India’s smartphone market saw several noteworthy trends, including a surge in 5G smartphone shipments and a shift in pricing dynamics in the third quarter of 2023.

Smartphone vendors in India have been focusing on offering affordable 5G devices and discounts across various channels. As a result, 5G smartphone shipments reached a record 58 percent market share, with 25 million units sold in the third quarter of 2023. The ASP for 5G smartphones decreased to US$357, marking a 9 percent year-over-year decline.

A significant shift was observed in the 5G smartphone market, with a majority of launches in the mass budget (US$100<US$200) price segment. This led to a notable increase in the 5G market share in this segment, rising to 52 percent from 34 percent in the previous quarter.

The top three 5G smartphone models in 3Q23 were Samsung’s Galaxy A14, Apple’s iPhone 13, and Xiaomi’s Redmi 12. These models contributed significantly to the growth of the 5G smartphone market in India.

Upasana Joshi, Research Manager, Client Devices, IDC India, commented on these trends, stating, “A swift uptake in affordable 5G smartphone shipments signals bullish sentiments and the success of affordability efforts by vendors. We should expect the previous generation of premium smartphone models to be in high demand this festive season, made affordable by various offers and upfront discounts across channels.”

The IDC’s report also highlighted the performance of various smartphone segments in India:

The entry-level (sub-US$100) segment experienced a 16 percent year-over-year growth, capturing a 20 percent market share.

The mass budget (US$100<US$200) segment underperformed, with its market share declining to 44 percent from 51 percent, reflecting a 14 percent year-over-year decrease.

The entry-premium (US$200<US$400) segment showed modest growth, with a 2 percent year-over-year increase and a 22 percent market share.

The mid-premium segment (US$400<US$600), with a 5 percent market share, recorded an impressive 37 percent year-over-year growth.

The premium segment (US$600<US$800), with a 3 percent market share, registered the highest growth of 52 percent. This growth was driven by models such as the iPhone 13, Galaxy S23/S23 FE, and the newly launched Moto Razr 40.

The super-premium segment (US$800+) also demonstrated healthy growth, with its market share increasing from 4 percent to 6 percent in 3Q23. Apple led this segment with a 60 percent share, thanks to high shipments of its iPhone 13/14/14 Plus. Samsung also gained market share, growing from 24 percent to 36 percent in 3Q23, largely due to the success of newly launched models like the Galaxy Z Fold5/Flip5 and Galaxy S23+/S23 Ultra.

Foldable phone shipments hit a record half million units in a single quarter, with Samsung leading the market with a 66 percent share. The introduction of lower-priced foldable phones by Motorola contributed to a decline in the average selling price of foldable phones from US$1319 to US$1198 year-over-year.

Shipments to offline channels continued to outperform online channels, showing strong double-digit growth in 3Q23. However, the IDC anticipates that multiple rounds of eTailer events, such as The Big Billion Days on Flipkart and Amazon Great India Festival, with special platform pricing and online exclusive deals, will drive online demand in the coming weeks.

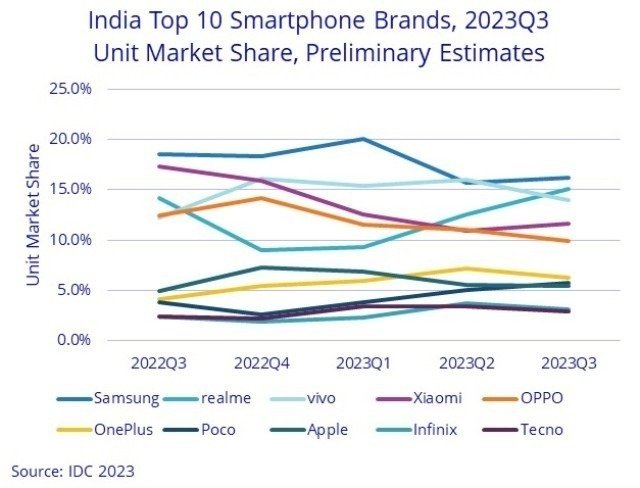

In terms of market leadership, Samsung surpassed vivo in the third quarter, although its shipments declined year-over-year. Samsung also had the highest ASP among the top five brands, growing by 43 percent year-over-year. realme secured the second position, driven by the success of newly launched models C53 and 11x. vivo (excluding iQOO) experienced the highest growth among the top five brands, primarily due to affordable Y and T series models. OnePlus, with 35 percent of shipments driven by the Nord CE3 Lite, and Poco, also reported impressive growth of over 50 percent year-over-year.

Looking ahead to 2023, the IDC anticipates a flat market or a low single-digit decline. “Next year we will see a range of affordable 5G and foldable phones at the mid to premium end, but inflationary stress and longer refresh cycles will limit annual market growth in 2024,” said Navkendar Singh, AVP – Devices Research, IDC.

The Indian smartphone market is undergoing significant transformations, driven by the increasing availability of affordable 5G devices, changing consumer preferences, and intense competition among smartphone manufacturers. As the market continues to evolve, consumers can expect a wider range of choices and competitive pricing in the coming years.