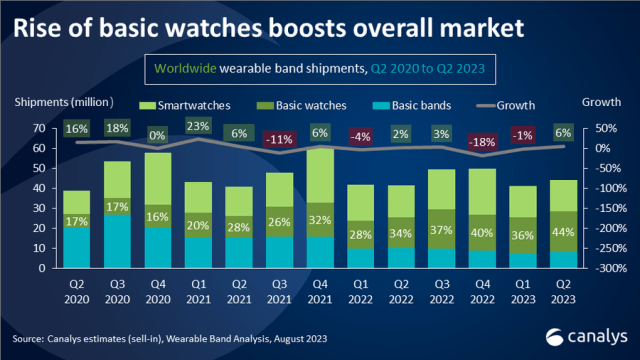

The global wearables market demonstrated a notable resurgence in Q2 2023, witnessing a 6 percent year-on-year growth with vendors shipping a total of 44 million wearable bands worldwide, according to market research firm Canalys. This growth has been attributed to a surge in consumer demand across various aspects of daily life.

The market share of top vendors in the global wearables market is: Apple (18 percent), Xiaomi (11 percent), Huawei (10 percent), Noise (8 percent), Fire-Boltt (7 percent) and Others (47 percent) during the second quarter of 2023.

Jack Leathem, Research Analyst at Canalys, commented on the revival of the wearables market, stating, “The wearables market is coming back to life, driven by increasing consumer demand in various aspects of daily life. Demand across different segments is rebounding, leading vendors to address specific consumer needs.”

The report highlighted the robust growth in the basic watch category, which secured nearly half of the market share. This growth was primarily fueled by Indian players and major smartphone vendors, including Huawei, Xiaomi, and Huami. In the Indian market, basic watches saw a remarkable 73 percent increase in shipments, emphasizing the vibrancy of the wearables market in the country.

The watch category experienced substantial double-digit growth, driven by competitively priced basic watches. To fortify their market presence, vendors introduced a variety of new wearables in the second quarter, including enticingly priced basic bands and watches from Xiaomi and Huawei.

Indian vendors also played a significant role in the market by introducing entry-level models and higher-priced products, catering to different customer segments. Brands like Noise and Fire-Boltt cut prices, providing exceptional value to consumers, with Fire-Boltt offering an average selling price below $19.

Leathem emphasized the evolving market dynamics and segmentation trends, indicating a shift towards more affordable entry-level products packed with enhanced features. Advances in screen technology have expanded the reach of smart wearables to a wider audience.

Premium vendors, on the other hand, focus on enriching features and delivering added value, resulting in an increase in average selling prices. For instance, Google experienced a notable rise in the average selling price of its smartwatches, going from $216 to $266, attributed to the integration of additional services and value. This strategy underscores a progressive vision that prioritizes value beyond just hardware, reflecting the rapid progression of the wearables market.