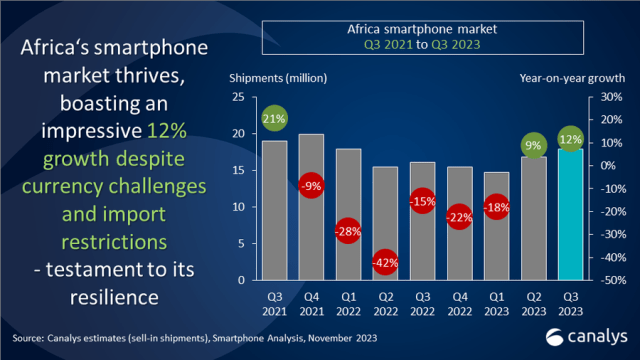

The African smartphone market showcased a robust resurgence for the second consecutive quarter in the third quarter of 2023, according to Canalys.

Leading smartphone suppliers in Africa and their shipment is follows: TRANSSION (8.6 million), Samsung (4.6 million), Xiaomi (1.9 million), Oppo (0.8 million) and Realme (0.6 million) and others (1.5 million) for the third quarter of 2023.

Leading the market, TRANSSION sustained its dominant position with a 9 percent annual growth, capturing a commanding 48 percent market share. The company strategically broadened its reach, particularly in emerging markets, emphasizing price segments below US$100.

However, Samsung experienced a setback with a 13 percent decline in the African smartphone market, primarily due to challenges faced by its mid-to-high-end devices, yet retained the second position, claiming a 26 percent market share.

Additionally, Realme witnessed an impressive 11 percent growth in the African smartphone market, attributed to its acclaimed Number series, particularly the C series known as the brand’s ‘Hero range’ for its innovative high-spec, low-cost focus.

TRANSSION’s influence in Nigeria, offering entry-level devices, and Xiaomi’s success as an aspirational brand, notably with products like the Redmi series A2, Note 12 4G, 12, and 12C, played pivotal roles in their market standings. Similarly, Xiaomi found success in North African countries like Egypt and Morocco, experiencing substantial growth in smartphone shipments, indicating the successful resolution of challenges posed by stringent import restrictions from the previous year.

TRANSSION’s initiatives like the Takenow device financing schemes and collaborations with Easybuy not only bolstered sales but also pushed for an increase in Average Selling Price (ASP). HONOR and Xiaomi made significant impacts by introducing diverse products at accessible price points, aiming to expedite the transition from basic feature phones to smartphones.

Conversely, Samsung focused on its A-series to drive volume while actively promoting foldable devices to secure a significant presence in the premium segment amidst consumer preferences shifting towards mid-range devices from competitors like Xiaomi, OPPO, and realme. Additionally, Huawei collaborated with local software suppliers in South Africa, enhancing the usability of HMS to counter the absence of GMS.

Looking ahead, Canalys foresees limited expansion in the African smartphone market in 2024, expecting single-digit growth. Factors like currency devaluation, increased import taxes, and initiatives promoting local production pose challenges that might lead to cost and price hikes. Nevertheless, accessible device financing schemes from operators and channel partners could substantially enhance accessibility and adoption rates, Pravinkumar, a Canalys analyst, said.