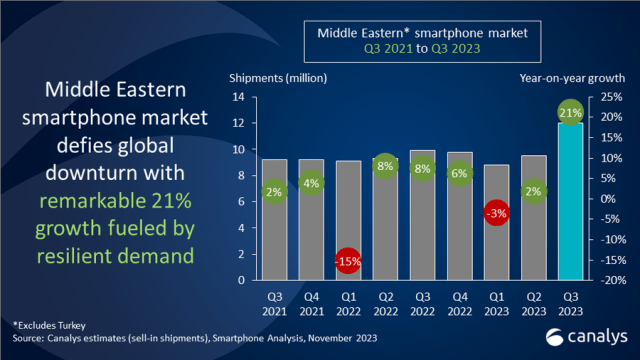

The smartphone market in the Middle East (excluding Turkey) saw a remarkable upswing in Q3 2023, as per Canalys research, with shipments hitting 12.0 million units, marking a substantial 21 percent annual growth.

Samsung (with 3.8 million), TRANSSION (2.7 million), Xiaomi (1.8 million), Apple (1.3 million) and Realme (0.5 million) are the top suppliers in the smartphone market in the Middle East.

The surge in the smartphone market in the Middle East was propelled by strong domestic demand, driving both consumer bases and employment opportunities despite challenges posed by fluctuating oil prices.

Saudi Arabia has emerged as a standout, boasting a staggering 46 percent year-on-year growth in smartphone shipments, fueled by escalating demand for entry-level models. Despite initial obstacles, government expenditure initiatives are anticipated to sustain economic diversification efforts.

Conversely, the United Arab Emirates witnessed a modest 2 percent rise in shipments, buoyed by an influx of expatriates and tourists, alongside positive momentum from investors and consumers.

Iraq continued its robust momentum with a notable 57 percent growth, propelled by the surge in demand for sub-US$150 phones and increased brand activities, despite facing import hurdles due to currency procurement challenges and financial access gaps.

The surge in demand for budget models, particularly those priced below US$200, has emerged as a defining trend during Q3. Companies like TRANSSION, Xiaomi, and HONOR made significant strides in this segment, catering to the expanding mass-market amidst economic uncertainties. Infinix and Tecno, under TRANSSION, introduced exclusive models in Saudi Arabia and Iraq respectively, while Xiaomi and HONOR made inroads into the premium market with aggressive promotions.

Motorola made substantial gains in both consumer and enterprise sectors, notably in the GCC region, leveraging its partnership with Logicom distribution to offer enterprise-ready solutions. Meanwhile, Samsung and Apple maintained their market dominance with extensive distribution networks and comprehensive device services, with the demand for used devices from both brands remaining notably high due to their resale value.

Emerging brands seized opportunities by launching flagship devices, with OPPO and HONOR venturing into the foldable segment to compete with established players like Samsung. Yet, consumer hesitancy in certain markets remained, highlighting the significance of affordability, aspirational value, and accessibility for emerging brands. Schemes such as Buy Now Pay Later gained traction, proving beneficial for retailers and consumers alike through platforms like Tabby and Tamara.

The smartphone market in the Middle East continues to evolve, driven by a combination of market strategies, economic shifts, and consumer preferences, promising further innovations and competition in the quarters ahead.