highlighted Apple’s contrasting performance amid the overall market struggles. Reith noted that Apple’s movement in the opposite direction is noteworthy, driven by appealing trade-in offers and the expansion of ‘buy now, pay later’ programs.

These factors have particularly bolstered the premium segment of the market, especially in more developed markets. In 2022, while the overall market dropped by double digits, the $800+ segment experienced only a 1.7 percent decline. Consequently, the used smartphone market has seen robust growth, primarily due to the availability of high-quality used phones.

In summary, while 2023 is poised to witness a contraction in global smartphone shipments, IDC’s projections suggest a rebound in the subsequent years, driven by strategies such as flexible financing options and increasing consumer willingness to pay premium prices for devices.